Benefitting from Funding Rates with DeCommas Futures

The popularization and development of decentralized exchanges offering the possibility of margin trading open up a whole new set of capital growth opportunities for crypto investors — with so-called “funding farming” certainly existing as a key frontrunner amidst these opportunities. It allows users to profit via this vital component of cryptocurrency futures trading. In order to maximize traders’ opportunities, we created the DeCommas Futures platform, which takes farming strategies and elevates them to a brand new level. Today, we are going to talk about the platform’s features and the subtleties of working with crypto futures.

What are perpetual futures?

Futures are derivative financial instruments — and a derivative, in turn, is a financial contract between the parties to a transaction that is based on changes in the value of the underlying asset (in this case, cryptocurrency). Under the terms of a futures contract, its holder undertakes an endeavor to buy or sell a certain amount of the underlying asset at a predetermined price, and at a predetermined time (the expiration date). Futures trading has become extremely popular in the crypto sphere, because it has served to open up the possibility for crypto traders to now buy and sell coins with leverage; that is, to utilize funds that are borrowed from an exchange.

Perpetual futures (also known as “perpetual swaps”) are futures contracts that do not have an expiration date attached to them. They can be divided up into two types:

- Coin-margined: a futures contract is purchased for the same token (underlying asset); these are also called “inverse futures products”.

- USD-margined: a futures contract is purchased for U.S. dollars or stablecoins; alternatively known as “linear futures products”.

Because perpetual futures have no expiration date, the underlying asset’s value in such a trade may, in theory, greatly increase or decrease in relation to its spot price. A funding mechanism is used to compensate for this difference.

What is funding, and why is it necessary?

Funding is a fee paid by holders of short or long positions to that of the counterparty (owners of shorts pay the owners of longs, or vice versa). Some exchanges can be seen conducting this process each hour, whereas others will recalculate fundings every eight hours.

Example: because of high interest in the perpetual Bitcoin contracts, their price rises above the spot price. During that time, the fundings are taken in favor of short position holders (bears); that is, those who are longing (bulls) pay a commission to the other side. When the price of a contract drops, then the bears fund the bulls. The greater the gap between the spot price of the underlying asset and the futures’ price, the higher the value of fundings is.

