How Decentralized Exchanges Stack Up to Their Centralized Counterparts

The recent downfall of a major centralized exchange FTX kicked the hornet’s nest, and the public pays closer attention to alternative solutions like decentralized exchanges (DEXes).

Although DEXes made substantial progress over the last years, they still lack some functionality of centralized exchanges (CEX). This take sheds light on how DEXes may derive the best CEX features while solving notable issues caused by centralization.

CEX & DEX At a Glance

Both centralized [CEX] and decentralized [DEX] exchanges contribute to one of the most notable crypto infrastructure cornerstones — the Application Layer.

Alt: crypto ecosystem infrastructure. Source

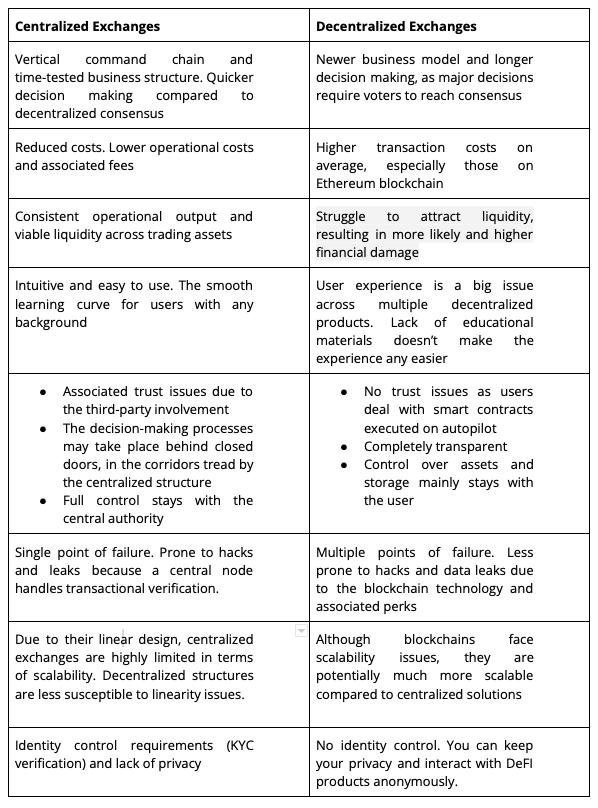

Exchanges majorly influence the Application layer and, combined with the Access layer, bridge users into the crypto industry. While equally important for the crypto ecosystem, DEX and CEX platforms contribute in slightly different ways. Let’s start with a summary first.

In a centralized network, a central authority governs and handles the network. Such a centralized structure causes several issues that may affect users.

Shortfalls of current generation Centalized Exchanges (CEX)

CEX usage implies three key issues. Anyone using CEX solutions carries the following associated risks.

Infrastructure Risks

- Complete/partial loss of server availability

- Emergency reboot of the trading engine

- Physical failure of the server

Server-related issues may eventually entail a permanent loss of your funds. Since centralized exchanges act as 3rd parties, they aren’t responsible for any losses caused by server downtime or other technical issues.

Exchange Connection Risks

- Interrupted connection

- Order execution delays (hence slippage)

- Incorrect data processing

- Partial data loss

Similar to infrastructure risks, any of the above may cause permanent loss of your funds. As a retail user, you can’t influence the impact caused by the Infrastructure and centralized exchange connection risks in any way. Any issues of these two classes root in the centralized tech stack. Another class of risks refers to business management and operations caused by the centralized backbone.

The Black Box Policy Risks

- Non-transparent flows of user funds

- Custodial wallets and lack of control, as a result

- Other issues such as growing centrality, lack of transparency, and more (see the diagram below)

Here’s a diagram of possible trust-related issues that may be associated with CEXes (may be applied to DEXes to a lesser extent).

Alt: trust issues crypto. Source

The black box bullet points all address trust-related risks more of less. Simply put, you have no choice but to trust third parties that may fail or misbehave. Let’s recall the swift collapse of the FTX exchange to understand these issues better.

The collapse of centralized exchange FTX

The collapse of FTX is one the fastest destruction of the capital of all time. Somewhat the financial contagion, or crypto’s Lehman moment. It still sends shockwaves across the industry and may leave an untold number of creditors — up to one million — holding the bag, including countless customers who had funds on the exchange, many of them retail clients.

Here’s a quick summary of how FTX (a multi-billion dollar ecosystem) has zeroed almost overnight.

- Alameda Research hedge fund was founded back in 2017.

