Cryptocurrency Options today

Derivatives are a popular tool in traditional markets. Access to these instruments has long been limited for less advanced users, but with the development of cryptocurrencies and blockchain technology, this niche has started to rapidly develop. allowing the use of these instruments for speculation and risk management in a permissionless manner.

In today’s article, we will talk about options and look into both centralized and decentralized options trading solutions. We will also touch on the Opex Options aggregator by DeCommas and its benefits for automating options trading.

The development of Options

Options are a type of derivative financial instrument utilized by traders to gain outsized returns as compared to buying an asset outright. These instruments are contracts whose value is based on an underlying asset, such as oil, metals, coffee, cocoa, or, in this case, cryptocurrencies. Options differ from other derivatives in their features and functions, which are also dependent on which market they are traded.

Options are agreements or contracts between two parties giving the right to buy or sell an asset at a predetermined price, called a strike price. The purchase/sale of such a contract takes place before or at the time of its expiration. The option holder has the right to execute the option and is obliged to pay the premium to the seller, while the seller has no such choice and is obliged to fulfill the terms of the contract at the request of the buyer.

Options contracts are complex financial instruments used by professional traders and institutional investors as a tool for hedging against volatility or speculation.

For example, put options give the buyer the right to sell an asset at a given price and can be used to hedge against a possible decline in the price of the underlying asset. Or, the same put options contract can be used by traders for speculative purposes as a means to profit from the decline of an asset. A similar strategy can be applied to call options, which give the buyer the right to purchase an asset at a given price.

There are generally two versions of options contracts:

- European options — The contract can only be executed on the expiration date

- American options — The contract can be executed anytime before or on the expiration date

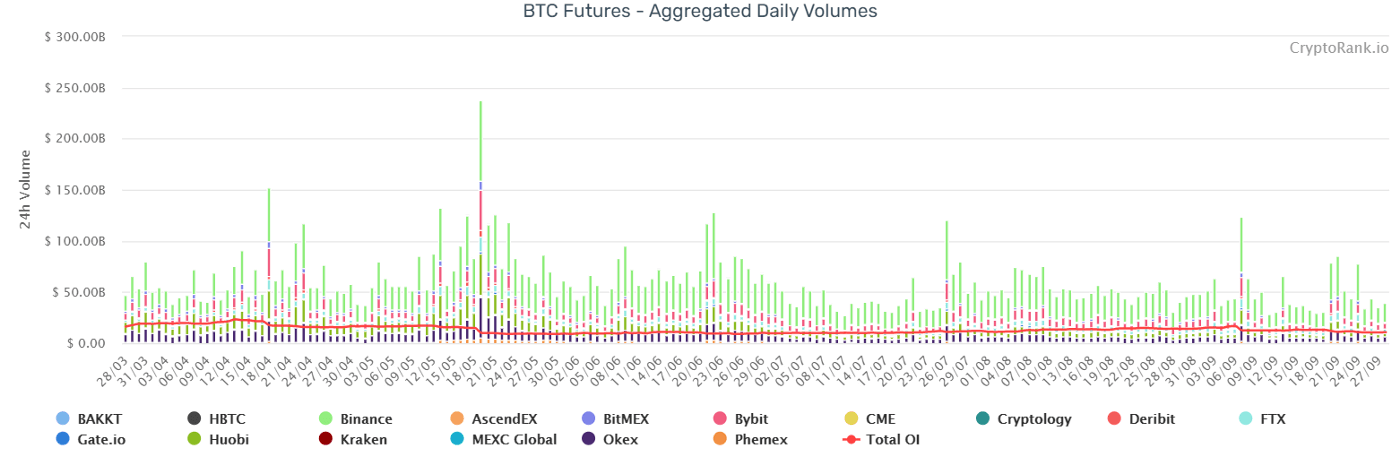

With the development of blockchain technology, we are witnessing rapid growth of the cryptocurrency derivatives market. At the time of writing, according to CryptoRank, the total daily bitcoin futures trading volume on centralized exchanges is about $50 billion.