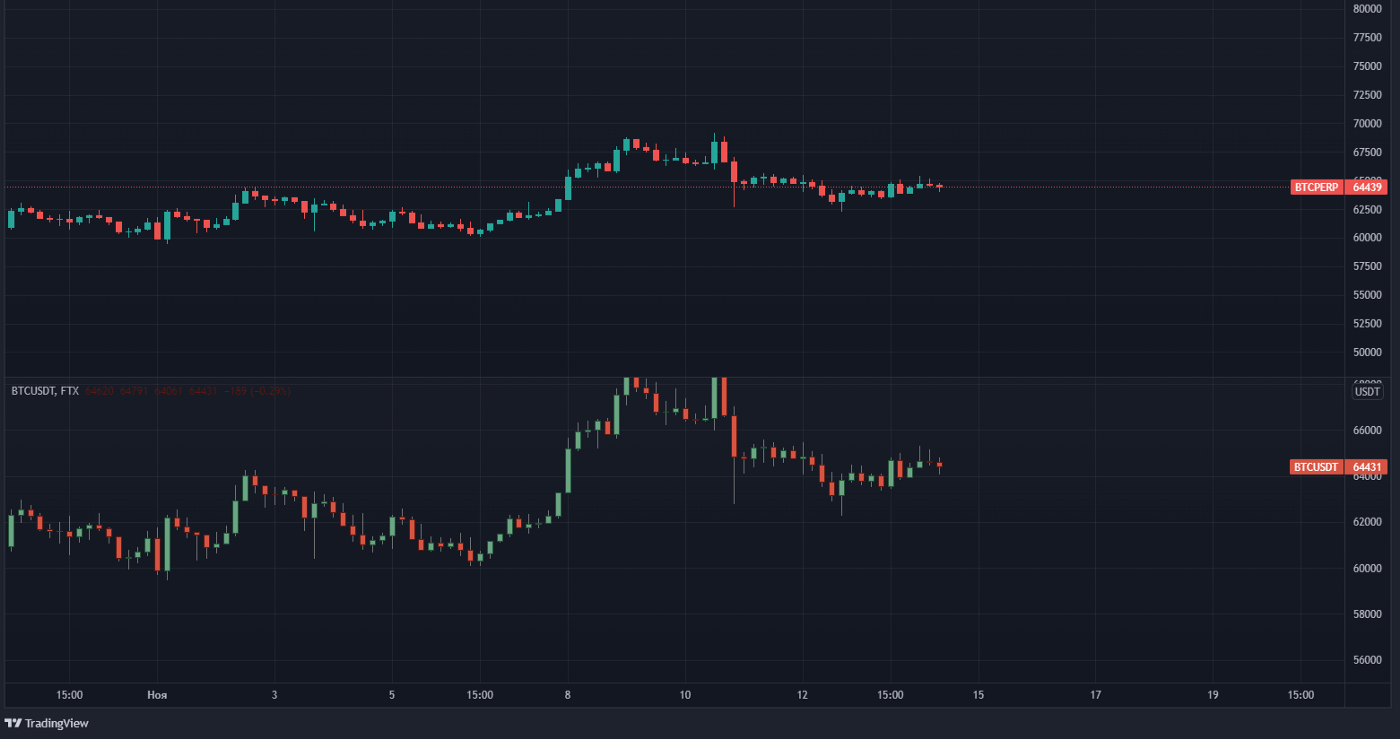

Let’s compare BTC / USDT trading pair charts with those of perpetual cryptocurrency futures on the FTX exchange. The price of Bitcoin futures is higher than the coin’s spot price (64,439 for BTC / PERP and 64,431 for BTC / USDT). This means that the bulls have to provide the funding.

Now let’s move on to the FTX fundings table for the BTC / PERP pair. As you can see, the last recalculation was in favor of the bears. For reference: if the value of funding is positive, this means that the bulls have paid the bears — and if it is negative, then the inverse is true. The greater the absolute value of the fundings, the greater the gap between the price of futures and an asset’s spot price.

Suppose that the current gap stays until the next fundings recalculation (this takes place every hour on FTX). In that case, funding rate value will become positive again, and its absolute value will depend on the formed difference between BTC / PERP and BTC / USDT.

