DeFi Vaults: What Are They and How You Can Benefit?

This article elaborates on the DeFi vault concept, also touching on common vault types and DeCommas automation strategies you can utilize to optimize your DeFi returns.

TL;DR

- DeFi vault is a collection of users’ funds automatically invested based on a specific strategy.

- DeFi vaults automatically optimize the return on the funds you provide. They’re handy if you’re a small investor, as you can significantly save on transaction fees.

- Not all DeFi vaults are equally safe. Higher rewards usually imply higher risks.

- DeCommas features DeFi vaults you can follow in one click.

Introduction to DeFi Vaults

Decentralized Finance [DeFi] is a complex system comprising several pillars — the key ones are lending, borrowing, and decentralized exchanges [DEX]. Liquidity is a connecting link between the three, a valuable resource DeFi protocols extract.

More liquidity = More functionality and connectivity for the protocol.

Since liquidity is quite limited, the DeFi protocols capture and redistribute liquidity to gain an advantage. Protocols may use various DeFi tools, such as yield farming, to access/manage more liquidity.

Yield farming is lending/staking in exchange for interest. In other words, you supply the protocol with tokens while the protocol uses additional liquidity to generate value and reward you in return. Think of a bank deposit, but more transparent and flexible.

Protocols pool retail users into so-called vaults to make yield farming more efficient. DeFi vault is a collective, auto-compounding strategy similar to asset management companies or mutual funds. Instead of dealing with all yield farming milestones, you can pool your funds once and benefit from automatically reinvested compounded gains.

Let’s talk about DeFI vaults in detail.

What is a DeFi Vault?

DeFi Vault is a service that manages your tokens — it automatically optimizes the return on the funds you provide. Vaults aggregate funds of users into pools, thus reducing the overall transaction costs and optimizing returns for each pool participant.

Imagine you’ve locked in tokens and want to claim your yield farming rewards. You might also want to reinvest for more gains if the pool is profitable. Now think of 99 more users doing the same — that’s a lot of transactions, each associated with additional fees. DeFi vaults reduce transaction count and costs by pooling funds, thus making your yield farming more efficient. Vaults further collect your rewards and reinvest automatically for even more profits.

DeFi vaults are not necessarily yield farming strategies. The underlying strategy may vary, but the principle remains the same. Automated vault strategies maximize the efficiency of your investment while keeping it simple for you. Vaults are particularly useful for small investors, as investors can save on gas fees. It’s also an excellent way to get started with DeFi.

DeFi Vaults: Risks Explained

Not all DeFi vaults are equal. Some of them offer higher rewards, but also risks. Let’s classify DeFi vaults based on risk tolerance.

- DeFi Vaults with low risks. Single asset staking, those are usually stablecoin vaults or major tokens. You deposit an asset and earn more of the same asset. Lower rewards.

- DeFi Vaults with moderate risks. More complicated strategies involve lesser-known tokens and auto-compounding of the rewards. The underlying token is more likely to fluctuate in price. Moderate rewards.

- DeFi Vaults with high risks. Advanced strategies involving multiple assets, yield farming pools, and even protocols. Auto-compounding makes such strategies even riskier. High rewards.

- DeFi Vaults with extremely high risks. Complex tools involving multiple protocols, assets, and leverage.

There’re many more classifications for DeFi vaults, but the core principle never changes. Rewards rarely decouple from risks, as they usually go hand in hand.

DeFi Vaults: Types

Here’s the list of some popular DeFi vault types you can encounter.

- Leveraged DeFi vaults. Yield farming + borrowing from other pools.

- Options DeFi vaults. Complex option strategies to hedge the risks.

- Fixed-yield DeFi vaults. Single asset vaults with low risks.

- Basis farming DeFi vaults. Profits made on funding rate difference.

