The $GLP Wars are here — All you need to know about $GLP and GMX related strategies

It’s been a dynamic few months in DeFi, and for every set-back there’s at least as many positive developments in the industry. Decentralized perpetual exchange GMX is one of the examples of one of these positive developments, as the exchange offering low swap fees and zero price impact is flourishing.

As a result of this newfound traction, DeFi automation protocols are scrambling to deliver high impact, yield generating, delta- or market-neutral strategies to leverage the massive opportunity GMX and $GLP bring. Today we’re taking a look at how the #GLP-wars are shaping up!

What are GMX and GLP, and how do they relate?

GMX is a decentralized perpetual exchange where users can exchange… you guessed it, perpetuals. Perpetuals are contracts without an expiry date, similar to a futures contract. This makes a perpetual contract a derivative, deriving its value from the underlying (crypto-)asset.

These contracts allow users to hold leveraged positions without an expiry date, giving them flexibility to enter- or exit trades at any moment in time. They also make for a great opportunity to earn passive incomes through collecting funding fees, as perpetuals require funding rates to ensure that future prices and index prices converge regularly. If you have been following DeCommas, you know that this is currently the bread and butter of our strategies.

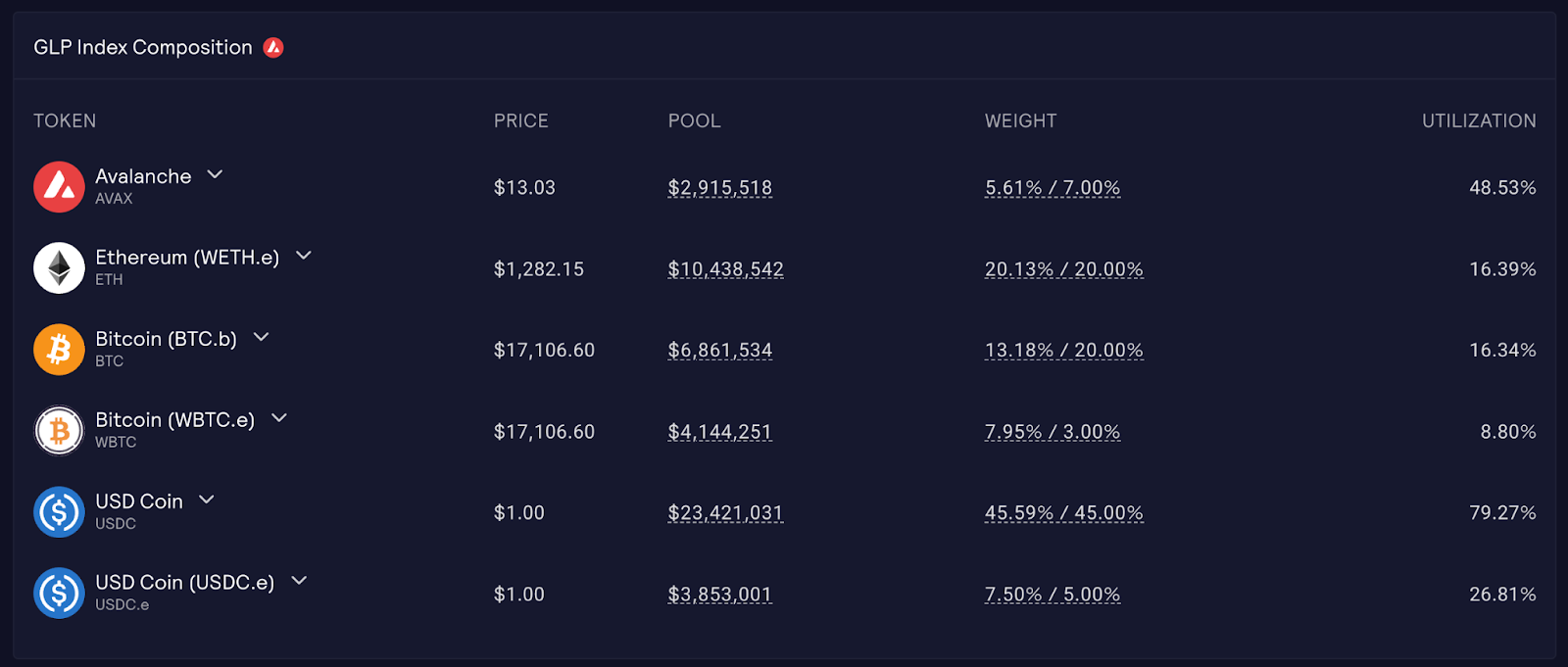

As any decentralized exchange, GMX relies on a liquidity pool to enable users to transact near instantaneously. To create liquidity, GMX has created a token for liquidity providers: $GLP. As a holder of GLP you are providing liquidity to the exchange, whilst at the same time getting exposure to an appealing mix of underlying crypto-assets.

GLP Index composition — https://app.gmx.io/#/dashboard

Why is $GLP the talk of the town for DeFi strategy buildooors?

