$ARB token progress overview

$ARB token progress overview

It’s only been a week since the launch of the $ARB token, and the defi community is already buzzing with excitement and anticipation about its potential. As a native utility token of the Arbitrum network, $ARB has the potential to be a game-changer. As more users adopt the Arbitrum network and the $ARB token, it will be fascinating to watch how its value and utility evolve and transform the defi landscape, particularly over time.

Let’s dive deeper into this token and see how it’s doing!

Definition Of Arb Token And Its Role In Defi

Arbitrum is a Layer 2 scaling solution for Ethereum that aims to significantly improve the speed and cost efficiency of transactions on the Ethereum network. The ARB token is Arbitrum’s primary token for governance purposes. Recently, Offchain Labs, the team responsible for developing Arbitrum, unveiled a new decentralized autonomous organization (DAO) structure known as the Arbitrum DAO. Through this framework, ARB token holders can participate in the decision-making process by voting on proposals related to protocol upgrades, features, funds allocation, and the Security Council’s election.

Arbitrum Introduces DAO Governance And Orbit For New Chains With Retroactive Airdrop.

Arbitrum announced a retroactive airdrop of 12.75% of its token supply to users in its ecosystem, marking its transition to a DAO-based governance model. Chain ownership will be responsible for decisions about chain parameters, sequencing and verifying nodes, and the emergency upgrade council. In addition, Arbitrum Orbit will permit anyone to launch chains using the Nitro codebase, so long as they use Arbitrum’s general purpose L2s for settlement.

Source: Arbitrum

This differs from Optimism, which targets ecosystem growth by incentivizing development and funding public goods with RPGF. Both scaling projects pay homage to Ethereum but differ in their approaches to value capture. Arbitrum plans to airdrop an undisclosed portion of its token to a collective of Ethereum core developers, and Nitro’s Business Source License prohibits developers from using the codebase in a production environment.

Comparison With Other Tokens Drops

Let’s take a look at some examples of previous drops with a deeper dive.

Uniswap (UNI)

Uniswap’s UNI token had an airdrop in September 2020, with 91.02% of the tokens claimed so far. The majority of recipients sold their tokens, but some increased their allocation.

Source: Dune Analytics

UNI also had a liquidity mining program, causing the token price to drop by 80%, before rallying by 1,200%. The airdrop and liquidity mining program boosted Uniswap’s TVL and trading volume, and UNI’s rally was fueled by being the largest DEX in terms of volume and TVL, the brand name, and the potential for revenue sharing with token holders.

ApeCoin (APE)