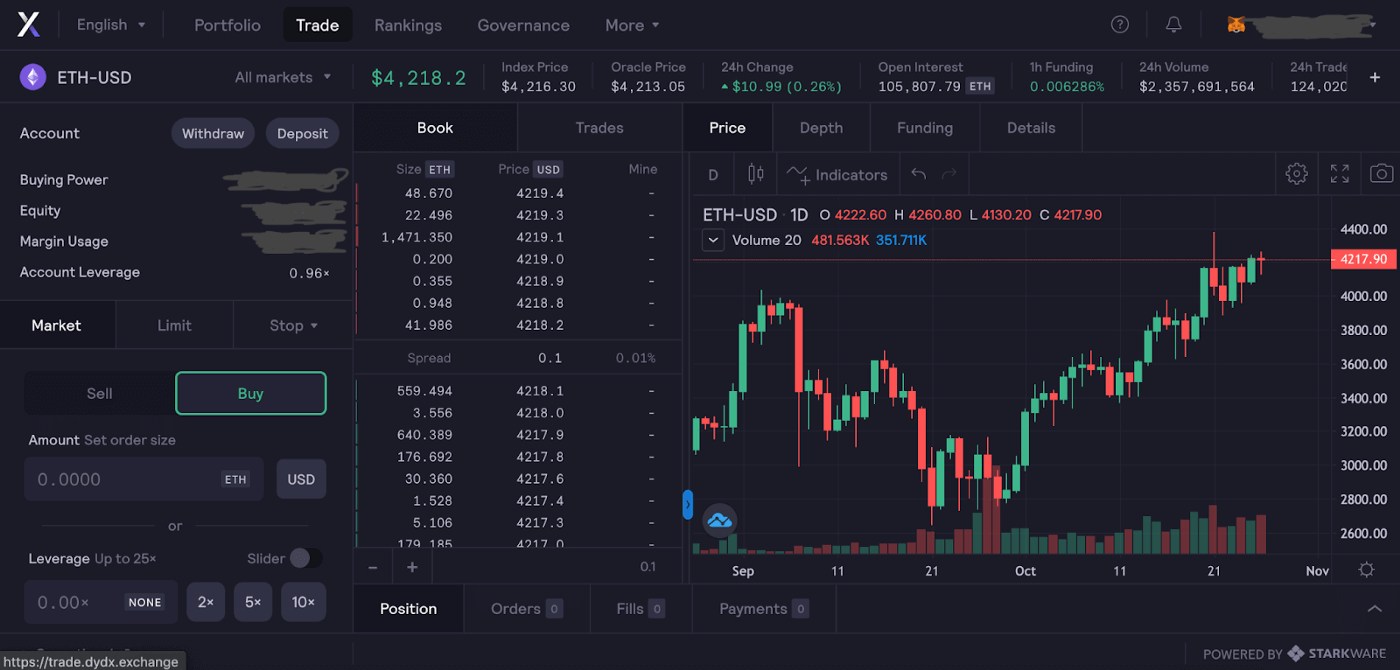

dYdX exchange

dYdX is a decentralized (DEX) trading platform based on Starkwave’s layer 2 Ethereum solution, which offers perpetual futures trading. It utilizes the familiar order book for centralized exchanges (CEX), a clear interface, and several popular trading pairs to work with. On top of this, the platform also offers the possibility to open trades with up to 10x leverage.

Perpetual futures trades are handled off-chain, and are made possible thanks to the aforementioned layer 2 Ethereum solution using ZK-Rollups (Zero-Knowledge rollups) with the following features:

- Fast transaction speeds.

- Decentralization and security — trading information is stored in the Ethereum blockchain.

- Low trading commissions and gas fees.

- Privacy — Starkware does not publish all trades on the blockchain.

To start trading on dYdX, you’ll need a Metamask wallet (or another available solution suggested by the platform), USDC for trading, and ETH to cover the fees.

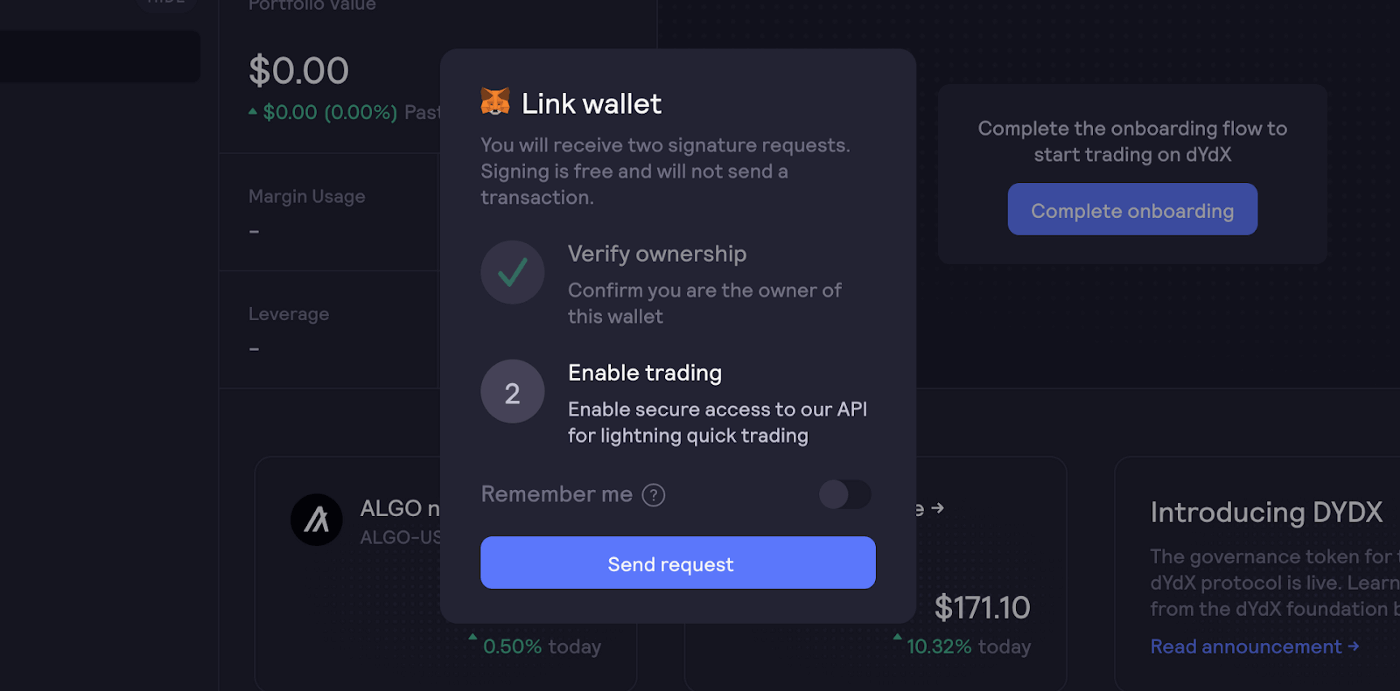

Simply follow the instructions below:

- Visit the exchange’s website.

