Building the Control Center for Defi and Web3

The defi landscape experienced the rise and fall of “defi Summer” in 2020, marking a significant milestone in the mainstream adoption of decentralized finance. During this period numerous defi innovations; automated market makers, yield farming, flash loans, synthetic assets, layer-2 scaling solutions, and the list goes on. But with the emergence of all these building blocks on the blockchain, complexity is lurking around the corner.

In traditional finance, consolidated applications focused on specific use cases, mostly provided by banking apps. These banks operate on their own infrastructures. In defi this is very much not the case. Defi is made up of transparent building blocks and bits of infrastructure, Ethereum, Solana, Avalanche, and Arbitrum being a few good examples. As a result of this, we don’t have to interact with the front-ends of each of these individual server providers to get access. We have the ability to create UX aggregators that are effectively a control center (or front-end) for the defi space. And that’s exactly the mission DeCommas is on!

The need for an aggregation layer in defi & web3

At the moment of writing, there still really is no app or interface that bundles all of defi and web3 in one easy-to-use interface, while providing the right tools and automation to interact with the underlying assets and protocols.

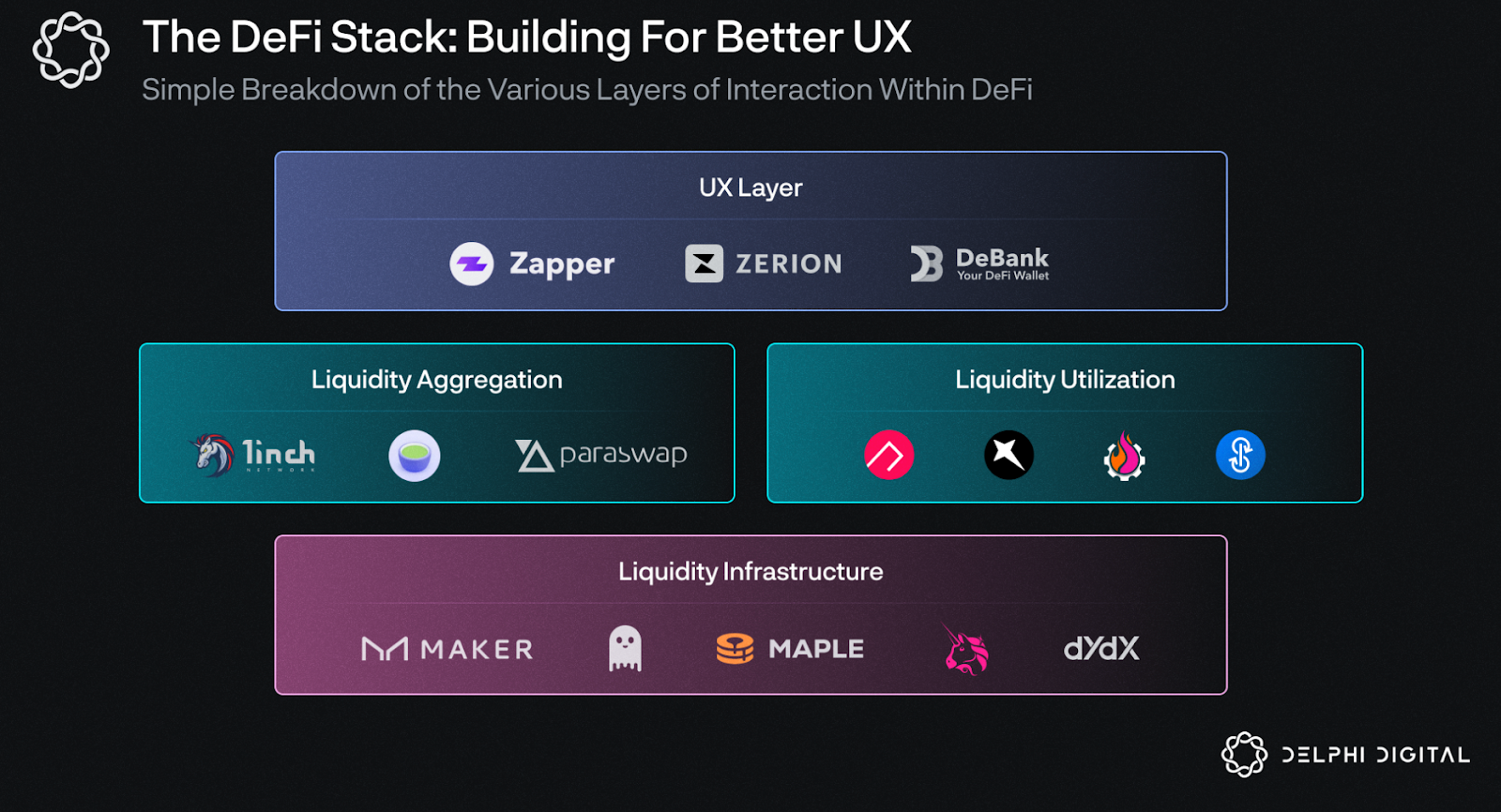

DEXes have seen the best adoption within the defi space, and as a result of this DEX aggregation has been relatively successful. But aggregation should not stop there. We need to continue to aggregate defi building blocks such as borrowing, lending, yield farming, options or perpetual swaps.

