The Year 2022 In Review

We wish you all a happy New Year from all of us at DeCommas.

Even though it was a challenging year in crypto with lots of hacks, insolvencies, and bad luck — you are still here. That’s all that matters.

2022 — a Not-So-Good Year for Crypto

The previous year was one of the worst-performing global financial markets. Indices were down to unprecedented levels; interest rates rose to the highest of 40 years and recession concerns.

DeFi was no exception; liquidity started to drain away from DeFi applications. We saw an almost 80% TVL decrease, according to DeFillama. DeFi token prices forced users to sell their bags even with losses to find safe haven in stables. Stables that also suffered from Terra ecosystem collapse and lost a significant part of user trust. There is no narrative like “algorithmic stable” anymore, at least in its pure sense, and “the true decentralized stable king” place is still empty.

DeFi hacks, such as multiple cross-chain infrastructure hacks or Beanstalk hack, pushed retailer traders to their limit. With low liquidity and less funding, builders also started to lose hope. In conjunction with the huge gap between centralized and decentralized UX, the complexity of DeFi tools, and difficulties in understanding for the average user that leads to onboarding and retaining DeFi user base problems, these all left us with a feeling of lethargy in DeFi space.

Another source of worry is regulation. This year we were witnesses of the first attempt of sanctioning open-source technology. The story of Tornado Cash is far from ending and maybe not just a “battle for our privacy” but something even more (so many things are not incomprehensible and not clear there), but it is obvious to us that regulation is coming in the form DeFi degens do not appreciate here. As true DeFi believers, we stand on the ground of openness, transparency, and free access to financial primitives. However, we also see that fair, privacy-preserving, and permissive (but not prohibitive) regulations and common industry security standards are needed to protect users and developers.

However, hope is not lost. A bear market allows you to have fairer investment opportunities. As an investor, you can avoid distractions and focus on identifying valuable projects to invest in.

The builders who build in a bear market are the true backbone of this crypto industry.

Despite all the negativity and fewer incentives, they are building, which shows their belief in crypto. They are the ones to keep an eye on.

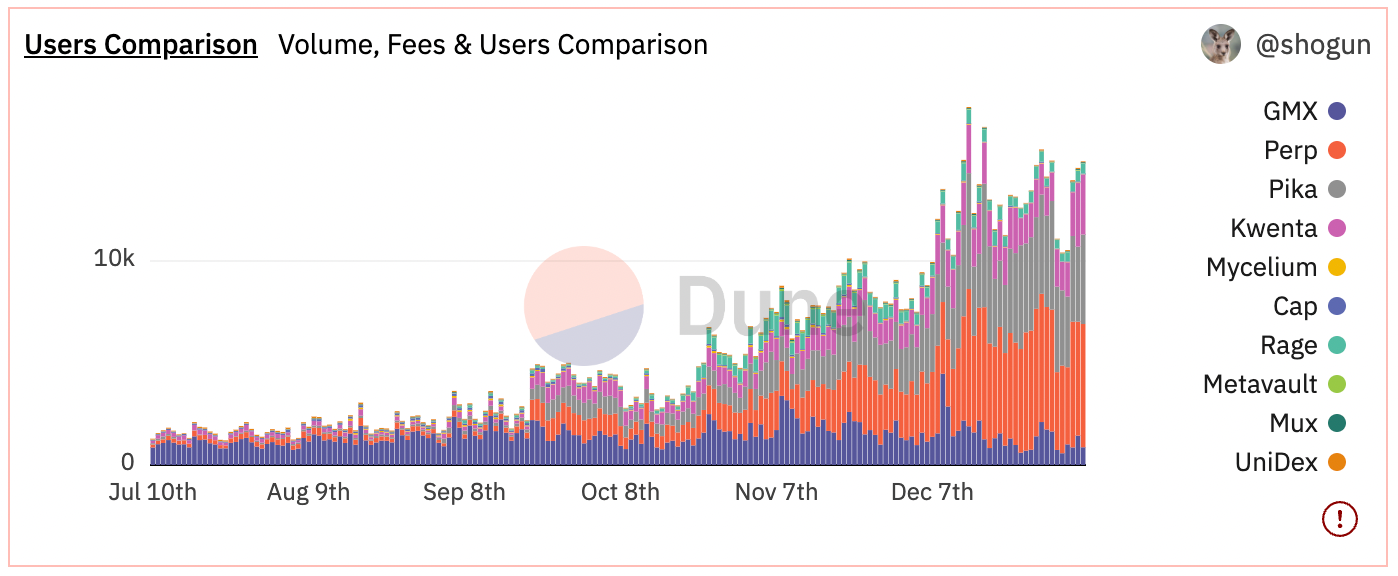

On a positive note, trading volume started to increase in decentralized exchanges after the collapse of FTX due to a lack of trust in centralized exchanges. Protocols like Perp, GMX and GNS gained popularity, and the #RealYield narrative became the hottest topic of crypto. Investors became more intelligent, moved away from Ponzi/inflationary yields, and started looking for sustainable “Blue chip” yields. Apps began to build on top of GMX, which provides innovative solutions to users’ needs, such as risk-free delta-neutral yields and other types of vaults.