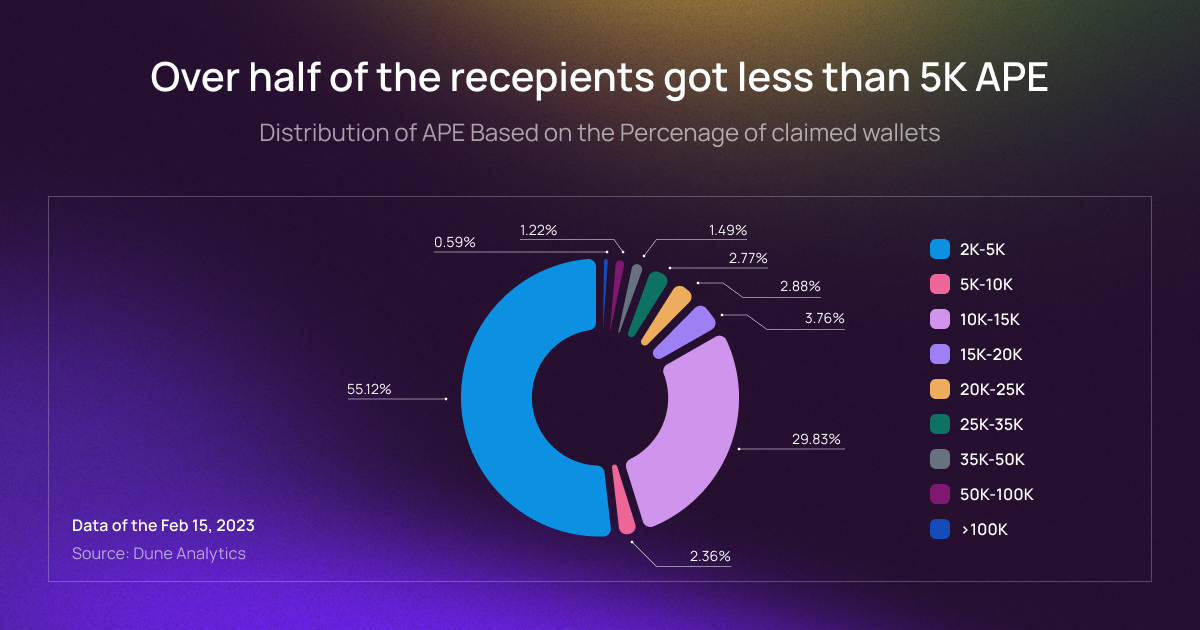

Yuga Labs gave an APE token airdrop to holders of BAYC, MAYC, and BAKC, with 15% of the total APE supply claimable by 15,717 wallets.

Source: Dune Analytics

The claim rate was the highest on the list, but it’s hard to determine the airdrop’s success without a working product. Volumes for BAYC, MAYC, and BAKC spiked post-airdrop due to people wanting these NFTs to claim the airdrop, but floor prices saw a muted spike. Although the airdrop generated buzz in the short term, APE’s price action lacked a tangible, long-lasting utility. Without a proper use case for APE, it’s harder to imagine the token having sustained constructive price action.

Optimism (OP)

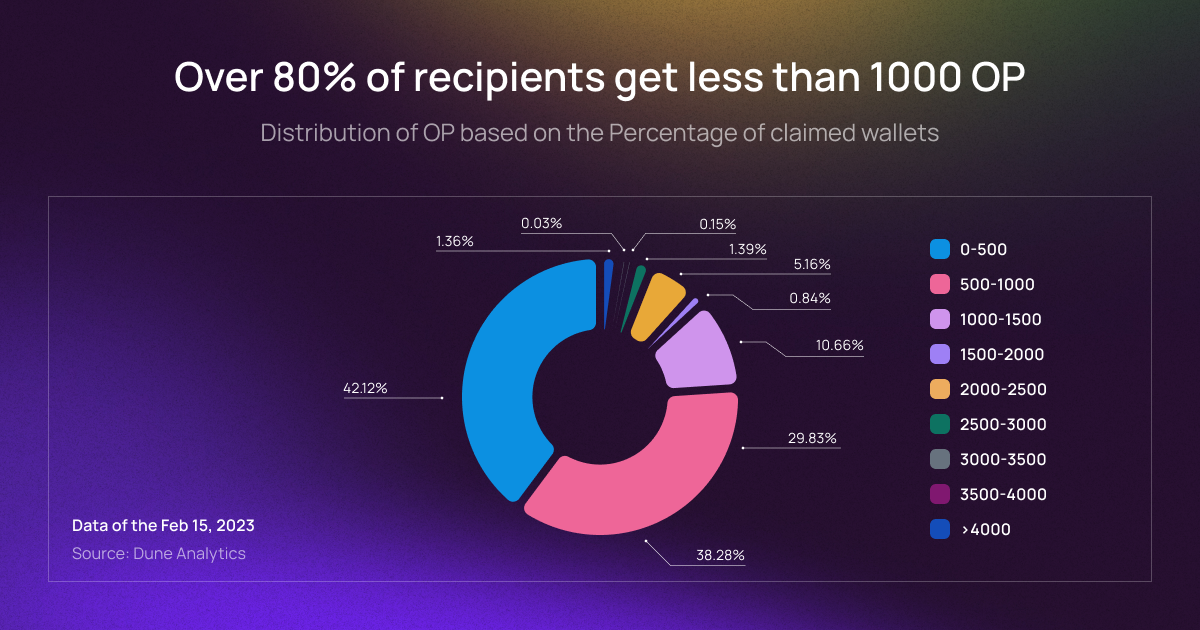

Optimism’s airdrop offered 5% of the total OP supply to around 250k eligible addresses, and announced additional future airdrops totaling 19% of the supply. The eligibility criteria included various groups such as DAO voters, Gitcoin donors, and multi-sig signers. The first round of the airdrop saw a claim rate of 75.47%, with most recipients receiving less than 1k OP.

