The future of DeFi — What the collapse of FTX means for our ecosystem

November 2022 kicked off with a series of events that shook up the entire crypto-industry resulting in the collapse of crypto-currency exchange FTX.

Before we jump in, let’s take a look at:

- What

- H

- A

- P

- P

- E

- N

- E

- D

There’s been so much writing and analysis about this, we’ll give a brief summary based on the timeline and the currently available public information here. Based on a leaked balance sheet of Alameda Research¹, an FTX sister company, concerns about the solvency of FTX started to mount. The leak revealed Alameda Research held a significant amount of FTX’s native exchange token FTT on its balance sheet, casting doubts over collateral or reserves to cover FTX or Alameda’s outstanding obligations.

Following these revelations Binance CEO Changpeng Zhao announced the intention to liquidate any FTT on its books². The mounting negative speculation triggered high amounts of withdrawals (a “bank run”), putting FTX in acute liquidity issues. On October 11th FTX and all affiliated businesses filed for Chapter 11 bankruptcy.

(link)

Billions of dollars in value wiped out in a matter of days, as a result of the largest crypto-exchanges turning out to be, let’s put it as it is, poorly run. Crypto had its “Lehman Brothers moment”, and we’re picking up the pieces….

In this article we’ll share the DeCommas team’s collective perspective on how we believe this will shape the DeFi- and crypto-industry for the better, as we remain laser focused and our convictions have not changed.

How is the FTX collapse changing crypto and DeFi, right now?

In times like these, it’s hard to love crypto and blockchain. But it also shows its resilience, flexibility and most interestingly its transparency. We see the community responding in real time.

Here are some of the trends we see happening right now:

1. The community wants to see “Proof of Reserves”.

As reported, one of the key contributors to the collapse of FTX was its lack of reserves in comparison to the debts it had to its users³. The reserves on balance had been opaque until the moment balance statements started leaking.

One of the fundamental principles behind blockchain technology, and DeFi, is transparency. Yet, it seems, we have built numerous influential projects that do not take this value to heart, and turn out to be centralized institutions that do not disclose much information about their financial health.

We expect the community to demand more. The community will demand full transparency from the projects they are involved in, and we’re already seeing some examples of exchanges taking the lead here.

(link)

2. Traders transition to DEXes, uncertainty towards CEXes

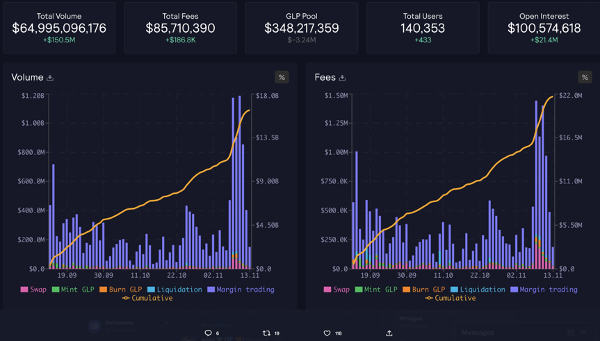

The collapse of FTX is a huge blow to the trust of the community in CEXes, obviously. These growing doubts about whether or not CEXes are safe to use has led a growing number of users to start using DEXes. We’ve seen increased trading volumes in DEXes like Uniswap, Perpetual Protocol, GMX and dYdX.

(link)

(link)

While we think the accelerated adoption of DEXes is something that will not be reversed, we do believe there’s a role to play for CEXes. Centralized exchanges will not go away. We expect many users in the space to enjoy using CEXes for their (so far) more user-friendly UX, higher speed, liquidity and ability to provide fiat to crypto solutions. Users of centralized exchanges can also benefit from a higher rate of regulatory compliance (although it’s good to note this is not always the case).

However, being DeFi advocates ourselves, we stand firmly in our belief DEXes are paving the way forward, being more transparent, censorship resistant and eventually more secure.

3. Growth spurt for storing crypto-assets in self-custody

You’ve heard the mantra before: “Not your keys, not your coins”. Billions of user assets getting stuck on what people perceived as a safe option was a wake up call to the crypto-community. When an asset is stored on a centralized exchange, the exchange acts as a custodial. When liquidity issues arise, they might not be able to repay the assets it held for you.

We expect a growth spurt in users looking to store their assets in a (non-custodial) wallet, taking ownership over storing and accessing their assets. We expect this to be a sustained trend, as wallets will become more accessible and user friendly, and understanding of basic blockchain-principles will grow amongst users.