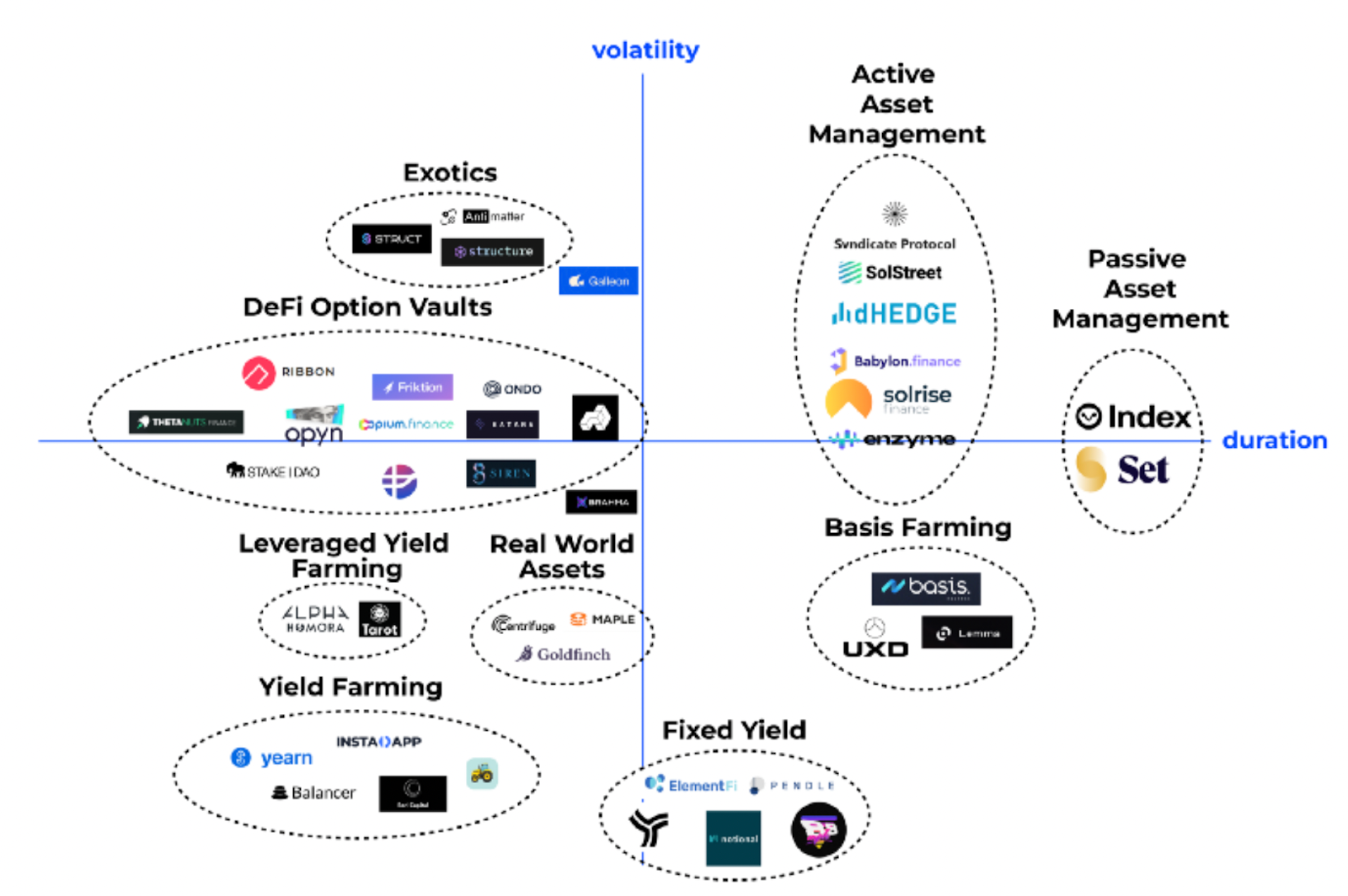

Each type has its own pros and cons, as well as risk/reward ratio. You can also run into more vaults, schematically represented as follows.

Original image by STFX protocol.

Learn more about DeFi vault product classification, structured products, and decentralized asset management considered from various angles.

DeCommas DeFi Strategies

DeCommas is an automation layer that provides access to one-click DeFi vaults and various strategies. Let’s break down core DeFi vault strategies by DeCommas for clarity.

