A Deep Dive into Stablecoins

Many newcomers to the crypto space enter without a full grasp of the variety and potential perils posed by stablecoins. They often assume that stablecoins will always be worth $1.

In this article, we will focus on different types of stablecoins, their risks, and their benefits.

What Are Stablecoins?

Stablecoins are a type of cryptocurrency that aims to stabilize its value to another cryptocurrency or asset. The most famous of such stablecoins are those that are pegged to the value of the US dollar, such as USDT and USDC.

It’s worth noting that the total stablecoin market cap is second only to that of Bitcoin, so it’s something important to keep an eye on.

Source: https://defillama.com/stablecoins

Different Types Of Stablecoins

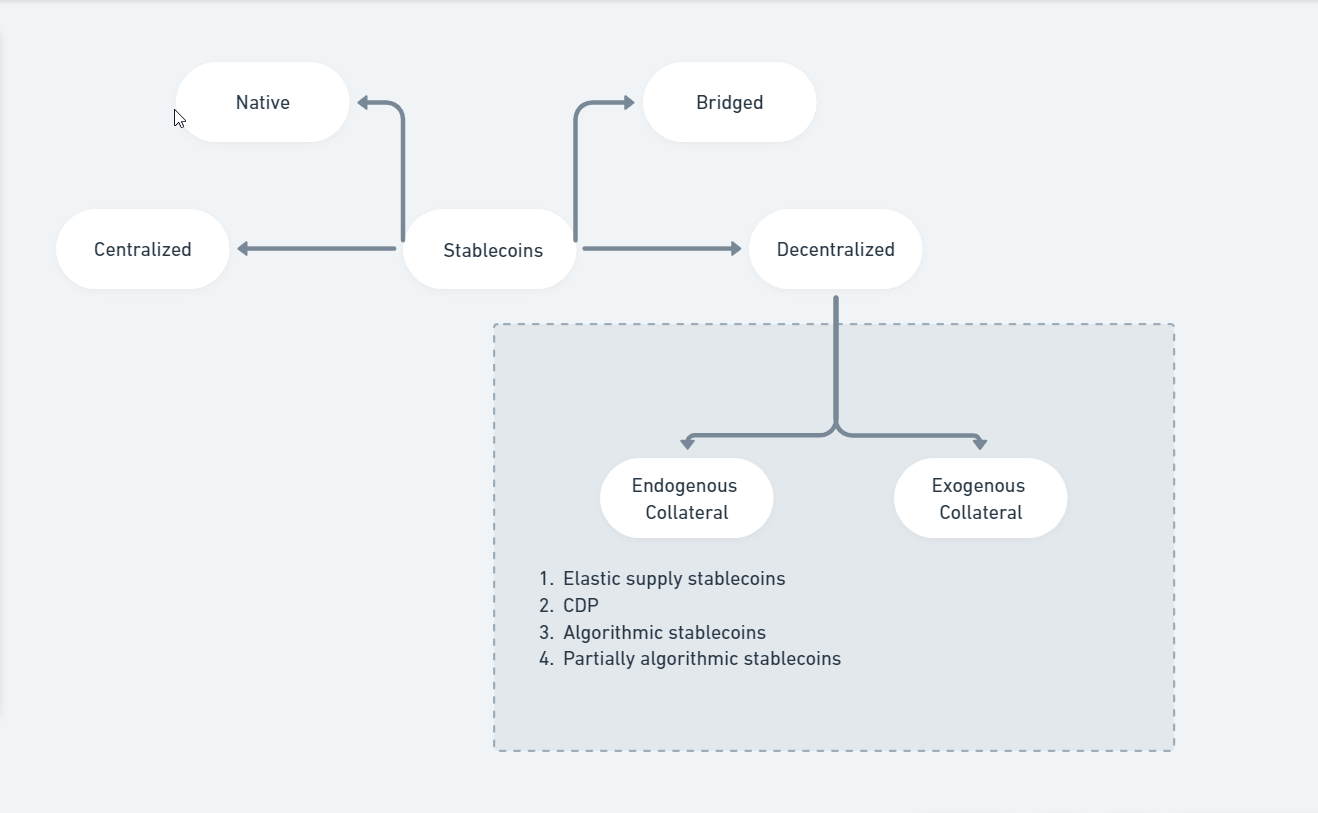

Flow chart showing different stablecoins

Stablecoins can be primarily classified into two — Centralised stablecoins and Decentralised stablecoins.