https://cryptorank.io/derivatives-analytics-full/bitcoin

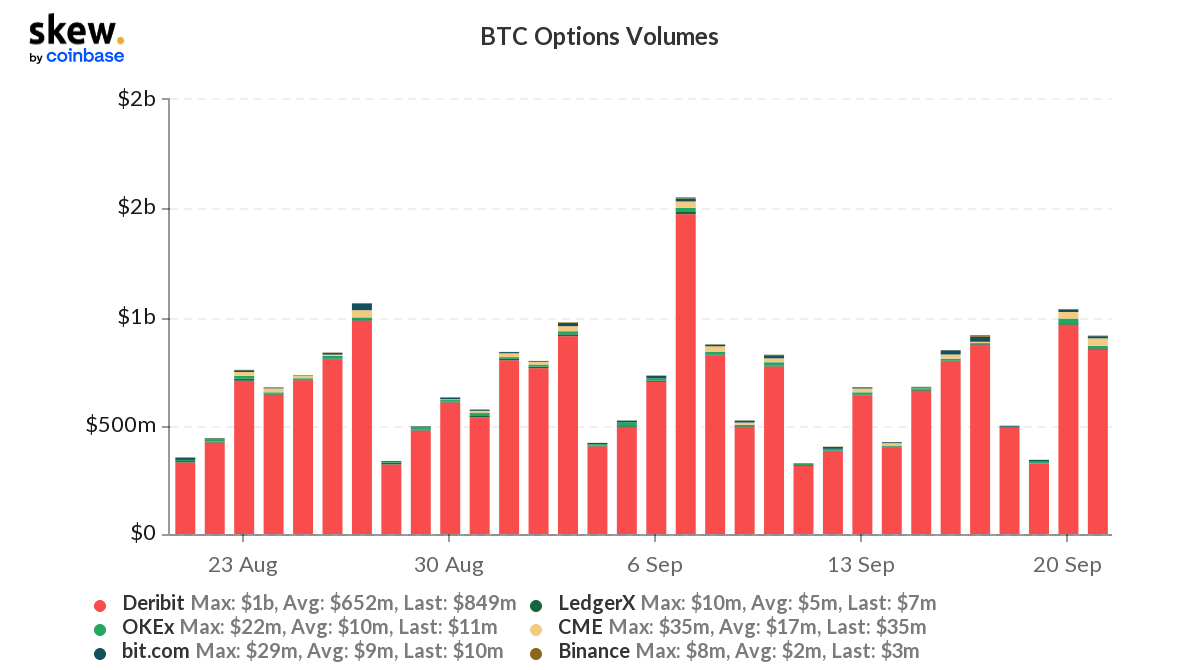

As for bitcoin options, at the moment, the total trading volume on the centralized exchanges is $0.5–1 billion. This makes the bitcoin options market only a fraction of the futures market, although this number is growing by the day.

https://analytics.skew.com/dashboard/bitcoin-options

Today, exchanges like Binance, FTX, Deribit, Bitmex, and many more offer derivatives trading tools. The obvious disadvantages of these services are the need to pass verification procedures and trust the exchange with securing assets and executing trades as intended.

Comparing the cryptocurrency derivatives market with the traditional derivatives market, — which is estimated at $600–700 trillion — it’s clear that the use of derivatives in the crypto space is just beginning to develop and we will see a huge number of new solutions and instruments in this direction in the coming years. The development of DeFi has provided opportunities for a decentralized approach to organizing derivatives markets, with access to risk hedging tools and derivatives contracts without having to undergo any KYC procedures or trust third-party platforms.

Cryptocurrency Options trading solutions

Today, much of options trading is concentrated on centralized exchanges. Derivatives entered the cryptocurrency space from traditional markets. This opened the door for institutional investors and professional traders to assets such as BTC and ETH. The demand for these solutions is driven by investment and speculative interest from large institutional players, creating more demand for centralized derivatives solutions which gained in popularity.

Decentralized protocols for options trading have been created quite recently, but we can already observe the rapid development of this sector and the increase in its popularity among users. Cryptocurrency investors and traders need decentralized mechanisms to manage their risks because the centralized approach to these mechanisms is a risk in and of itself. Protocols for decentralized options trading are innovative in terms of liquidity, trading, liability transfer, analysis tools, and trading strategies creation.

Centralized solutions

Bitcoin options are listed on regulated exchanges such as CME, Bakkt, and SVOE, and unregulated exchanges such as Deribit, FTX, Okex, Binance, and others. Let’s take a look at the features of options contracts on several of these exchanges.

Deribit is the most popular crypto options trading exchange, which accounts for more than 90% of all options trading in the industry. On Deribit, European BTC and ETH options are available for trading. A wide range of contracts with different expiration dates and strike prices are available to users. Deribit also offers analytical tools to monitor the derivatives market.

FTX offers its users leveraged European cryptocurrency options trading opportunities. FTX uses the Request For Quotes (RFQ) model instead of the usual order books; OTC Options-related transactions are also available.

The bit.com exchange, which specializes in launching secure derivatives instruments, has partnered with Paradigm to launch a similar automated RFQ protocol that provides on-demand liquidity for large trades. In addition to BTC and ETH options, the exchange also offers BCH options contracts.

Binance provides its users with American and European style options contracts settled in USDT. Contracts with different premiums and expiration times are available on the platform.

Access to options trading on regulated exchanges is closed for retail investors due to high limits and/or jurisdictional peculiarities. Overall, the main disadvantage of using centralized solutions is the need to trust a third party to secure your funds.

Decentralized solutions

The expansion of options trading is significantly limited by the need to fully collateralize options contracts. Partial collateral allows for increased leverage for short options but carries the risk of forced position liquidation.

Opyn is one of the most popular decentralized options trading platforms on the Ethereum network where you can create your own options using the platform’s oToken token. To obtain a tradable option, one must specify the asset, its strike price, expiration date, the underlying asset, the option type, and collateral. Users of the platform can choose between full or partial collateral for the created option. Additionally, WBTC/USDC and WETH/USDC pairs are available for trading on Opyn.