- Two years later, the sister company, FTX exchange, started growing by leaps and bounds. They become the #2 biggest crypto exchange, they also cut huge marketing deals and get lots of unregulated funds

- Alameda Research was revealed to be holding billions of dollars worth of FTX native token FTT. Alameda had been using FTT as collateral in further loans and built a financial pyramid. This information was clearly not known by users and FTT holders. The unabated domino effect destroyed FTX.

Access a full review of the FTX crash in the Nansen report.

The FTX collapse undoubtedly patched off some of the centralized finance (CeFi) issues, but exactly why did it happen? Long story short, the back-door policy buried Sam Bankman Fried’s brainchild. Let’s be more specific, though.

- The absence of daily reconciliation of positions on the blockchain

- Use of software to conceal the misuse of customer funds

- Payment requests through a chat where supervisors approved disbursements with personalized emojis.

How Does The FTX Collapse Relate to CEX & DEX?

The lack of total value locked (TVL) growth shows that the FTX collapse caused trust issues across the board — both for centralized and decentralized solutions. Although TVL hasn’t grown during or right after the FTX collapse, many DEXes and protocols have experienced a substantial inflow in terms of volume. The volume redistribution seems temporary, yet it still shows that users run out of confidence and tap into decentralized solutions. However, the same users don’t stick with protocols due to risks other than centrality and trust. Why then?

The FTX collapse caused a massive liquidity crunch. Several decentralized protocols and platforms (for example, Solend) had a bank-run scenario where all assets are fully borrowed in SOL, USDC, and nearly all in USDT. That means no current supplier can withdraw.

Shortly after, key APRs on Solend reached 2,500% on SOL, 169% on USDC, 61% on USDT. It’s terrible for users who are locked in and highlights a key reason why being in the most liquid place possible is so important. That circles users back to centralized exchanges with dominant liquidity across the board.

It’s not that bad for DEXes, though. The latest developments around Aave and Compound protocols (over $5.5B in TVL) clearly demonstrated that users address the liquidity issue.

- Compound governors unanimously capped borrowing levels across assets with low liquidity to avoid additional strain on protocol.

- Aave users almost unanimously decommissioned assets with thin liquidity to protect against price manipulations.

These two examples of liquidity management show how users tackle the threats with given (low) liquidity. Whether smart governance could drag DeFI through hard times despite the liquidity issue is an open question.

Learn even more about the FTX collapse consequences.

Decentralized Networks & Exchanges: How can Decentralized Exchanges potentially Solve CEX Issues?

In a decentralized network, no central authority governs and handles the network. As a result, decentralized exchanges could be a great alternative to centralized exchanges. A quick summary first.

Decentralized Exchanges: Key Takeaways

- DEXes require no identity verification. Could be a huge score point if you somewhat care about your privacy.

- DEXes list more tokens compared to CEX on average. A paradise for small-cap token lovers. Some tokens have higher than CEX liquidity.

- DEXes stand for wide access. Trade regardless of your geography.

- DEXes are part of the DeFi ecosystem, implying efficient and transparent asset control on top of other Web3 values.

- DEXes can boast flawless security perks if built well. Since these perks are powered by blockchain, any changes in code require consensus. No single malicious actor can change that.

- DEXes supply functionality with no trust issues. You don’t have to rely on third parties, as decentralized solutions are completely transparent

Let’s now elaborate on how DEXes work to understand why they may solve core CEX issues.

How DEXes Work In Under 15 Seconds

Users don’t transfer their assets to an exchange/third parties. Instead, some users create liquidity pools, deposit funds, and then other users can use those funds to exchange between assets. For example, the pool with the highest volume on Uniswap is ETH-USDC. This is a pool that allows users to swap between Ethereum and USDC. Because anyone can deposit funds into this pool, all depositors, regardless of deposit size, can earn from the fees generated by the pool.

Smart contracts automatically handle all transactions, implying immutable data control and no third-party trust issues.

How DEXes Have Already Beaten CEXes?

Let’s untoggle several DEX aspects that solve CEX issues.

Identity Information Control

Say farewell to Know Your Customer (KYC), as most DEXes require no identity verification. If you cherish your own privacy and want to trade with your anonymity veiled, decentralized exchange may come in handy.

Centralized exchanges must collect your personal information to meet legal standards. The information collected is used to identify or track suspicious activity. DEXes do not have this requirement due to their decentralized nature and lack of legal touch.

Token Count & Liquidity

Listing on a decentralized exchange is much easier than on any centralized one. As such, an average DEX usually lists much more tokens than any CEX. You can access token pairs otherwise unavailable and untangle new trading perspectives.