Source: Dune Analytics

Despite the lack of clear-cut value accrual, the TVL and price of OP increased after the airdrop. A surprise second airdrop of 11.74M OP was announced, but most recipients received less than 10 OP. The maximum OP received was much less than in the first airdrop, and OP’s price dropped by 28.2% in two days. While the airdrop incentivized sustained usage, it may not be sustainable without future token incentives.

Popular Defi Protocols That Support Arbitrum Token

Several popular defi protocols have started supporting the Arbitrum Token ($ARB) on their platforms. These include Uniswap, SushiSwap, and Balancer, among others. This move is in response to the growing popularity of the Arbitrum network as a Layer 2 scaling solution for Ethereum, which has seen a surge in adoption due to its faster and cheaper transactions. As more defi protocols integrate with Arbitrum, it provides users with more options to access and use the platform’s benefits, ultimately increasing its value and usability in the ecosystem.

Here are some ways to earn some APY on $ARB right now:

- ARB-ETH pool with a 0.05% fee on Uni V3–116% APY

- ARB-USDC pool with a 0.3% fee — now at 114% APY

- WETH-ARB pool on Camelot with 32% APY (20% — $Grail token incentive)

- WETH-ARB on Sushi with 2291%

- $ARB put and call options on Premia with 114% APY (half APY is Premia token incentives)

- ARB-ETH 1% fee Elastic pool on KyberSwap 103% APY (with 57% KNC token incentive)

- ARB-USDC pool on Balancer V2 with 68% APY

Remember the IL risks, price action, and smart-contract risks while investing in DeFi. Do your own research and, of course, this is not financial advice. All data is according to Defillama.com on 29/03.

Potential Risks And Challenges Of The ARB Token

As with any investment, there are potential risks and challenges associated with the Arbitrum Token. Here are a few to consider:

- Market volatility: The price of $ARB, like any other cryptocurrency, can be volatile and subject to sudden fluctuations due to market conditions, investor sentiment, and other factors.

- Network risks: While the Arbitrum network is designed to be secure, there is always a risk of hacking, bugs, or other network vulnerabilities that could compromise the security of $ARB or other assets held on the network.

- Regulatory risks: Governments around the world are still grappling with how to regulate cryptocurrencies and blockchain technology. Any changes in regulations or legal issues could impact the value and viability of $ARB.

- Adoption risks: The success of $ARB ultimately depends on its adoption by users and developers. If adoption is slow or fails to materialize, the value of $ARB may suffer.

- Competition: There are many other Layer-2 solutions and blockchain platforms competing in the same space as Arbitrum, and the success of $ARB depends on its ability to compete with these other options.

It’s important to do your own research and assess these risks and challenges before investing in ARB or any other cryptocurrency.

Guide on how to buy, sell Arbitrum Token on DeCommas (even if your funds are on another chain)