- Connect your wallet.

- Click the “Complete onboarding” button.

- Sign the “Verify ownership” and “Enable trading” transactions (this step is free when connecting the wallet).

- Deposit funds.

Note: The provided link is the DeCommas referral link — which will give you a pleasant bonus in the form of a 10% discount on all trading fees.

Perpetual Protocol exchange

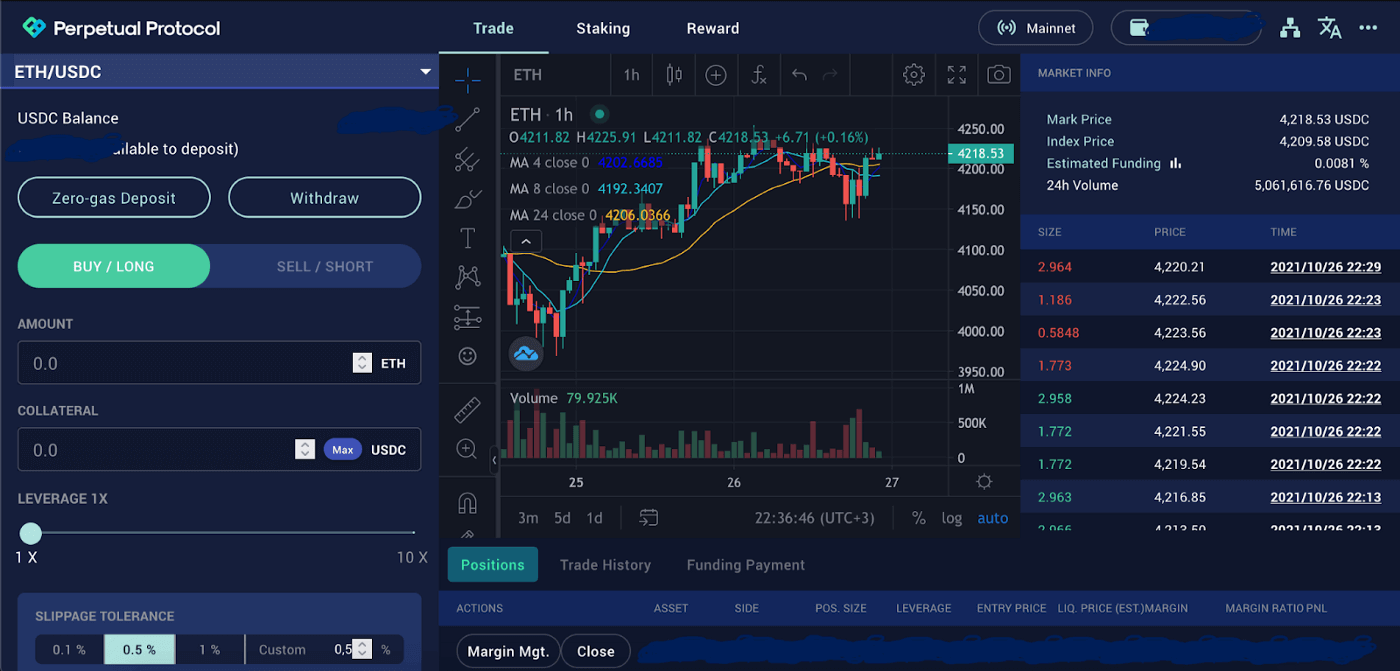

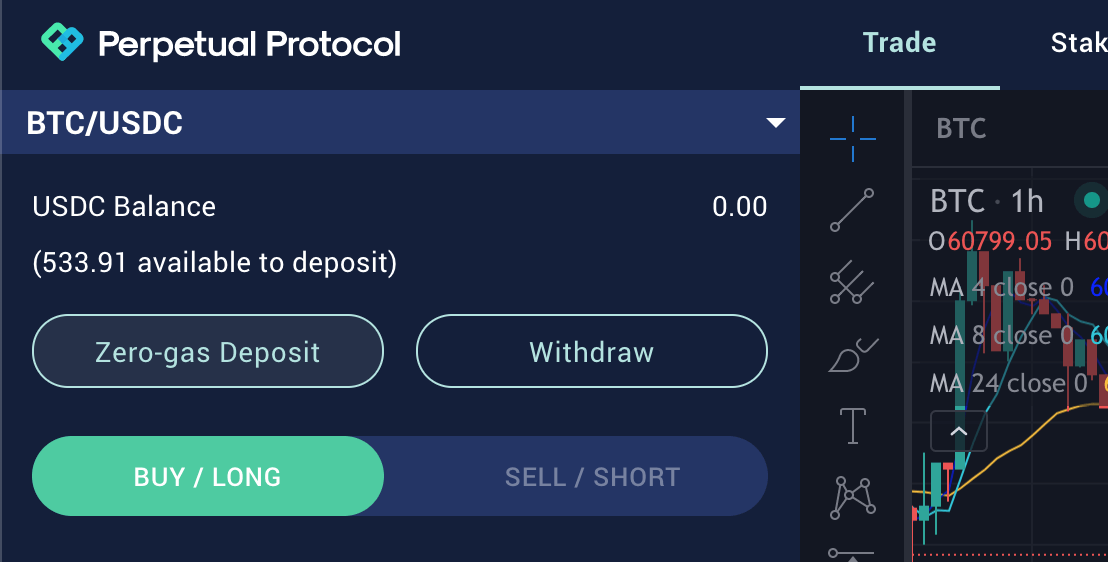

Perpetual Protocol is another popular decentralized futures trading platform, which utilizes the vAMM (Virtual Automated Market Maker) model based on the second layer of the xDai blockchain solution. The next version of the platform will introduce migration to Arbitrum. Perpetual Protocol’s features include up to 10x leverage for futures.

In the case of the most common AMMs, users deposit crypto assets into liquidity pools which represent specific trading pairs. Customers trading against the assets in the pool pay a fee, which is then proportionally allocated to all liquidity providers, depending on their contribution to the pool.

Perpetual Protocol’s vAMM is used exclusively for price discovery, and not for spot exchange. Although it uses the same mathematical function as other DeFi projects — such as Uniswap — to determine prices, vAMM has no real crypto assets. That’s why they call it a “virtual” automated market maker.

Perpetual Protocol also supports the following features:

