Uniswap V4: Empowering Defi with Flexibility

Defi has witnessed exponential growth in recent years, revolutionizing traditional financial systems and empowering individuals with greater control over their assets. At the forefront of this movement is Uniswap, a groundbreaking DEX protocol built on the Ethereum blockchain. Uniswap has been instrumental in facilitating seamless and permissionless token swaps, and it continues to evolve with the introduction of Uniswap V4.

Background

Two years ago, they introduced Uniswap V3, marking a significant milestone for on-chain liquidity and the defi industry. Fast forward to today, the Uniswap Protocol has emerged as the largest decentralized exchange protocol, facilitating a remarkable trading volume of over $1.5 trillion.

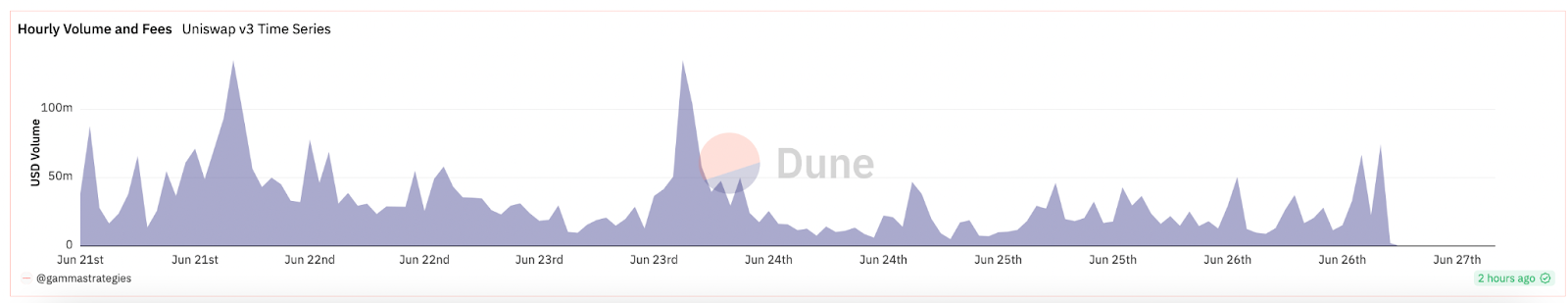

Source: Dune @gammastrategies

Now, Uniswap V4 represents the latest iteration of the protocol, aiming to further enhance the defi ecosystem by addressing key challenges faced by its predecessors. Building upon the success of its previous versions, Uniswap V4 brings an array of innovative features, including hooks and custom pools, improved architecture, gas savings and governance.

Open Collaboration and Community Contribution

To foster open feedback and meaningful community contribution, Uniswap is releasing the draft code of Uniswap V4 for public access. They invite developers and enthusiasts to explore the open-sourced, early version of the Uniswap V4 core and periphery repositories, dive into the draft technical whitepaper, and learn how they can actively contribute to the Uniswap transformative project.

The Power of Customization: Hooks and Custom Pools

Uniswap V4 introduces an innovative concept called “hooks” to enable users to make crucial tradeoff decisions. Hooks are contracts that execute specific actions during various stages of a pool’s lifecycle, such as before or after a swap or when an LP position is modified. This customization empowers developers to add new functionality or retain the tradeoff choices of Uniswap V3.

The possibilities are endless, with potential features including time-weighted average market makers (TWAMMs), dynamic fees based on volatility, on-chain limit orders, depositing out-of-range liquidity into lending protocols, customized oracles, autocompounded LP fees, and distribution of internalized MEV profits back to LPs. Each pool can utilize its own hook smart contract, ensuring flexibility and tailored experiences for users.

Uniswap V4’s introduction of hooks and modularity brings a captivating balance between liquidity providers and arbitrageurs, while opening up a treasure trove of still unexplored use cases that could very well become the gold standard in the future liquidity market. These revolutionary features allow for a whole new level of customization, empowering participants to shape their strategies and unlock the full potential of the Uniswap Protocol. By fostering collaboration and igniting the spirit of open engagement, Uniswap v4 sets the stage for an exhilarating journey filled with endless possibilities that will shape the very essence of liquidity provision in the days to come. Get ready to embark on this thrilling adventure!