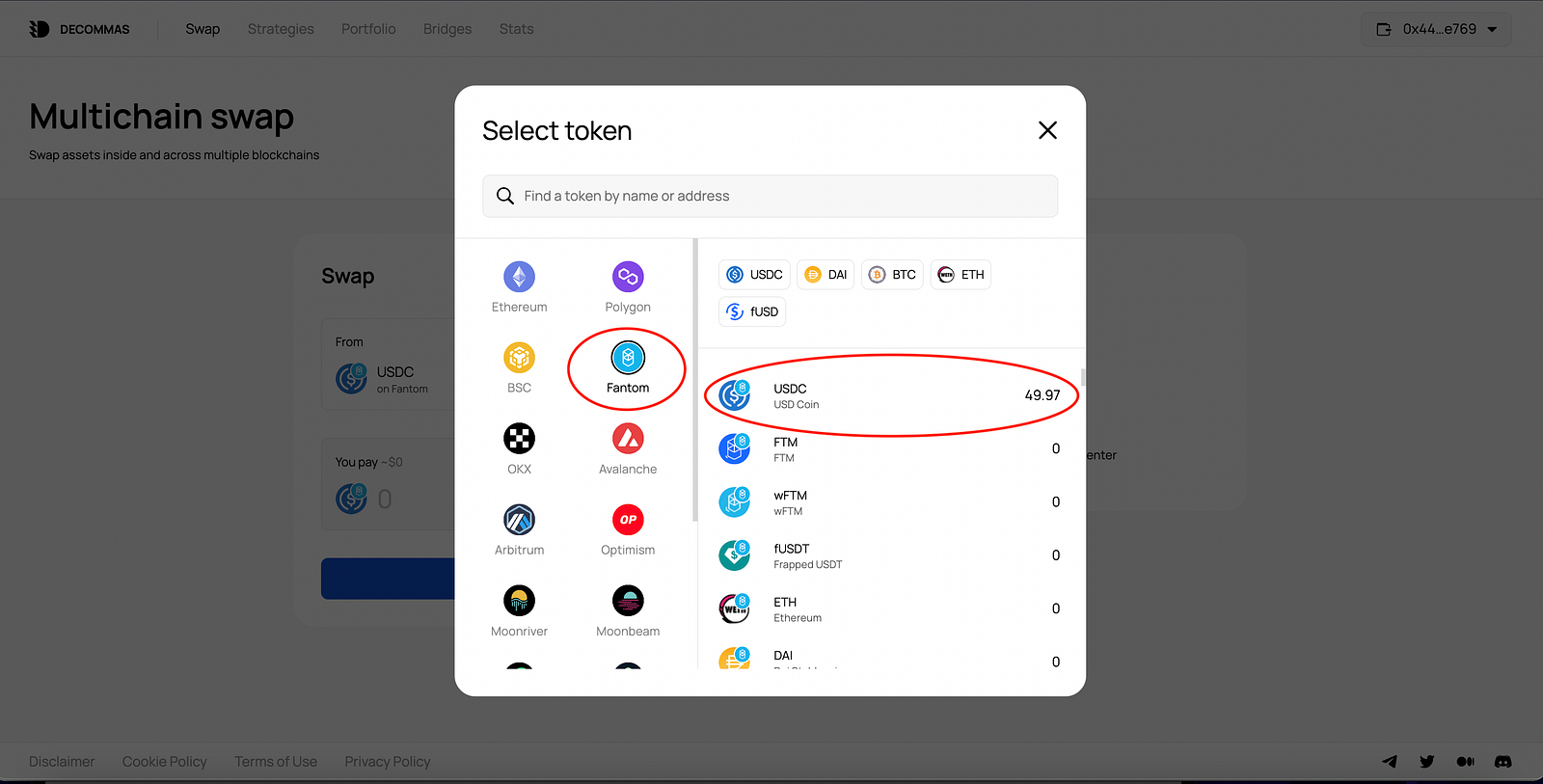

- Visit the DeCommas app and connect your wallet.