- Lower slippage. Decentralized platforms such as Uniswap generate trades based on the xy=k formula, resulting in higher slippage compared to that of centralized exchanges. The vAMM Perpetual Protocol can algorithmically set k* to reduce slippage.

- Zero-Gas Deposits. Transfers to perp.exchange above 500 USDC can be paid with no gas fees, i.e. from a wallet with 0 ETH.

- Calculating a price via oracle under certain market conditions. If the value of an asset rapidly deviates by more than 10% from the price index (oracle), then position liquidation is based on the oracle, thus deterring the liquidation cascade.

- Zero impermanent loss risk while staking PERP.

- Partial reimbursement of spent transaction fees with PERP.

To get started with Perpetual Protocol, all you’ll need is a cryptocurrency wallet, USDC, ETH, and xDAI to cover the fees.

After ensuring that you have all the required assets, just follow these simple steps:

- Connect the wallet to the xDai network through this website.

- Head over to Perp.exchange and connect the wallet.

- Deposit funds through the Zero-gas deposit button, then receive a drop in xDai for the first transaction.

- Start farming funding rates.

Note: If you would like to receive weekly PERP bonuses, be sure to use our referral link to start trading. The referral program refunds a part of the trading fees. The weekly rebate amount is initially limited to the equivalent of 200 USDC, but it can be increased up to 1200 USDC with PERP token staking.