Pre-expiration options are available on the Auctus platform, and options contracts are available for ETH, BTC, and AUC with settlement in USDC. Auctus allows any user to create OTC options for any ERC-20 token with any strike price and expiration date and offers automated options strategies.

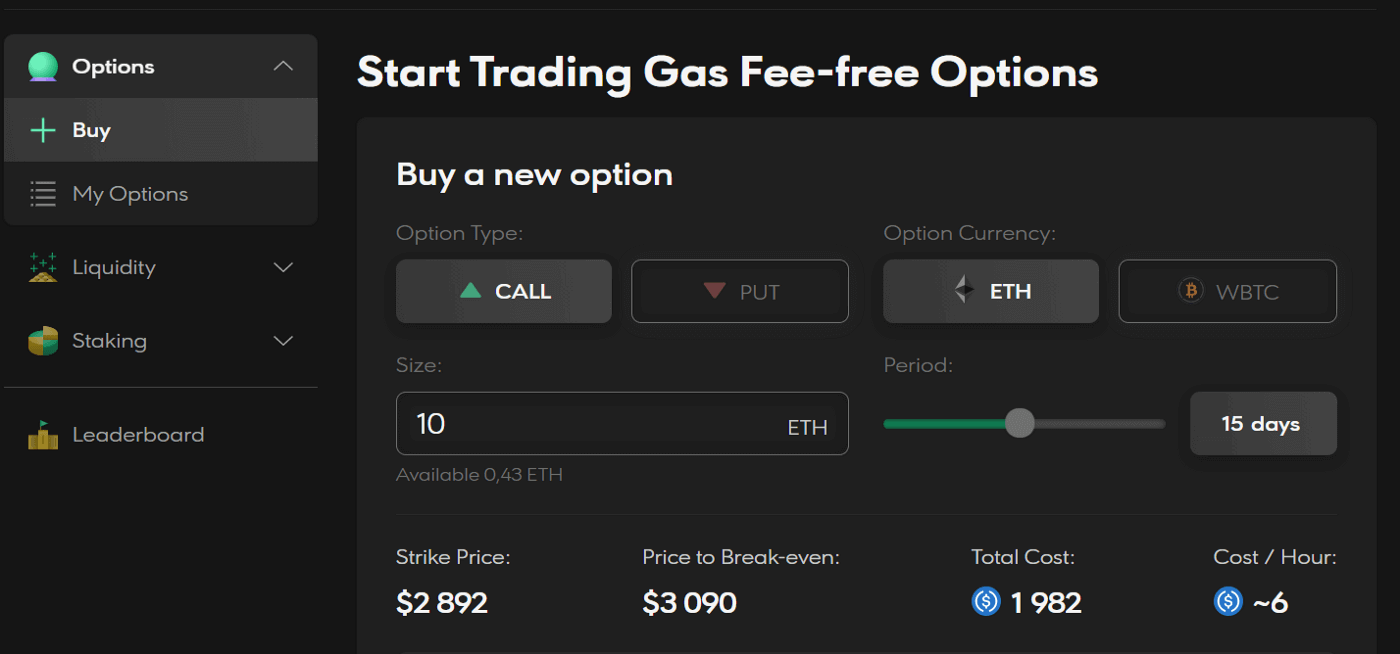

The Hegic platform on the Ethereum network allows traders to reduce risk by spreading commitments among all liquidity providers. The platform offers users the ability to trade call and put options on ETH and WBTC. Options with any strike price and a holding period of up to 30-days can be purchased on the platform.

https://www.hegic.co/app.html###/options/buy

Meanwhile, the Charm Finance platform has created an AMM system that allows you to create and burn options tokens with the options’ price set based on the market supply and demand. The protocol solves the liquidity fragmentation problem by creating a single liquidity pool that provides liquidity for multiple options with different strike prices. The team is currently working on the creation of reliable and stable Alpha Vaults liquidity pools for Charm Option v2.

FinNexus has developed a cross-chain protocol (MASP) to create a single multi-asset pool for DEX exchanges that offer options. The protocol operates on Ethereum, BSC, and Wanchain networks. FinNexus allows users to tokenize options, transfer them, and use dynamic margin as collateral. FiNexus has trading pairs in BTC, ETH, MKR, SNX, and LINK which can all be settled in USDC, USDT, FNX, and FRAX.

Decentralized options protocols differ in the type of options provided, the liquidity provision mechanism, available assets, and the range of strategies and instruments provided.

The number of options trading solutions is growing. It becomes difficult to find suitable platforms and trading conditions among a large number of different protocols. At the same time, keeping track of open positions on different platforms becomes more difficult as their number increases. DeCommas’ Opex platform solves these problems and offers tools to aggregate options contracts information from various platforms.

Conclusion

The options market is undoubtedly one of the noticeable trends of the emerging decentralized space. Large traditional investors and companies, professional traders, and investment funds turn their attention to the maturing cryptocurrency market and DeFi space and considering that derivative instruments allow to maximize profit and protect funds from unwanted price movements, the popularity of these instruments will only grow, and with them will increase the need for solutions to automate trading strategies and information aggregation.