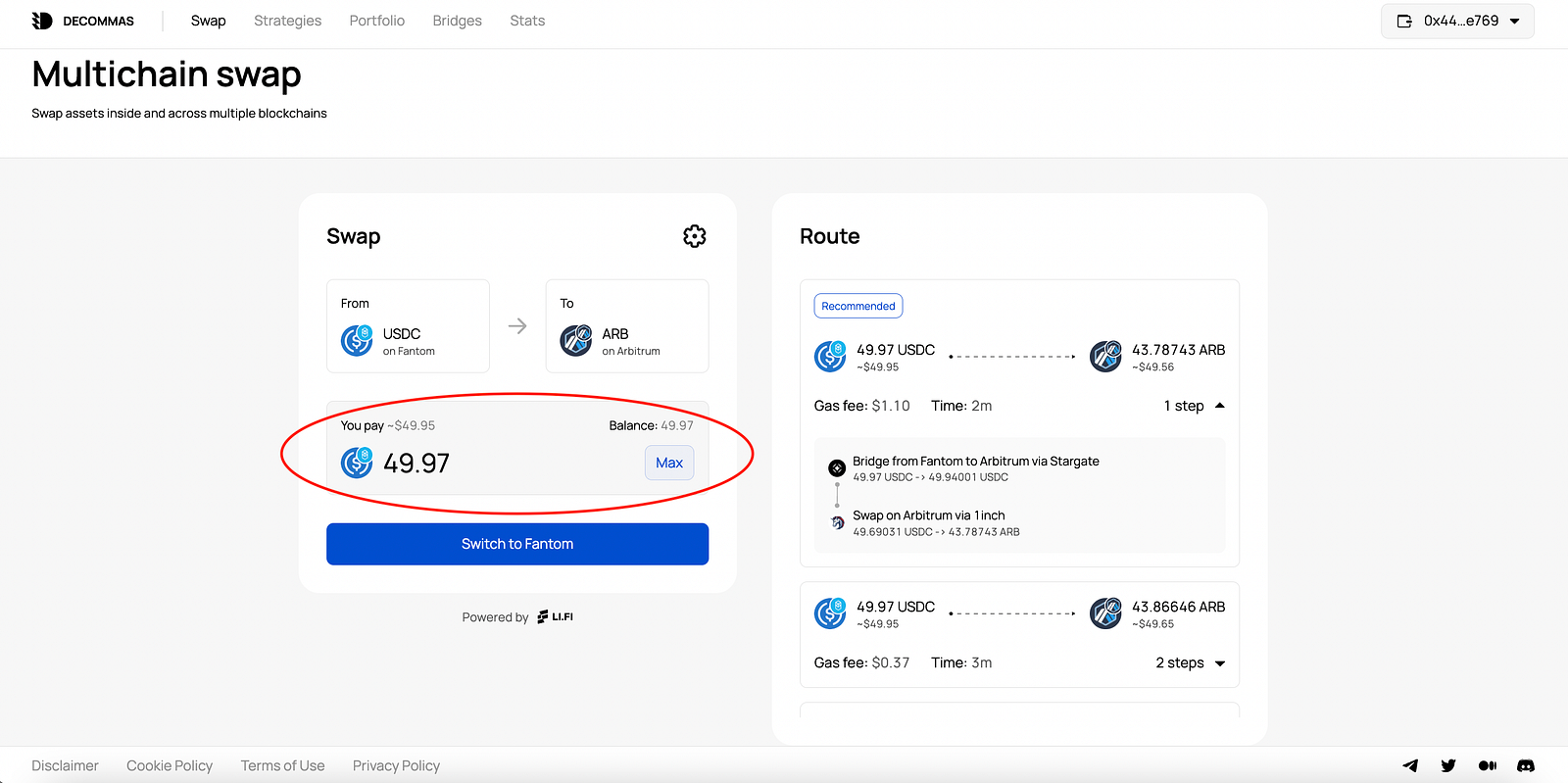

- Once you are connected, click on the “Swap” tab. Then, choose the “From” option where you have assets to swap the Arbitrum Token. We`ll choose USDC on Fantom.