There’s a few reasons we can name that makes $GLP such an interesting token to build (automated) DeFI strategies for, we’ll list a few:

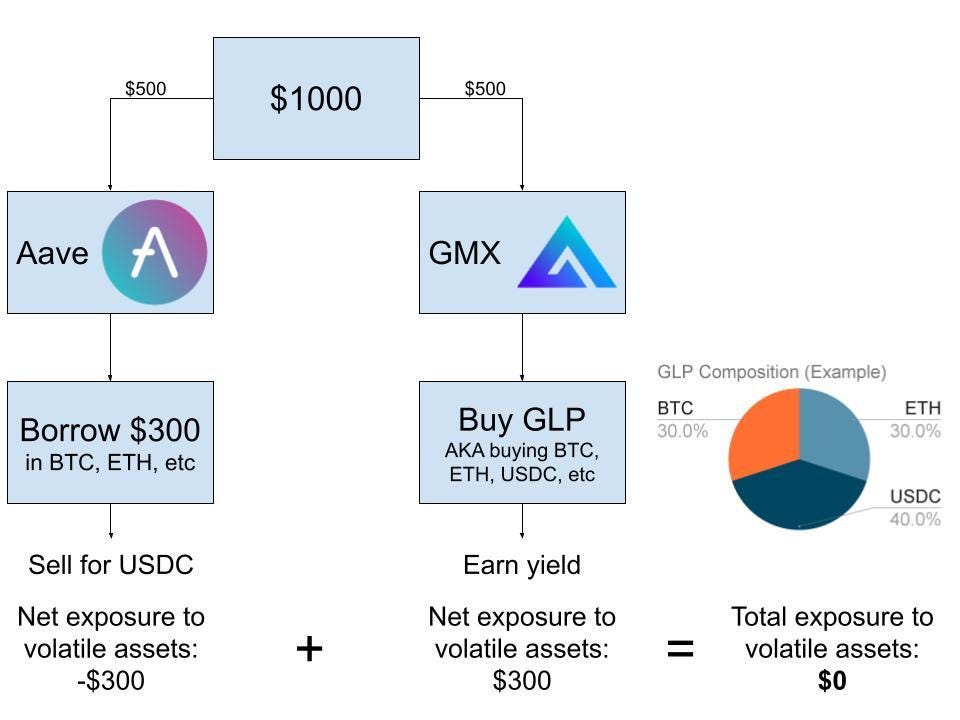

- With $GLP currently yielding an impressive 29,55% APR at the moment of writing (check https://app.gmx.io/#/earn for the actual APR) the token provides a great opportunity for delta neutral, or market neutral, trading strategies. As a reminder, the reason delta neutral strategies are a popular option in DeFi is because it enables users to benefit from APR’s, without being exposed to price action of the underlying asset.

- $GLP’s APR is generated as something we refer to as “real yield”, meaning the APR is not generated by deflationary mechanics such as token emissions, but by awarding token holders a share of actual revenues. In the case of $GLP, the yield comes from swap fees, perpetual interest and liquidations; 70% of these fees will go to stakers of the $GLP token.

- The $GLP token itself is composed of a well-balanced basket of assets, as pointed out earlier. This makes the token not only solid in terms of economics, its composition is resilient and — depending on your view on crypto — made up of assets with a presumably bright future.

- GMX, the decentralized exchange behind the $GLP liquidity provider token, is on a serious hot streak, drawing attention in and outside the DeFi space. Since its inception in September 2021, it has become a top-20 DeFi project in terms of total value locked (TVL), growing towards $500 million USDC in TVL.

Very healthy proving grounds for some next generation DeFi strategies, we believe. And we’re not alone. Many DeFi projects are scrambling to deliver $GLP-based strategies, resulting in what you could call #GLPwars. Now, in DeFi we build together, so we took some time to list the projects currently building in this space.

An inconclusive list on DeFi projects building GLP strategies

It’s important to note this list is inconclusive and not final. If you know (or are) a project that should be on this list, you know where to find us!

DeCommas GLP Hedged strategy

Of course we’re starting with the most brilliant team of them all 🤓

The DeCommas team is working on something that’s being described as a “GLP Hedged strategy”.

DeCommas is building a GLP strategy with as little as possible price exposure, buying #GLP on one side of the equation, while shorting the position by lending the equivalent values of individual assets within GLP at that moment, creating a strategy that is close to delta neutral. To optimize yields, the DeCommas team is currently developing it’s rebalancing interfall to offset shifting composition within the #GLP asset.

DeCommas is expecting to launch its GLPheldged strategy in the first quarter of 2023.

Fellow DeFi projects joining the #GLPwars

As always, DYOR, not financial advice. We have in no way or form audited any of the following strategies, but we’re so excited to see these projects building to further our DeFi cause:

- Umami -> After a short hiatus, Umami is expected to launch the “V2” of their GLP vault which is built to generate “Delta-minimized” returns on assets including USDC, BTC and ETH.

- DAOJones -> DAOJones is working on a similar product aiming to maximize yield, built on top of their own jUSDC and jGLP tokens. They’re looking to achieve a concept DAOJones refers to as “Delta maximal”, in which it tries to amplify GLP yield.

- UnstoppableFi -> The team at UnstoppableFi has also been joining in the GLP wars. They’re looking at a strategy that is splitting the stablecoins and crypto assets in to their own synthetic token, which could generate 10% APR on the stables (“RealYield”), and 30% APR on BTC.

- Rage Trade -> Rage trade is building Delta Neutral Vaults for GLP, which is earning yield on GLP while shorting ETH and BTC exposure.

- VestaFinance -> VestaFinance is currently aiming to maximize the yield, and volatility, of GLP by applying leverage through lending.

- GMD Protocol -> GMD has a “pseudo-delta-neutral” GLP strategy in the works, which will have a hedge in USDC, ETH or BTC allocated in accordance to the actual composition of GLP at that moment, rebalancing weekly.

Most of the projects mentioned are aiming to deliver their strategies early Q1, so it seems like it’s going to be a race to the finish line. We can’t wait to see how these GLP wars will shape up! May the odds be ever in your favor…