Why we’re showing Projected Yield on our strategies

The often-heard cliche is true, we’re still very early in DeFi, and this also applies to predictable and realistic forecasting of yield within DeFi projects. In this post we’re going to describe the Projected Yield concept, and why we think it’s important to report on, instead of just APY or APR, to give our users the best estimation of what they can expect.

Key takeaways:

- Annual Percentage Yield (APY), Annual Percentage Rate (APR), and Projected Yield are different yet connected terms.

- Projected yield is a dynamic metric to measure potential yields from an automated strategy which can be used next to, or in substitute of APY

- Most importantly: Yield projection narrows the gap between model simulations and actual results. Projected yield can limit trading risks.

What is Projected Yield?

Projected Yield is a dynamic metric that forecasts expected performance based on a recent set of data points. The prediction model implements different mathematical functions like rates and curves to analyze the most likely performance you can expect.

Effectively, this means a Projected Yield model will look back at recent conditions during a predefined period, and forecast yield based on this range of conditions. The projection will be a dynamic value, as the period the model looks at constantly changes.

Projected yield is sometimes also referred to as projected-, estimated-, backtested- or expected APY.

Why report Projected Yield in DeCommas app?

Unlike APY, projected yield is a more flexible estimate than a solid one, painting a picture based on a range of data points in the past which can change over time. This helps assess the effectiveness of a strategy based on the current market conditions.

At DeCommas we’re big believers in providing full transparency about the performance of our strategies, and think just APY does not paint the complete picture for our users. Adding projected yield as a data-point for our users makes making well-informed decisions easier, whilst providing more insight into the dynamics of our DeFi strategies.

3 Reasons why projected yields and actual performance may vary

Backtesting is mainly built upon historical data analysis across various timeframes. As the times flow, the analysts access a wider range of data and market situations, resulting in higher accuracy. However, the market is an ever-evolving mechanism that adjusts to the trading majority, not the data of the days long gone.

There are three common reasons why expected yields do not always equal actual outcomes.

- Rate difference. Projections consider the fixed or ranged rate on a specific timeframe, but the actual rate might vary. Unexpected global or local events can make the distinction quite significant.

- Volume difference. Projected and actual growth may vary, as some models ignore the growth/volume over specific timeframes.

- Source change. Any model would assume the product you participate in remains almost the same or moves towards the initial direction over time. Imagine participating in a DeFi protocol that decided to pull off a 180-degree reverse in customer approach, technology backbone, etc. No models can consider all the factors, resulting in the yield differences

Projected Yield, APY, and APR: What is the Difference?

Projected Yield, Annual Percentage Yield (APY), and Annual Percentage Rate (APR) are all used to calculate your expected performance. However, there’s a difference you might want to know before you apply either of the terms to estimate your interest.

Neither projected yield nor APY can guarantee any specific yields. However, projected yield estimates tend to be a more fair representation of the current conditions, as they narrow down the difference between a one-off projection and real yields you could expect. As a result, you might want to apply projected yield to get a clearer picture of your trading strategies.

Projected Yield

Projected yield is a term to describe your estimated income divided by the current account value. The “yield” word refers to a return on your investment based exclusively on income over a specific timeframe, while “projected” addresses the forecast based on current data trends. You can use the projection yield to evaluate potential, and this is never a guaranteed result.

Annual Percentage Yield (APY)

Annual Percentage Yield (APY) is the most common way to measure the amount of interest earned over a year, including the compound effect. Be it an investment, trading, or anything else — you can use APY to get a rough estimate of your potential yield. Higher APY means you can get higher yields.

Even though APY reflects your estimated yield, you can expect the difference between the APY promised initially and your final yield, as APY is a metric which forecasts yield based on one moment in time. As conditions are subject to change, APY might not be the most accurate representation of expected yield.

An example would be a freshly launched DeFi protocol with a cosmic 4-figure APY for some assets within the pool. The same protocol can easily yield you any double or even single digit for the same asset just several weeks later.

Annual Percentage Rate (APR)

APR is the interest you pay to get a credit. In other words, APR reflects the % rate to cover the cost of borrowing. The lower APR means the lower your overall cost of borrowing. Specifically in DeFi, you can also get APR as a reward for providing liquidity, which would make you a lender.

The terms APR and APY can be used together to supplement each other. For example, if you’re using advanced DeFi arbitrage strategies or automated yield aggregation strategies.

How to Calculate Projected Yield

Let’s address the stock market to understand how projected yield can be calculated in crypto. Your projected yield for a stock (10-year annual) is equal:

Starting Yield + Earnings growth + Percentage change (Price per share/earnings)

You can apply the same logic to calculate the projected yield for any asset class, including cryptocurrencies. The overall idea is just four steps.

- Determine the market value of your investment

- Evaluate the income it may generate (for example, lending, staking, or trading).

- Divide the market value by the projected income.

- Multiply the result by 100 to get the final projection

The trickiest part here is the projected income evaluation. Analysts use various concepts of statistics, big data, mathematics, and machine learning to model accurate estimates.

Either way, you might want to run the expected yields through several rounds of testing before relying on hypotheses and the best way to succeed is by following the experience of someone who works with hypotheses on a daily basis.

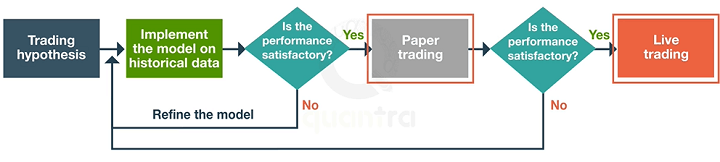

Trading analysts build specific models and test them using a secure framework to evaluate the estimates and actual yields. But how do they do it? The overall scheme for testing a trading model and hence understanding whether the displayed projected yield holds true is described below.

Source: https://blog.quantinsti.com/backtesting/

Closing Thoughts

In an ever evolving DeFi-and trading-ecosystem, it’s crucial to do your own research and understand how to assess the expected performance of your activities. Even though APY is a popular way of estimating expected yields, it’s great to have another metric at your disposal to get a more complete outlook on the yield that can be expected.