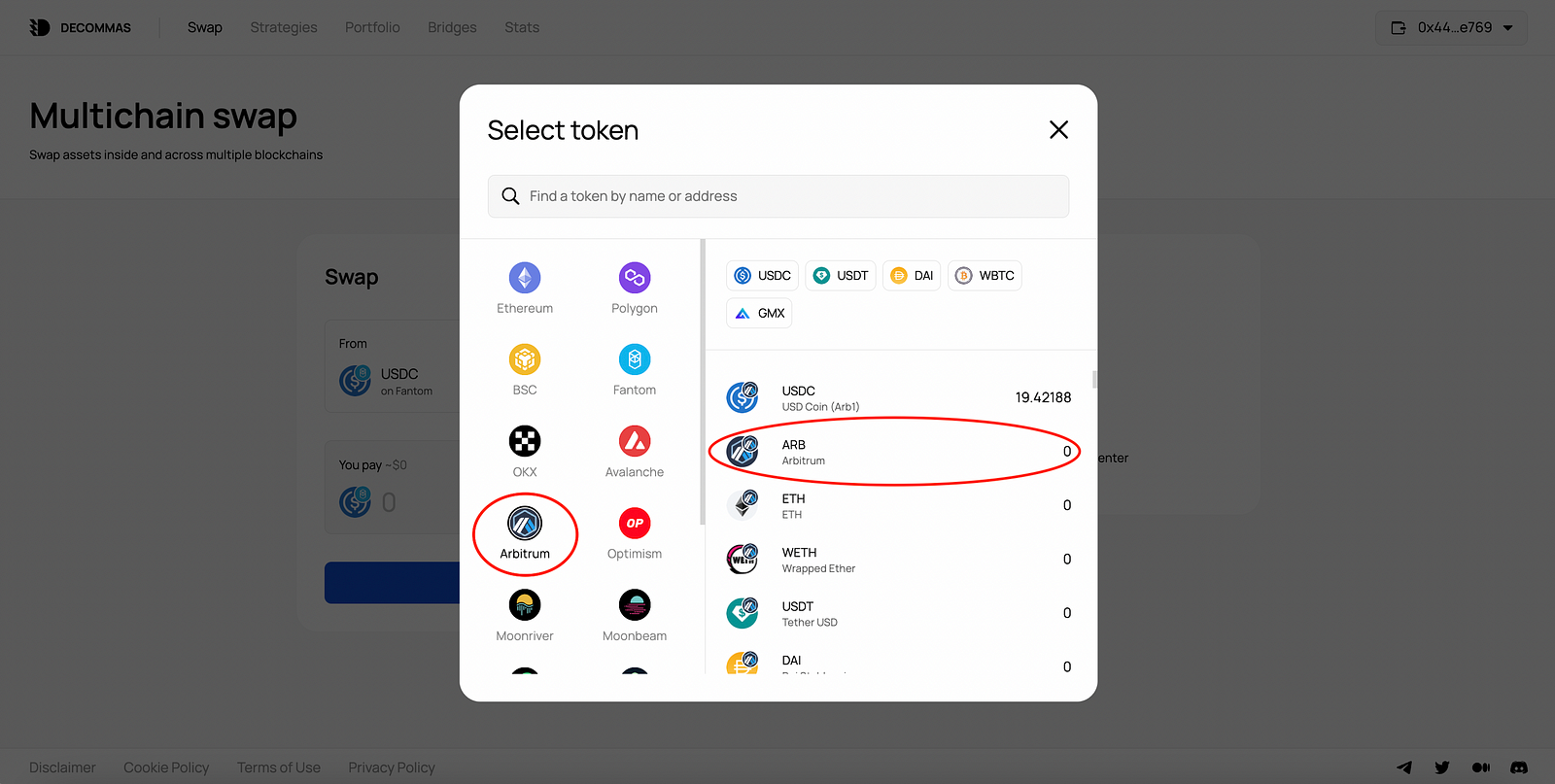

- In the “To” bar choose Arbitrum chain and $ARB token.

- Enter the amount of $ARB you want to buy.