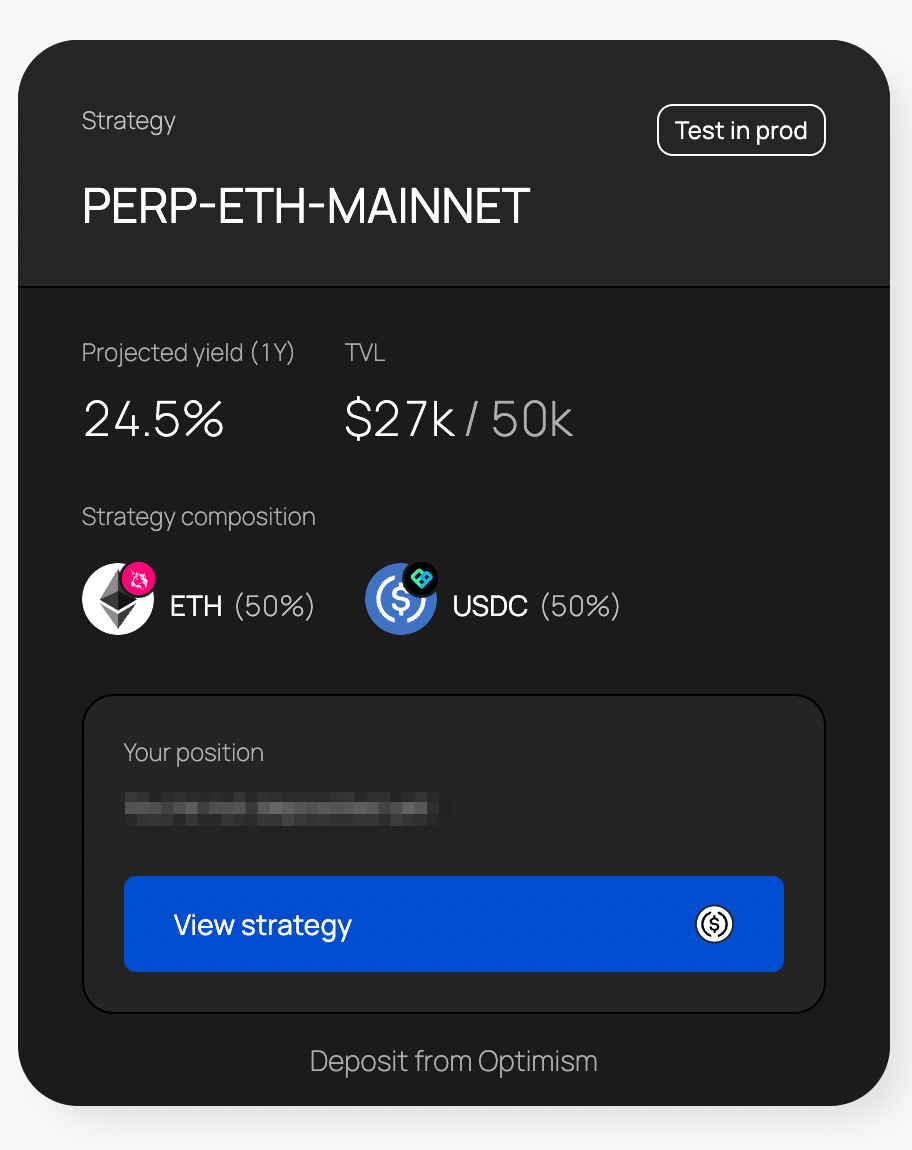

DeFI Strategy #1: Ethereum Perpetual [Optimism]

An automated basis trading strategy to capitalize on positive funding rates of ETH. The strategy uses the same principle as Mango Markets PERP-ETH, but you can deposit from Optimism.