Profit from funding with DeCommas Futures

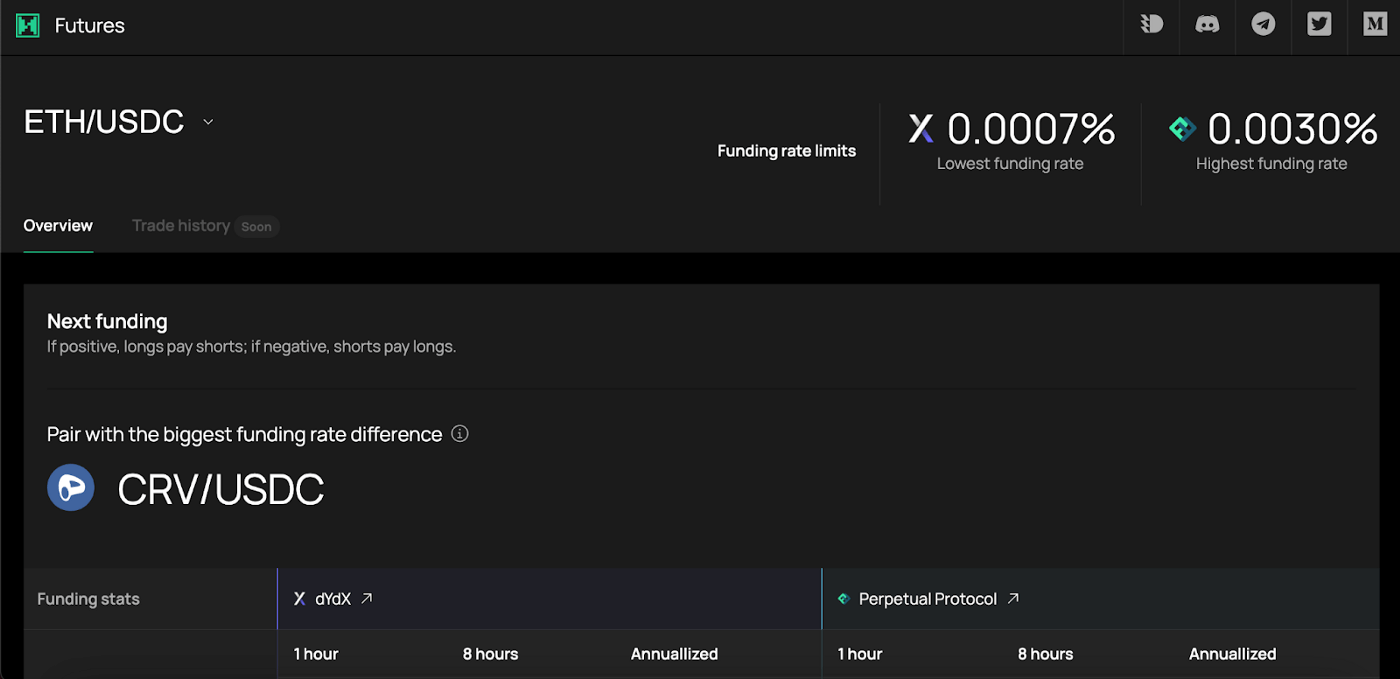

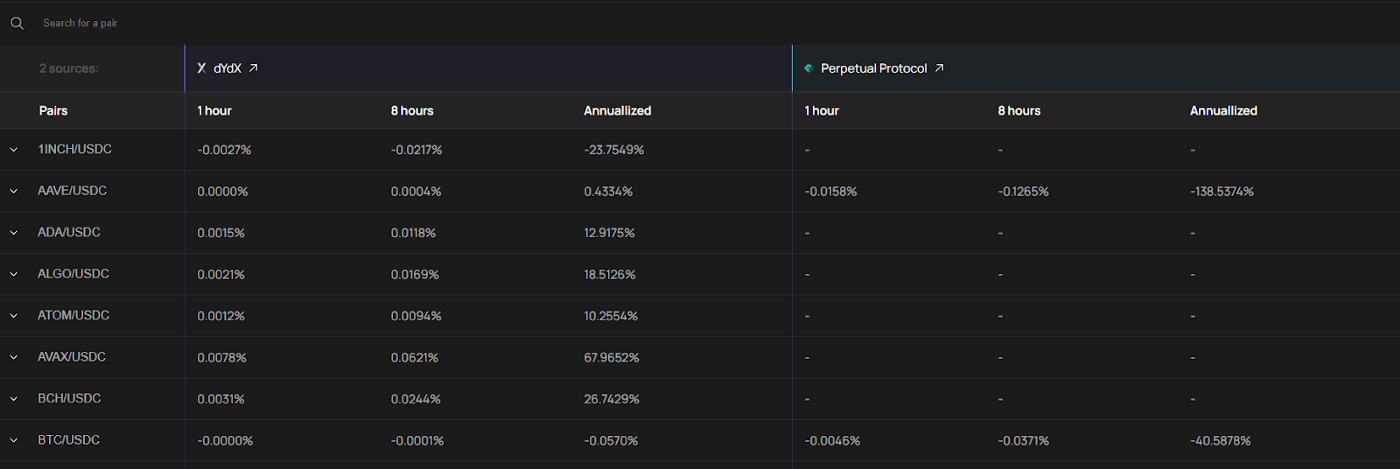

DeCommas Futures is a new product from the 3Commas.io team with a global goal of creating portfolios and automated strategies to make efficient use of the DeFi protocols. In its current version, DeCommas Futures offers a funding rates spreadsheet for individual trading pairs on the aforementioned decentralized platforms.

Let’s start by exploring the interface. If we look in the upper left corner, we’ll find a menu for selecting a trading pair. To the right, we can see the lowest and highest fundings available on the supported exchanges. If one of the exchanges does not yet support an asset, then the platform will display the single rate available on the trading platform.