-

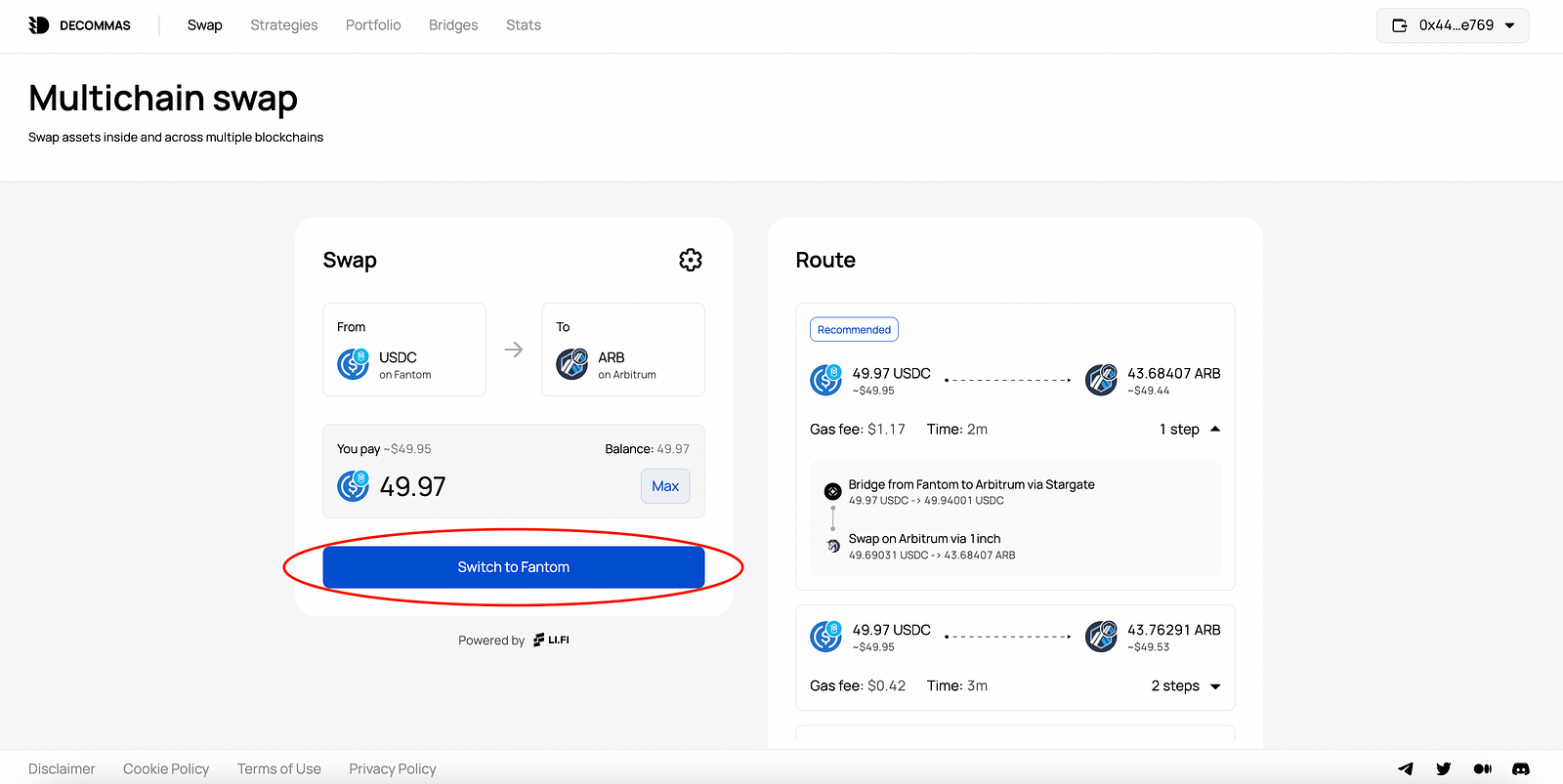

Choose a route you like. But pay attention to gas fees and estimated time of transaction.

-

Then, switch and congratulations! You are now the owner of the $ARB token. The same algorithm applies to selling it.