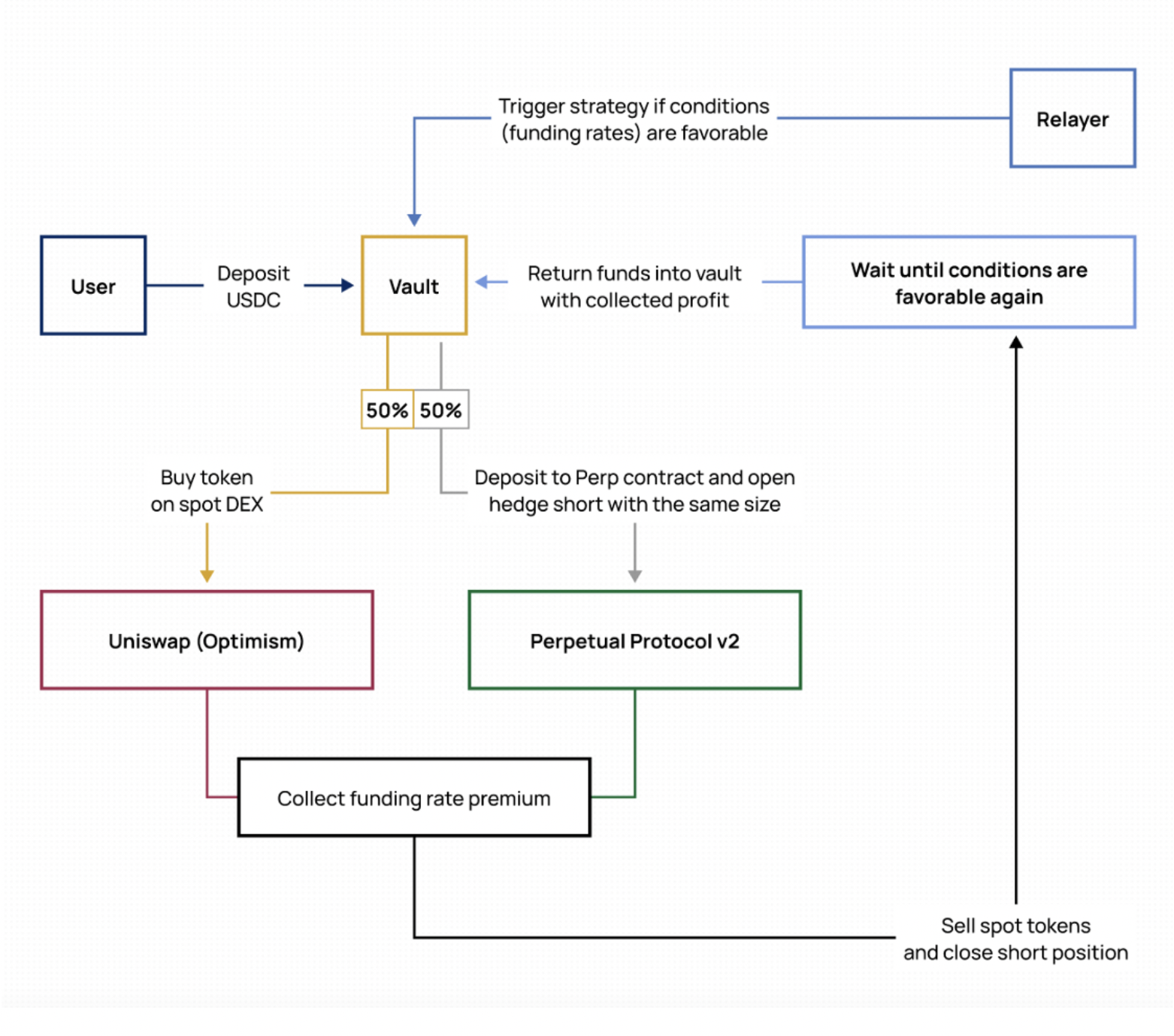

How Does The PERP-ETH DeFi Strategy Work?

PERP-ETH DeFi vault is a basis trading strategy. You can capitalize on the price difference between ETH perpetual futures and ETH on spot. This particular strategy generates yield from opening opposite positions on perpetual futures and spot to collect funding rate when it’s in the positive area.

Learn more about basis trading and benefiting from funding rates to understand the PERP-ETH strategy in detail.

DeFi Strategy #2 [Coming Soon]: 10% Stablecoin APR with GMX

This delta-neutral farming strategy capitalizes on the GMX ecosystem — a perpetual trading platform on Avalanche and Arbitrum. Although previous backtesting reports state 10% APR on average using stablecoins only, the DeCommas team is still running more simulations [adjusting market parameters] to evaluate the upcoming APR more accurately.

💡Delta-neutral strategies even out the response to any market movements, leaving the net change of your position neutral [no price exposure].

Let’s introduce the platform’s key principles to understand the 10% stablecoin DeFi vault.

- GMX platform is backed by the GLP token.

- GLP comprises a basket of crypto assets. The basket backing GLP comprises both volatile assets and stablecoins. As a result, GLP value changes in respect to the basket’s value.

- Similar to funding rates, GLP pools counterparty trades to keep the balance in power.

- GMX platform rewards GLP liquidity providers with a share of all activities within the ecosystem. Fees, swaps, trades, liquidations, and beyond.

As such, the GMX DeFi vault capitalizes on the earnings paid by GMX to GLP stakers.