4. Fear, uncertainty and doubt (FUD)

When turmoil hits the market, FUD (fear, uncertainty and doubt) will be spread. It’s not just bears being bearish, it’s a very predictable human pattern: most traders FOMO in during bull-cycles, and make a panicky exit during bear-cycles.

We see this is leading to a skeptical attitude in the space, which is not entirely irrational. In the days following the FTX collapse, we have already seen the impact of the “contagion” of the situation, with the halting of withdrawals at digital asset brokerage Genesis as an example.

We believe this will be a short-lived trend. We’ll get back to building, or even re-building. The lower valuations of projects will in due time attract value-oriented long-term investors, and the bear-cycle will end.

How we believe this will shape DeFi and the broader crypto space for the better

If you have been in crypto of DeFi for a minute or two, you’ve heard people claim “we’re still early” as a hint towards the massive potential that is still here for our industry. While it’s a cliche, it’s very much true. Being early means there’s a lot of “upside”, or potential, but it also means there’s a lot of room for growth, improvement and tweaking.

We believe these events will harden crypto, and specifically DeFi. Whilst there’s a direct negative impact from the collapse of FTX in the shape of decreasing valuations, locked assets and even potentially disappeared assets, these events will help crypto and DeFi in the long run.

A few dynamic months ahead, bringing focus on security and fundamentals

It’s fair to assume the bottom is not yet in, and we’ll have a few difficult months ahead. For this phase, we foresee the following changes re-shaping the industry as we know it:

-

Bear market consolidation

The FTX collapse has definitely had an impact on the available funds of multiple projects, and we fear contagion and the extended bear market will claim more victims. We’ll see projects run out of cash, failing to raise new capital in time.

This in turn will trigger consolidation, both through projects closing down shop and through mergers and acquisitions. We won’t go as far as saying it’s a winner-takes-all market, but we’ll definitely see a few players increasing their dominance in the industry. You could argue this is already the case for CEXes, where Binance’s dominance has only increased recently.

Although it’s a painful process, it’s not necessarily a bad thing. We believe this will make for a stronger blockchain ecosystem, which should cause the pessimistic sentiment to be overturned by a sense of trust and optimism. -

Ongoing focus on security

As identified in the immediate impact of the FTX fallout, we absolutely expect the security concerns are here to stay. We’ll see more forms of providing “assurances” to the community; audits, transparency initiatives and initiatives like bug-bounties will be a sought-after characteristic in DeFi-projects.

There’s a real opportunity here for security- and auditing-firms to step up their game, and we can expect new projects and products to be launched in this space, increasing competition. -

Increasing accessibility and transparency

Something we’ve been firm believers in from day one, we think will only get more important. Accessibility and transparency.

People need to understand what products they’re using and what the potential risks are. DYOR, for a lot of users in the space, is an empty term, as it’s extremely difficult to get a solid view of what is actually going on within a protocol or project.

We believe information should be accessible, and we expect users to (rightfully) demand more here. -

Scalability and speed remain top of mind

As accessibility grows, active users rise. As adoption increases, people expect better, more seamless experiences. Speed and convenience are important, and in some cases we might see projects make web2 compromises over web3 native solutions to accommodate for growth.

In the long run new projects will arise to tackle specific scalability issues, a trend that we’ve already seen in multiple chains, with Arbitrum or Optimism being excellent examples for indispensable projects in the Ethereum ecosystem. We expect to see numerous scalability focused projects in the near future.

All of these developments, in our eyes, are positive. But this cautious mentality might or might not lead to an extended bear-cycle.

This too shall pass, and will lead to development, growing maturity and in turn a new bull-cycle.

Building towards a mature CeFi and DeFi ecosystem

We believe in a bright future for DeFi, the potential is tremendous. In the space, so many incredible projects are shaping up and attracting smart people to build the next generation of financial products. We’re just getting started and after this bear-cycle we believe we’ll see a period of growth and increased maturity. We’re looking out for:

-

A more prominent role for regulation

Even though we’re big advocates of a censorship resistant DeFi ecosystem, its inevitable regulation will play a bigger role in the crypto-industry in the near future. It’s expect ed that regulators and lawmakers to be watching the FTX collapse closely, and they’ll be on the lookout to protect retail traders by enforcing new laws and regulation in CeFi.

But what does this mean of DeFi? Only time will tell. It could very well push DeFi to become a “gray” area, which you could argue it already is. We might see more DeFi projects taking a hybrid approach, where elements of CeFi, such as KYC processes, are implemented to provide regulators with proof of legitimacy. On the other end of the spectrum, we’ll have projects which will stick to the core DeFi-values of censorship resistance and privacy, which DeFi was built to deliver. The response of regulators to this… who knows? -

Security becomes a dominant subdomain in crypto

We expect projects offering security solutions to flourish. We’ll see analytics tools, active security monitoring solutions, auditing platforms and security specialists grow as a result of increased awareness of the risks present in crypto.