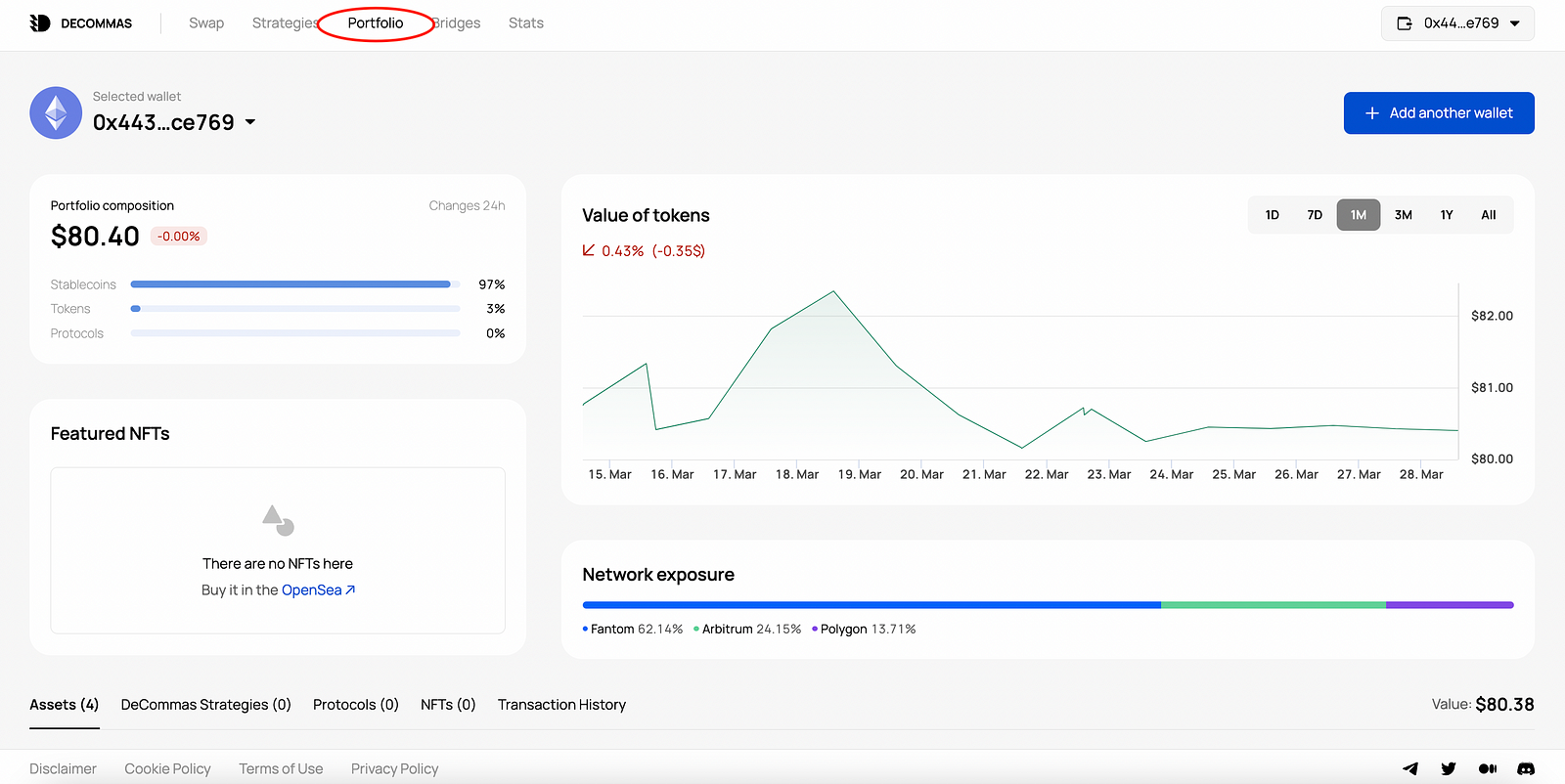

- To review your assets visit the Portfolio tab.

Closing Thoughts

Airdrops are a popular method for projects to distribute their tokens and gain organic holders. While they offer many benefits such as free marketing and incentivizing usage, they are susceptible to airdrop farming. To ensure a fair distribution of tokens, projects must balance economic gymnastics, demand, and supply to sustain usage without token incentives. Previous airdrops have shown mixed results, with some projects sustaining activity and token performance through ongoing incentives and solid products, while others struggle with reduced token incentives and growing competition.

To succeed, projects need pragmatic incentive mechanisms, fair distribution, solid product offerings, and non-trivial token utility. By learning from previous airdrops, new entrants can better calibrate their strategy for success.

If you missed out on this airdrop, don’t worry because our Swap is always available for you. To stay updated on future activities and events on Arbitrum, make sure to check out our Twitter thread and join our Discord community to discuss it. You can also earn some rewards for participating here easily.