What’s next for DeCommas?

Do not take anything from the article or from DeCommas in general as financial advice. Everything mentioned is only for narration or illustration purposes.

Our focus — The automation layer for a cross-chain DeFi world

Over the last few months, we’ve been working hard to shape our vision for DeCommas’ next steps. Today, we’re sharing that vision with you, our community.

The DeCommas project was started to tackle the main issues we see in DeFi right now:

- DeFi Automation is very limited

- Smart contracts do not self trigger

We foresee a future in which you will not have to go to several chains and DeFi ecosystems to construct and automate your portfolio. Most users care about opportunities, and not the particular chain those opportunities are on, they care only about setting up their portfolio and filling it with certain positions, assets, and strategies, and then being able to sleep tight after that, resting assured in knowing that their portfolio and assets are working for them.

This is why we are focusing our efforts at DeCommas on providing what we call an “automation layer” for constructing yield- and ROI-generating strategies in a cross-chain DeFi world.

No more jumping through hoops, using different bridges and wallets to leverage opportunities on multiple chains. We want to eliminate this complexity through cross-chain interoperability solutions, whilst adding a little (or not so little, actually) sprinkle of automation, to give you access to seamless cross-chain strategy construction.

The fast array of opportunities this opens up

Perhaps you’re curious about what could potentially be built with this “automation layer”? Let’s go through some of the possible strategies and products that could be created.

-

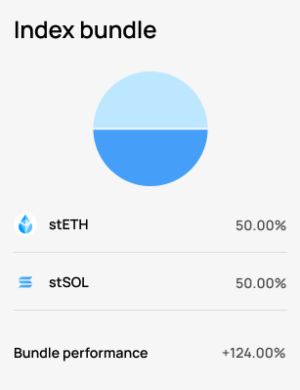

Simple cross-chain index, which is automatically rebalanced after certain thresholds.

-

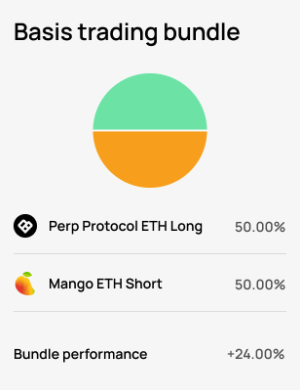

Automated basis trading strategy that you’re already familiar with, but cross-chain.

-

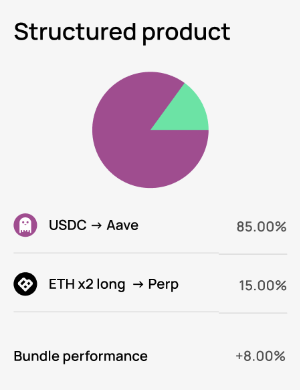

Simple structured product consisting of stable lending position and ETH perpetual long.

… and this is just the start!

In the future…

We believe that the most interesting and well-performing strategies and products will ultimately be created by brilliant minds from our community. As a logical next step, we want to build tooling and infrastructure to accommodate for our community to be able to develop their own strategies.

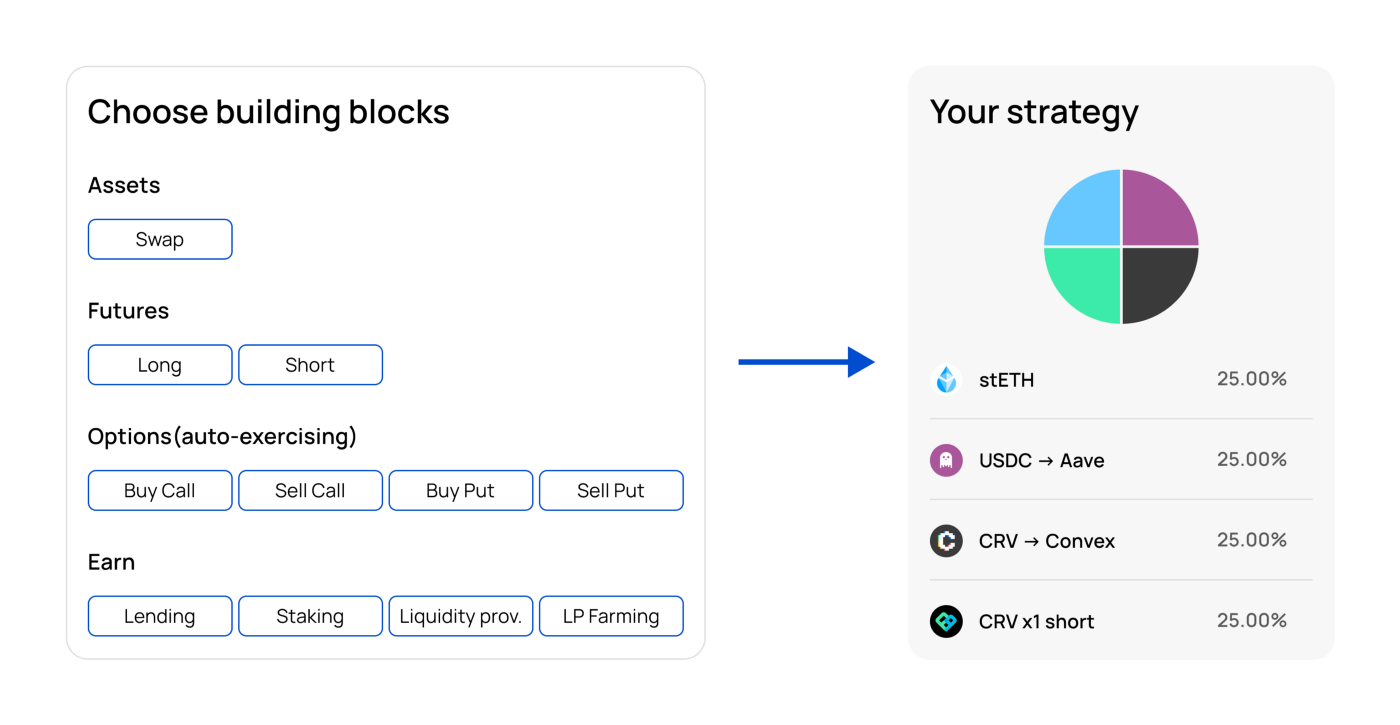

Just to paint the picture of what this could look like, we could follow a “building blocks” approach to the portfolio automation builder.

The picture is meant only for illustrative purposes of “bundle creator”, and should not be considered an actual strategy.

In order for us to get here, there’s a few steps we need to take in the next months:

- Cross-chain connection, initially through bridges → Work in Progress. First integrations have already been built.

- Automation network → Work in Progress. Our automated basis trading vaults are the first showcases to test the automation network.

- Integrated cross-chain swaps, to purchase assets as a part of the bundle(strategy) → Work in Progress.

- Cross-chain deposits into various protocols across the DeFi ecosystem to serve as “building blocks” for the strategies → Work in Progress.

- Maintaining these positions as a unified automated bundle/strategy to create indexes, automated strategies, and structured product

- Running automated rebalancing/adjustment for these strategies.

As you can see, we’re already working towards this bold vision. We’re extremely excited about what we’re building here at DeCommas, and will keep you updated through our Medium, Discord community and Twitter. Stay tuned!