Efficiency and Cost Reduction: Improved Architecture and Gas Savings

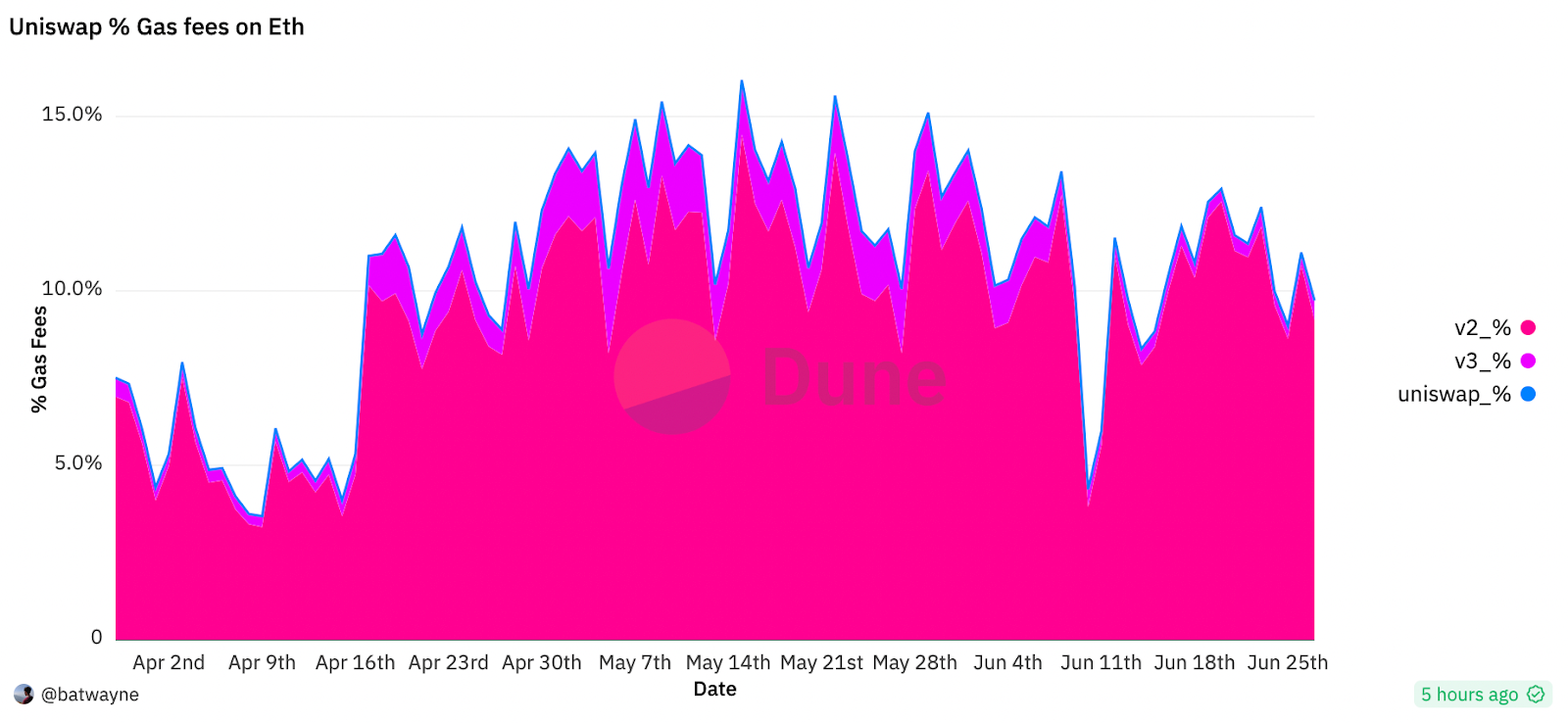

Uniswap V4’s architecture enhances efficiency and significantly reduces costs. The introduction of a “singleton” contract consolidates all pools within a single smart contract, eliminating the need for deploying separate contracts for each pool. This architectural enhancement leads to substantial gas savings, with early estimates showing a staggering 99% reduction in pool creation gas costs. However, the median gas price for ETH is lowering, it is still very high.

Source: Dune @batwayne

The singleton architecture enables efficient routing across multiple pools, amplifying the power of hooks and customization.

In addition, Uniswap V4 introduces a “flash accounting” system that optimizes asset transfers. Unlike V3, which transfers assets at the end of every swap, V4 only transfers on net balances, resulting in a more efficient process. This innovation, combined with the singleton architecture, provides further gas savings, enhancing the overall user experience.

License and Governance: Openness and Community Involvement

Consistent with our principles of transparency and community governance, Uniswap V4 will be released under a Business Source License 1.1. This license restricts the commercial or production use of the v4 source code for up to four years, after which it will convert to a GPL license, ensuring perpetual openness. As with previous versions, Uniswap Governance and Uniswap Labs retain the authority to grant exceptions to the license, fostering flexibility and collaboration.

Uniswap V4 will adopt a familiar fee mechanism modeled after V3. Governance will have the power to vote on adding a Protocol fee to any pool, up to a predetermined cap. Detailed information on the fee mechanism can be found in the whitepaper, encouraging further exploration and engagement from the community. Check the hourly volumes and fees here.

Source: *Dune @*gammastrategies

Comparison to Other Project`s Releases

Let’s compare Uniswap V4 upcoming release with other notable projects developments in the defi space:

- Sushiswap: It stands out with its proprietary automated market maker (AMM) platform, yield farming options, and incentivized liquidity pools. These efforts aim to optimize trading experiences and provide additional incentives for liquidity providers. They announce the launch of SushiSwap’s DEX aggregator, which enables users to access multiple liquidity sources and obtain optimal trading rates. More about it here “DEX Aggregator Live”.

- Curve Finance: As a specialist in stablecoin trading with a focus on low slippage, Curve Finance is implementing various optimizations to enhance trading efficiency. The introduction of gauge-weighted pools and strategic initiatives to reduce gas fees are indicative of their dedication to refining the user experience and ensuring cost-effective operations, as they claim about it in “Ahead of the Curve 007” update.

- Balancer: Balancer, functioning as an automated portfolio manager and decentralized exchange protocol, has made strides in improving gas efficiency and expanding functionality. The introduction of smart pools, empowering users with customizable asset allocations and trading fees, showcases Balancer’s commitment to providing advanced and tailored solutions. Read more about Balancer`s “Boosted Pool Magic” here.

Conclusion

Uniswap V4 represents a significant step forward in the evolution of decentralized finance. By introducing concentrated liquidity, multiple fee tiers, and advanced oracle integration, Uniswap V4 enhances flexibility, efficiency, and stability within the defi ecosystem. With its user-centric design and commitment to decentralization, Uniswap continues to empower individuals worldwide, enabling them to participate in the future of finance on their own terms.

If you enjoyed this article and want to see more like these, share your thoughts on our Discord general chat and follow us on Twitter!