Liquidity is another point worth your consideration. DEXes use automated market-making and organic stimulation/incentive frames to capture higher liquidity across trading pairs. Several years ago, DeFi suffered severely because barely anyone wanted to risk their capital investing in questionable brand-new teams with no performance record. The space also lacked functional products. As a result, DEXes had lower than CEX liquidity in 99 out of 100 cases. Things change. Some trading pairs on DEX nowadays flip CEXes in relation to liquidity.

Accessibility & Censorship Resistance

DEX allows you to trade regardless of your location, citizenship, gender, race, etc. It’s a 100% free zone available for anyone on planet Earth. Perhaps even beyond the globe in the future, who knows?

Some countries have strict legislation or no regulation whatsoever. Banning anything unknown is the most logical step from their perspective. Keeping the needs of many outweighs the needs of the few. Whether they quote Spock or mean it, such an approach has a point.

As a result, CEXes have the legal right to ban anyone without any notice. Think about it next time you send your pic for verification. No DEX can ban you due to unflattering photos, geography, or anything else. Trade with peace of mind. Trade regardless.

Decentralization & Asset Control

Sticking with DEXes means you can access an open-source code behind any exchange. Understand how it works, suggest ideas, debug, and fix things pretty quickly if required. A collective mind put in charge is powerful indeed. Imagine DEX is a car. In this little role play, open source code is the engine powering everything small to big. The community is a steering wheel or a driver behind the wheel orchestrating where the car goes.

Another strong point of decentralized solutions is simply being a part of the ecosystem. That implies you have unlimited and effective control over your assets CEXes can’t provide. For example, you can swap, stake, provide liquidity, take loans, and borrow effortlessly.

Although fees on DEXes are usually higher than on CEXes, decentralized solutions may cause a cumulative effect over the long run. For example, if you’re using smart wallet solutions, you may optimize your fee structure. Learn more about one-click DeFi solutions like DeCommas.

Security

Code is the law, and no single person can adjust the protocol in any way without the majority of votes in favor. That’s a security angle to keep in mind. Another negative one is a forkfeed product we digest from media channels. Exploit is a big pain point among DeFi and DEX in particular.

Decentralized platforms are flawless on paper, but when it comes to the real world, nothing is perfect. Neither DEXes nor CEXes. The media pays notorious attention to anything DeFI protocol, or DEX has been hacked. Compromised, exploited, drained. The list goes on. The truth is centralized exchanges experience data, funds, and other leaks just as often, if not more.

Think of a light projector in a dark room. The media works as a ray of light focusing on specific events and unconsciously forgets about the dark depth where small and uninteresting centralized exchanges hang out and socialize with each other. That’s not to say DEXes are completely safe. But neither are CEXes. You risk anyway, so why give up other perks DEXes > CEXes?

What Makes CEXes so Succesfull Today?

Centralized exchanges nail five key aspects.

- Higher liquidity across the board

- Better user experience (UX/UI)

- Lower trading fees

- Faster response to market changes

- More trading features and markets available

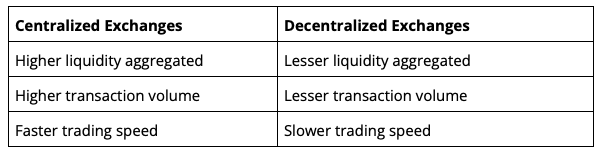

First and foremost, CEXes offer higher liquidity. No DEXes compare even closely in this regard. Let’s understand why this happens and elaborate on other strong points centralized exchanges offer.

Higher Liquidity

Most liquidity comes from large-scale providers such as institutions. They can only allocate funds if the area is well-regulated. In other words, the law obligates large liquidity providers to meet the regulatory framework. While CEXes offer compliance with the requirements set by authorities, DEXes are at a gray area crossroads. Hence, DEXes can only access limited liquidity by default.

The liquidity may also affect other transaction metrics. In particular, higher liquidity entails a change in translation volume (sometimes transaction count) and order execution speed.

Better User Experience

CEXes are more user-oriented compared to the complexity of using DEXes. Most centralized exchanges derive the experience of traditional finance platforms: including refined dashboards, website and app interfaces.

Lower Trading Fees

An average CEX features a much better fee structure compared to DEXes. Mainly due to the centralized business models, which are more entrepreneurial. DEXes are not that commissioned in nature, and it’s still unclear to whom they can be traced.