source: Dune analytics

We also saw developers’ concerns of LP protection narrative. Things like Rage.trade, Gammaswap, Duality and many others trying to protect DEX MMs from IL impact. And this is very important in times of very thin liquidity on the market. We’re also waiting for more UX simplification for users through automation and things like MPC and account abstraction.

As for DeCommas, as you may see below, it’s been a very eventful year for us. Let’s go through it.

DeCommas` Recap of 2022

Whatever shenanigans are happening in the market, we are happy to say that — “We are building”!

We announced our basis trading strategies in February 2022, and with regressive back testing private and public testnets phases, introduced our ETH-USDC vault in Solana this spring. Both the testnet and mainnet phases were warmly welcomed by the users.

Unfortunately, we had to pause the Solana strategy after the Mango Markets exploit.

Solana Hackathon Winner

In April, we won Mango markets and Serum prizes in the Solana Riptide hackathon for our automated vault. That added to our confidence to ship more.

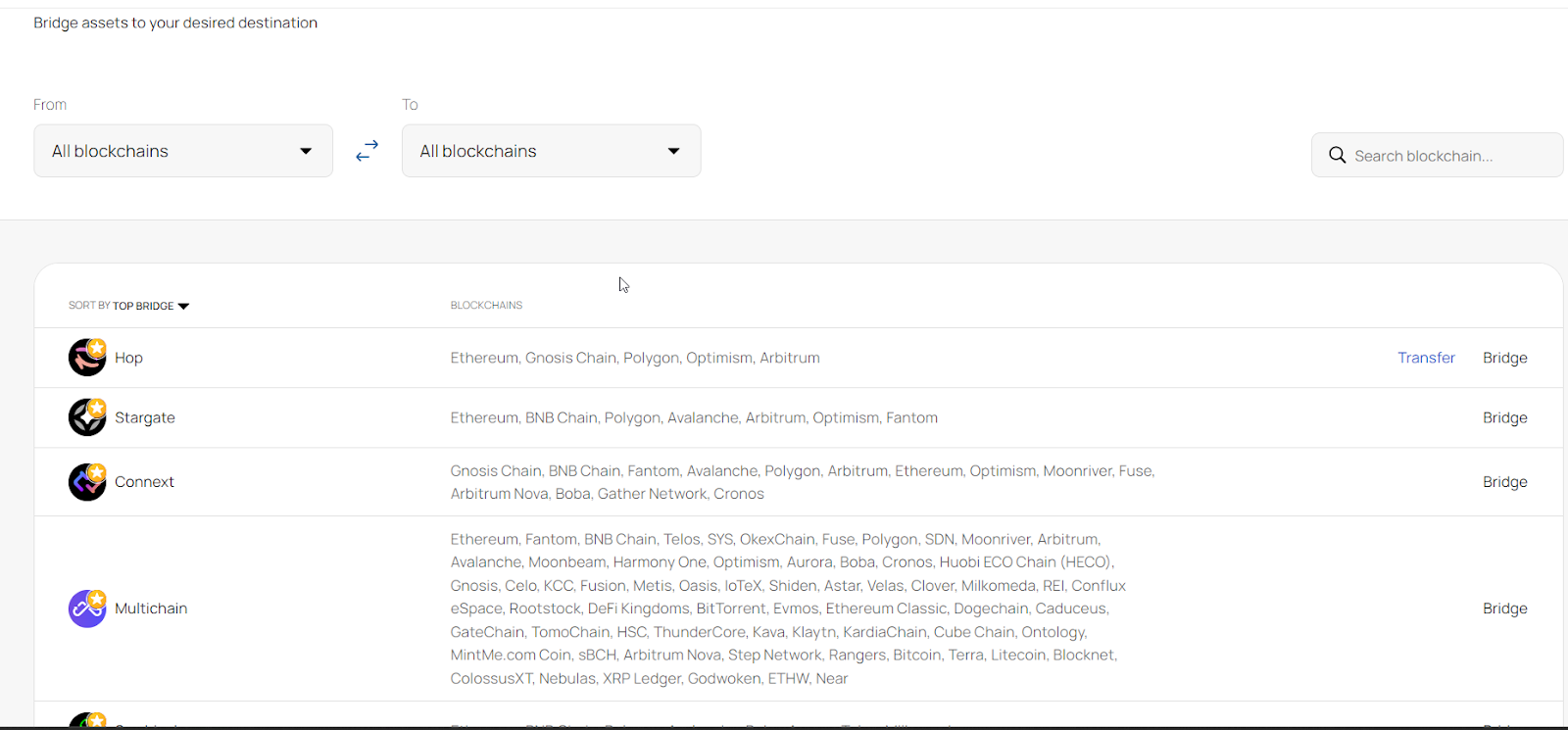

Bridge Integrations

Users can access the top-tier bridges to move funds between chains from the DeCommas Bridges page. Currently, users can use the HOP protocol natively integrated within DeCommas to move funds between Ethereum main chain, Optimism and Arbitrum. Juicy upgrade of this page is in plans.

DeCommas Bridges

Basis Trading Vault On Optimism

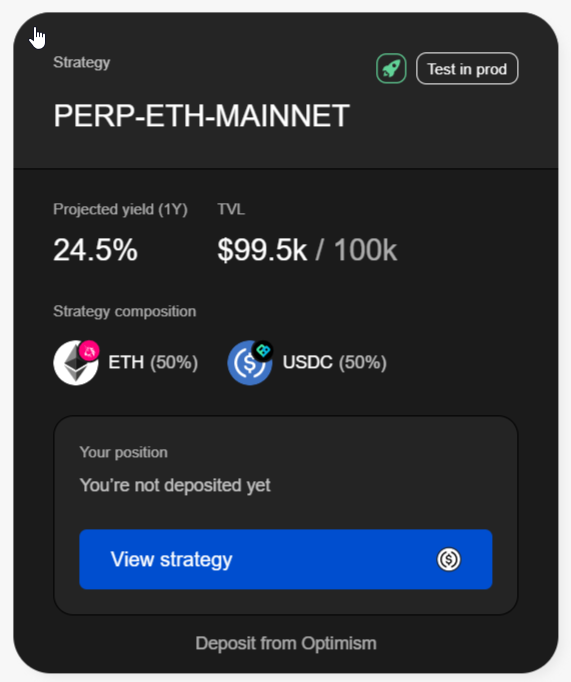

During June, we introduced basis trading vault on Optimism. Later on we increased our capacity to $100,000 and it was filled to maximum capacity within minutes! And the total trading volume right now is >1,819M USDC.

In this delta-neutral strategy, the funding rate of the perpetual futures contracts is used. Simply explaining there can be a difference in price for the futures contract and the spot price of a token. A funding rate is introduced to bring this value to parity. This funding rate can be positive or negative according to market conditions.