There are two tables so far. The first displays the next funding value for the pair with the biggest arbitrage opportunity (difference between the platforms) and the average funding value in the last 24 hours, 7, 30, or 90 days.

The second table shows the funding information for each trading pair separately.

Funding rate arbitrage between two exchanges

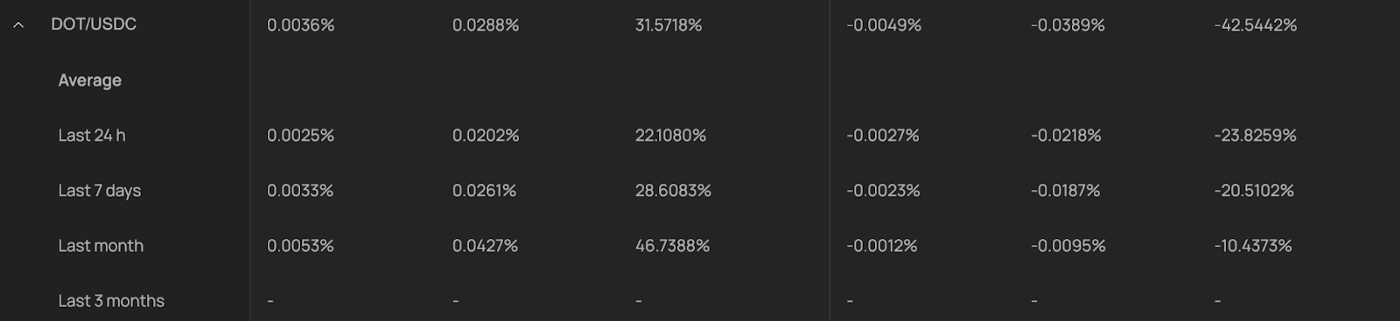

Now let’s have a look at the actual process in action. As we explained earlier in this article, funding is a payment from one participant of the trade to the other, depending on market conditions. The difference in funding rates between the decentralized exchanges provides opportunities for profit. So how is this done? The screenshot below displays the average funding for the DOT / USDC pair. If you take a look at the last 7 days’ value, adjusting it to see the yearly percentage, you can see that dYdX is showing 28.6%, while the value equals -20.5% on Perpetual Protocol. Once again: a positive funding rate means that the bulls pay the bears, and a negative value conversely means that the bears pay the bulls.

The next step is to open x1 short on dYdX and x1 long on Perpetual Protocol on the DOT / USDC pair. Therefore, we get fundings on both exchanges; a short position on dYdX brings us 28.6% funding, and a long position on Perpetual Protocol brings us 20.5% funding. These figures are the annual return of annualized funding rate; that is, the average hourly funding rate throughout the last seven days multiplied by the number of hours in the year.

Opening two positions of equal value enables you to avoid losing money due to price fluctuations. That is to say, for example, that if the coin’s price falls, then the gains in the short position will compensate the losses in the long position. For funding, our profit of this strategy equals 24.5% per annum on the amount of the position in USDC.

There is a risk in the form of liquidation of the short when the price approximately doubles from the entry point. Therefore, we cannot categorize this strategy as “passive income” — in the case of a sharp price movement, the position will have to be closed according to the predetermined price movement alerts.

Buying an asset on the spot

The basic principle of this strategy is similar to that of the previous one. The difference here is that rather than opening the long position, the asset is bought on the spot (there is no funding). You can do this on a centralized or decentralized exchange (although in the latter case, it is desirable to minimize the transaction fee spending).