Another reason why DEXes lose in terms of fees is the network-related expenses. Most notable DEXes operate on the Ethereum network, which is somewhat like New York city — abundant with opportunities, yet expensive. That implies transactions cost much more on prominent DEXes. Not to mention the network incentives DEXes payout on top of other expenses they share in common with CEXes.

Faster Market Response

DEXes lag behind CEXes substantially in markets requiring sophisticated analysis and human intervention. DEXes require consensus by design, which puts them in an unfavorable position from the decision-making speed angle.

Think of correspondence and trade execution as a consensus issue to determine who arrived first, which trades should be executed, and in what order. CEXes are far ahead, leaving DEXes no chance in terms of speed and efficiency achieved. Not to mention possible bugs and breaches related to smart contract execution.

More Trading Features and Markets Available

Carrying years of centralized finance experience, CEXes offer a wide range of tools and markets. The most notable would be margin trading and order management tools like Take Profit (TP), Stop Loss (SL), trailing orders, and more. Little to no DEXes support such features.

Can we expect DEXes to improve on CEX functionality over time?

Most DEXes don’t have the best liquidity balance, UX/UI, trading fees, or tools. Fixing those takes time, and most DEXes are headed in the right direction. Prominent industry developers like Uniswap and 1Inch shape DEXes functions to make them better. User-experience features are among the most notable changes. The overall look, functionality, and learning curve have improved drastically over the last two years (since DeFi summer blossomed).

Let’s draw a quick visual sample to understand the evolution of the DeFi user experience. The picture below is EtherDelta: one of the first DEX experiences available to retail users.

Alt: etherdelta DEX interface. Source

Compare it to the soft 1Inch look DeFI users can access nowadays.

Alt: 1inch DEX interface. Source

As to other aspects like order management tools, various markets, and trading styles, DEXes also evolve. For example, Uniswap already allows somewhat margin trading. You can lock UNI tokens as collateral for more UNI. Although it isn’t direct leverage, you can adapt and use it as one.

Limit orders are being rolled out slowly, but DEXes make visible progress. DEXes like 1Inch have been implementing limit order functionality recently. This allows traders to place orders at a specific price and receive corresponding fills at that price, exactly like on CEXes.

DEXes are also getting more and more battle-tested with every passing day, meaning hacks are less likely as more talented developers join the protocols. Even though DeFi is pretty much about taking the human element as much as possible, developers still affect the way smart contracts are programmed and audited.

Web2 veterans switch (as the Web3 industry matures), bringing decades of experience. On the other hand, more Web3-exclusive developers gain experience over time and avoid mistakes as they build. All above — we have more secure contracts.

Do DEXes Need to Match CEXes Functionality?

Liquidity. DEXes need more liquidity to operate safely. Low liquidity in a DEX entails a higher risk of meddling done by bad actors. Let’s draw a relevant example featuring the Mango Markets’ recent exploit.

- The Mango Markets lacked liquidity, creating an exposure point for malicious actors.

- The malicious actor funded the MNGO-USD perpetual and manipulated the MNGO token price, resulting in almost $423 million in unrealized profits used as collateral for a $116 million loan.

- The actor then drained out the rest of the liquidity, leaving the protocol in shambles.

Learn more about the Mango Markets exploit.

The same or similar attack vector has been applied across Transit Finance, TempleDAO, and Rabby Swap. If these protocols had higher liquidity, such attacks may not happen in the first place. Let’s now circle back to the importance of DEX matching CEX functionality.

Why do DEXes Need to Match CEXes?

DEXes can barely access institutions due to a lack of regulation, retail users are their main audience. Assuming DEXes source liquidity from retail users, they have to encourage retail users to actually use decentralized products. That’s impossible without a much smoother user experience CEXes already have.

Decentralized exchange developers understand it and already work on competitive products to cover the needs of retail users unfamiliar with crypto. Think of anything one-click and smooth, like a refined banking app. Even an intelligent toddler could use such an app because it’s intuitive. That’s the thing CEXes already have, but DEXes are still building.

Order management tools, trading markets, and regulation are among other notable reasons why DEXes should follow in the footsteps of centralized rivals.

In Closing

The recent FTX exchange collapse has undoubtedly spurred a wave of interest in the DeFi ecosystem. As a result, several protocols and exchanges are experiencing double-digit growth. Massive outflows of ETH and stablecoins from centralized exchanges also show that people push to self-custody, at least over the last few weeks.

Does it mean that decentralized solutions are better? Not necessarily. While DEXes advance towards better user experience and functionality in seven league boots, CEXes also walk away with a conclusion. The latest proof of reserve update might just pave the way for centralized exchanges in upcoming years.