UX aggregators are a game-changer, even for the most experienced users in the crypto space. In fact, pure UX aggregators primarily target individuals who are already familiar with hardware wallets and browser wallet extensions. But let’s not underestimate the significance of making life easier for this existing user base. Any improvement in the user experience within defi is a significant step forward.

Source: Delphi Digital

For those who are new to crypto and prefer using their own wallets for trading, UX aggregators bring forth some significant advantages. Firstly, they offer access exclusively to protocols that are considered “safe” and have minimal rug risk. You won’t find Zapper integrating a new farming opportunity boasting an astronomical 4-digit APY if there’s a high risk of the team executing a rug pull. Savvy users who comprehend the risks associated with these farms might occasionally venture to new front ends for a taste of the wild side. However, the beauty of the entire experience lies in its non-custodial nature, granting users a remarkable level of autonomy.

For instance, even when using a UX or liquidity aggregator, you can still swap into high-risk tokens by overriding the warning that pops up. Yes, you’ll receive a cautionary heads-up, but ultimately, the decision lies in your hands. No one is there to halt your actions or impose restrictions upon you.

It’s important to strike the right balance between ease of use and user autonomy, and it would make sense for a highly functional mission control for web3 & defi to find and deliver that balance. Think of it as the user-facing layer within defi.

DeCommas to deliver the user-facing layer within defi & web3

With the first iteration of Pathfinder just delivered, and a brand new Swap feature fully functional, it’s not hard to see how DeCommas’ tools are already shaping this control center for defi and web3. Let’s take a quick look at the tools already available:

- DeCommas Swap: Cost efficient cross chain swapping of crypto assets.

- DeCommas Pathfinder: The “SkyScanner for defi”, offering a comprehensive route finder across multiple protocols to give you access to opportunities in the defi landscape effortlessly.

- DeCommas Portfolio: A comprehensive solution for managing and tracking your web3 assets and investments in one user-friendly interface.

- DeCommas Datalayer: A powerful foundation providing accurate and real-time data for informed decision-making within the defi ecosystem. Want to be involved? We have a closed beta running which you can sign up for here!

These tools provide a solid starting point for DeCommas to become the UX aggregator that serves as the entry point or control center for web3 and defi. While it’s only a modest start, the opportunities for expanding this toolstack are very exciting. Let’s take a look at a few:

- Expanding the reach of Pathfinder

Integrating more protocols, aggregators, bridges and exchanges into Pathfinder will expand the possibilities to seamlessly swap, bridge, lend, borrow and more, all from within one interface. Over time Pathfinder will become faster and more cost-efficient as a result of ongoing optimization and expansion. The better Pathfinders coverage, the more powerful of a tool it is as an access point to defi. - AI-driven Portfolio Analysis:

While AI and blockchain might not be the most logical combination, AI and UX are. Implementation of an AI layer on top of DeCommas Portfolio will allow users to utilize the power of AI to analyze holdings and have AI provide them with personalized insights and even recommendations to optimize their defi strategies and investments.

AI could also be used to identify potential risk, opportunities and trends, helping users make informed decisions and achieve their financial goals. - AI-powered User Interface

Currently we interact with the blockchain through a complex set of tools, smart-contracts and aggregators. What if a simple query could be used to trigger certain actions? A simple “Swap my 0.1 ETH to USDC on Avalanche” could trigger the Swap interface to find your swap and execute it, based on simple text input. It’s easy to imagine what this tool could do when it grasps all the potential of defi and web3, and will be enabled to respond to complex queries about portfolio composition and trading strategies.

Speaking of AI to improve user experience, a ChatGPT marketplace plugin from DeCommas might just be on the way… - Maximize coverage with Datalayer and Portfolio

Expanding the coverage of DeCommas Portfolio to cater to the diverse needs of crypto enthusiasts, such as staking, yield farming, portfolio tracking, and more, providing users with a holistic platform where they can manage, monitor, and optimize their entire crypto portfolio, accessing a wide range of defi tools and services within a unified interface.

At the same time, the Datalyer powering DeCommas tools should continuously be built out and refined, providing users with an even more comprehensive and accurate view of the defi space. It will collect and analyze real-time data from various sources, including market prices, liquidity pools, transaction history, and user behavior, to empower users with valuable insights and a deeper understanding of the defi ecosystem. - Continuous improvement of UX

Focus on improving and expanding the user experience (UX) across the DeCommas platform, ensuring a user-friendly and intuitive interface for interacting with web3 and defi applications. Streamline onboarding processes, simplify navigation, and enhance visual design to make it easier for users, regardless of their level of experience, to seamlessly interact with the platform.

By executing these expansion plans, DeCommas will position itself to become the go-to control center for web3 and defi, offering a robust and all-encompassing platform that caters to the diverse needs of users and provides a seamless and empowered defi experience.

Make sure you keep an eye on DeCommas Twitter, Telegram, Medium or Discord. Exciting things are on the way at decommas.io!