Our delta-neutral basis strategy buys spot and short the futures contract for the same notional value to stay delta neutral while collecting the funding rate. More on basis trading here.

This strategy is almost full and currently yielding a ~6.7% APR. Which is below expected/backtested APR, mostly due to much harsher market conditions. However, it hasn’t even been a full year for it, so we’re eager to see how it’ll perform in the next few months…

More great news in August came from Perp Protocol, where we got a grant of $40,000 from them! This grant will be utilized to expand the DeCommas protocol.

GMX Market-Neutral Strategies

As for the GLP Hedged strategy, we have moved from backtesting and manual forward testing to the automated forward testing. Here you can see the Grafana dashboard that tracks the stats of one of the iterations.

However, considering all of the events over last few months, we’re internally evaluating and brainstorming the ways on how to make it as non-custodial from the get-go as possible.

What Do We Have in Store?

Even though we hit many roadblocks in 2022, bearish in both emotional and price action-wise, we are as excited as you about 2023. We are fully equipped to grind through next year and beyond, both from financial and talent perspectives.

We expect to see more partnerships and collaborations that will drive our future endeavours forward.

We have exciting developments in store for 2023. One of the concepts we’re working on as we speak will bring all the work we’ve been doing on both strategy- and UX-side together nicely. Internally we’re coding it “Pathfinder” — a “routing engine” for DeFi with the ability to build strategy routes and execute them in one interface without leaving it. Expect more hints and details on this development in the coming weeks!

Want to get involved with the DeCommas community? Say hi on our social media channels on Discord and Twitter!