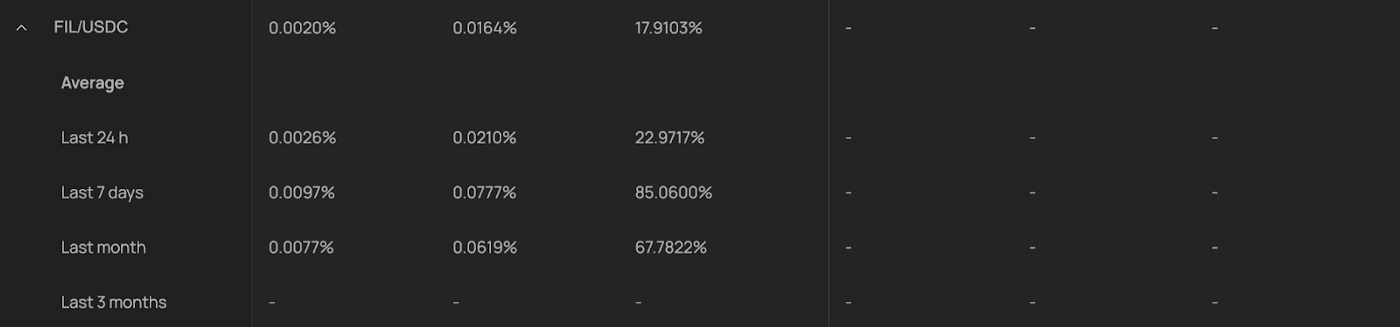

Example: a strategy with the FIL / USDC pair, which is not presented on Perpetual Protocol. In this case, the previously-described strategy cannot be applied. Judging by the screenshot below, the pair’s funding on dYdX remains positive for 7 days, so we open a short and simply buy an equivalent amount of the coin on the spot.

Note that the annual return on capital will be halved in this case, because half of the funds are involved in the spot trade, which does n ot offer any funding.

Selling an asset on the spot

This strategy is suitable for those who make a long-term investment in an asset, but would like to earn extra money on funding, since staking yields may not be high enough. In that scenario, we can sell coins on the spot and collect fundings on the decentralized exchange by going long.

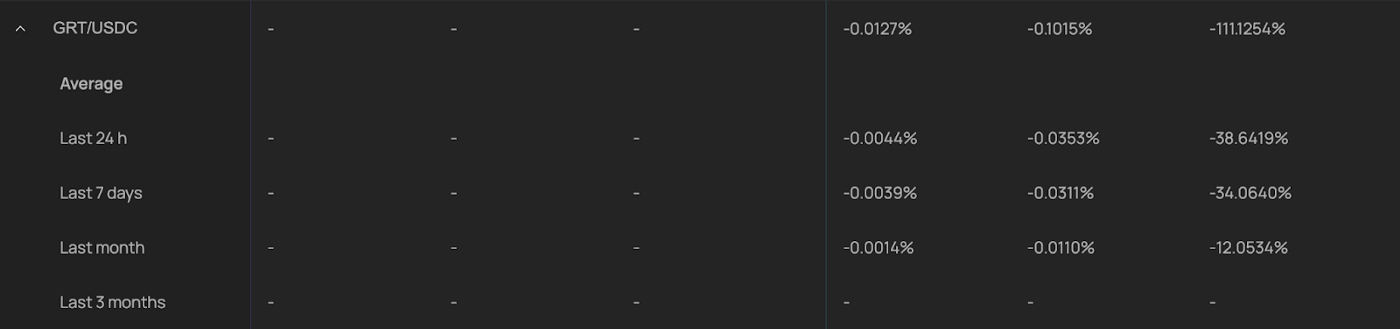

Example: a long position with GRT / USDC with average yearly fundings yields around 34% (taken from recalculations over the last 7 days). The investor keeps their exposure to the price and obtains an additional “bonus”. Note that this is appropriate if the staking yield is lower than the potential profit from fundings farming.

Risks and increased profits

In the aforementioned examples, positions are opened at x1 with low borrowing risks. But what if the profitability still seems too low? In that case, having higher leverage on dYdX and Perpetual Protocol while applying the same strategies comes to the rescue. As a reminder, fundings accrue on the amount of the entire position, which can be increased with leverage.

Keep in mind that in this case, the risks of position liquidation are higher. The annual return rises to hundreds of percent, but the probability of losing the whole capital is more than real. If you are not experienced in working with decentralized exchanges and margin trading in general, then it is not recommended to use high leverage.

A few more words on the potential risks: dYdX and Perpetual Protocol are relatively new platforms. These projects have strong development teams and the support of large funds, but this does not completely secure them against hacks and the lack of liquidity during sharp price movements.

Additional dYdX bonuses

dYdX has a rewards program, offering its native token for each epoch — at present, we currently find ourselves in the third one. The expected reward starts at +3% per annum on delta-neutral positions based on the Commissions × Open interest formula.

The future of DeCommas Futures

DeCommas Futures is still in its infancy, and the project will offer more interesting and useful features going forward. For now, we collect users’ feedback on the service and form short-term goals, such as displaying more detailed information on positions and strategies by connecting the wallet, displaying liquidity information, and integrating funding with Perpetual Protocol.

Long-term plans include earning profits in “a single click” (opening a delta-neutral position), adding more decentralized exchanges, fundings farming strategies via pools, a smart trading terminal, the ability to place orders directly from our platform, and much more. Be sure to follow the updates on our Telegram Channel, Discord, and Twitter!