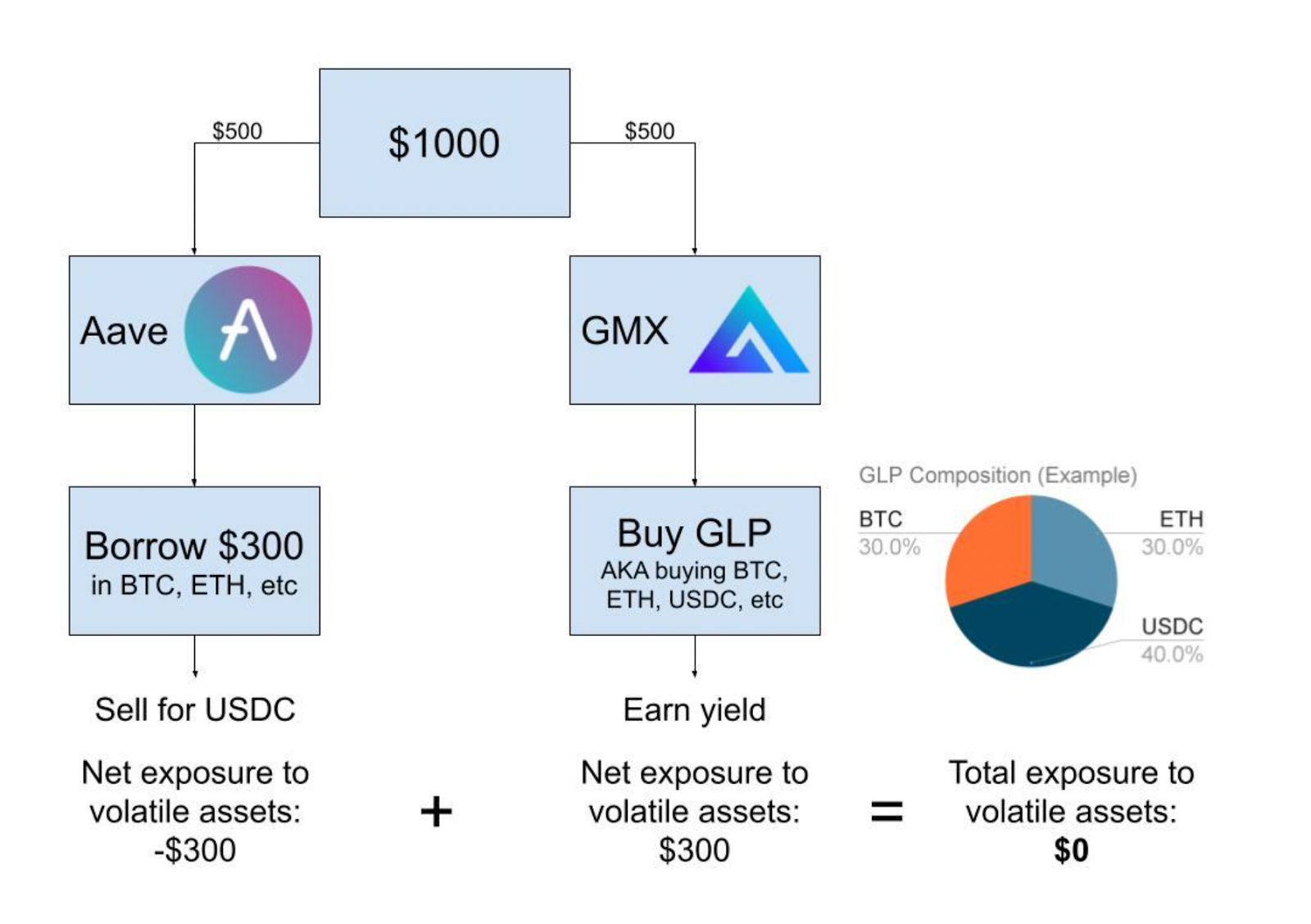

How Does the GMX Stablecoin Strategy Work?

The strategy seeks to benefit from the rewards paid to liquidity providers while hedging the risks. We use the Aave DeFi protocol to borrow the GLP equivalent of crypto assets and sell them for stablecoins, thus reducing the risks associated with value fluctuation. Here’s how it works.

Learn more about GMX DeFI Vault x DeCommas.

Closing Thoughts

Even though DeFi is an excellent alternative to traditional finance, it still lacks the simplicity the latter developed over the years. DeCommas is building the DeFi automation layer to enable next-generation DeFi strategies and is currently showcasing the prowess of its automation layer with multiple one-click “vault-like” strategies.

You can access our DeFI strategies in a few clicks and mind your own business while the protocol works for your benefit.