New solutions for auditing will come to market, and we might even see some “household-name” trustmarks get established in the next months or years. We think there will be a wave of pro-active security, which offers ongoing monitoring and auditing based on on-chain behavior and events. Users will more and more look out for proof that projects and protocols are safe to use, and might avoid unaudited projects altogether. -

The next wave of blockchain technology

Real innovation happens in the face of adversity, and the strongest builders will stick around and step up their game. We feel blessed to be in the right position to build right through this bear-cycle.

As always with innovation, it’s hard to predict just exactly what will be delivered. We’re assuming we see new innovations in scalability, Zero Knowledge proofs, multi-/interchain operability, user custody and of course automation.

We believe increased multi-/interchain operability and automation, coupled with improved user experience will mean the boundaries between TradFi, CeFi and DeFi will blur. Users will be able to access simpler user interfaces and smarter wallets that will take much of the processes present in blockchain today away, resulting in easier access for everyone. -

Porting legacy finance and Web2 products to Web3 (and vice-versa!)

Web2 🤝Web3. We’ll see more and more “legacy finance” and Web2 products get integrated or duplicated in the Web3 environment. A very recent and concrete example is this of the new ability to use stablecoin USDC in Apple Pay.

Another major development that is already visible in the Ethereum ecosystem, is Ethereum Foundation’s recent approval of Ethereum Improvement Proposal EIP-3475. EIP-3475 will bring bonds on Ethereum, a fixed income market worth about $130 trillion in legacy finance (compared to global equities markets totaling in at “just” about $42 trillion). Delivering this capability in blockchain can push DeFi beyond traditional finance, as blockchain technology will make management- and contract-fees we’re used to seeing in traditional financial institutions a thing of the past.

We believe it’s inevitable products with massive user adoption in traditional finance, like structured products, wil make an appearance in Web3. This is something we’re actually working on at DeCommas, providing the Web3 counterpart for many — previously hard to access — complex legacy finance trading products. -

Open experimentation will be celebrated

One of the things we love about web3 is its openness, and this is also reflected in the way web3 projects do product development. It comes natural to the core values of the space, as it shows transparency, but it’s also a signal of the level of innovation going on. We’re learning as we go.

At DeCommas we embrace this way of development as well. For the core of our protocol, our automated strategies, we follow an approach where early versions of a product will be released in closed alpha, and later as “test in prod”, to collaborate with the brightest minds in our community to further our product. -

Increased adoption for crypto, and DeFi in particular

This is hardly a new trend, but we argue that the FTX collapse can actually boost adoption of blockchain-technology in the long run. The cleansing of bad actors from the space, the increased focus on security and the consolidation of fewer but stronger players in the industry will increase adoption rates. Even regulation could help here, pulling in more traditional risk-averse users for whom regulation will put their mind at ease.

At DeCommas, even though we’re shocked by the recent developments, we’re super excited to be building the future of DeFi, and contributing to the development of the crypto-economy. Let’s take a look at what we’re working on.

DeCommas: The automation layer for chain-agnostic DeFi strategies

Within this “recalibrated” DeFi industry, DeCommas will become the automation layer that provides users with simple “one-click” access to automated, decentralized, chain-agnostic, yield- and ROI-generating strategies.

We are convinced this is the way forward, and will enable increased adoption of DeFi-trading by providing frictionless cross-chain experiences. This vision is a culmination of many of the trends mentioned in this article.

Our steps towards delivering on this promise

Amidst this bear market and uncertain times, we remain focussed on building the DeCommas protocol. As we speak, we’re working on delivering new and innovative strategies, such as a market neutral GLP farming strategy, on our app.

In the future we believe DeCommas will become a marketplace for tailored DeFi-strategies, welcoming the community of developers of strategies to showcase their strategies on top of the DeCommas Protocol. Accessible user interfaces will allow developers to deliver these cross-chain automations with no-code solutions.

Recently we’ve published an article about our vision for the future, and how we intent to deliver that. If you’re interested, read on here: DeCommas Protocol — The automation layer for chain-agnostic DeFi strategies

Needless to say, we’re optimistic for the future of blockchain, crypto and DeFi. If you want to join us on our journey, follow us on Twitter and join our Discord!

¹ https://www.newcapitalmgmt.com/news/ftxs-leaked-balance-sheet