Centralised Stablecoins

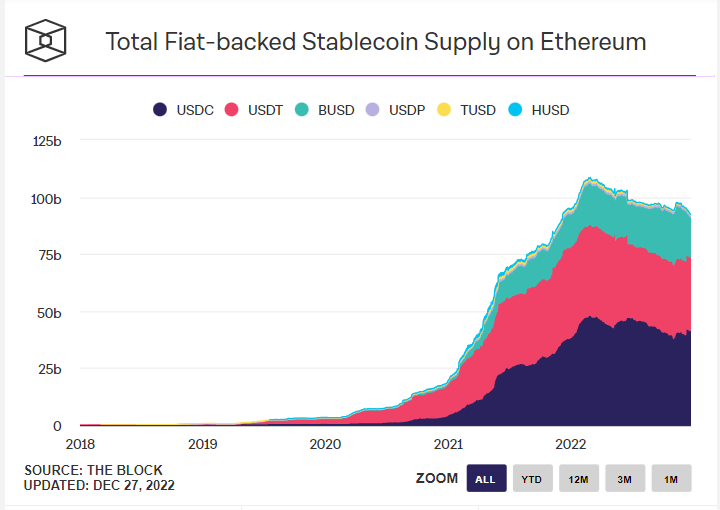

These stablecoins are issued by a centralised entity and backed by fiat currency. Widely used stablecoins such as USDT, USDC, and BUSD make up 8% of the entire crypto market cap.

- USDC is issued by Circle and counts Blackrock and BNY Mellon as custodians.

- BUSD on the Ethereum blockchain is issued by Paxos Global and is regulated by the New York State Department of Financial Services (it’s worth noting that Paxos only issues BUSD on the Ethereum blockchain, while Binance issues BUSD on the Binance Smart Chain).

- Tether, an offshore company, issues USDT and while it is audited, it is not well-regulated.

Even though they have little to no variation from their peg (arbitrageurs can buy cheap USDT from the market and redeem $1 from Tether in the event of a depeg), there are inherent issues with these stablecoins.

Lawsuits

In 2019, the New York State Attorney General, Letitia James, announced an investigation into Bitfinex. Tether also came under scrutiny due to its affiliation with the exchange. The case centered around allegations of a $850 million cover-up for a loss. Around this time, the Tether lawyer admitted that Tether was only 74% backed.Tether was able to settle the case with the state of New York. Under the terms of the settlement agreement, Tether was barred from conducting business in New York. Bitfinex and Tether did not admit to any wrongdoing, but the court fined them $18.5 million. Source:https://www.fxempire.com/news/article/tether-settles-a-1-trillion-lawsuit-regarding-manipulation-782368

Reserve And Audit Issues

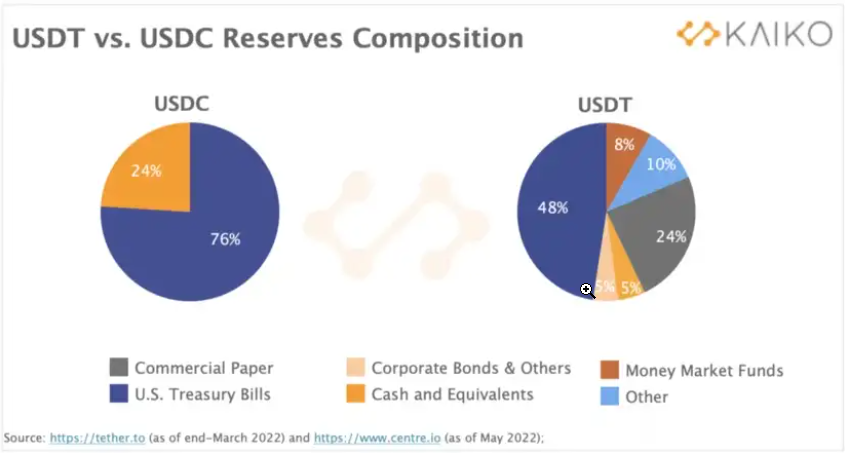

Lack of proper auditing and visibility of reserves has always been an issue for centralized stablecoins, especially Tether (USDT). The lawsuits mentioned above revealed that Tether was not always 1:1 backed by fiat currencies, and funds were not kept in separate escrow accounts from its parent company.

Tether and USDC reserves. The “Others” in USDT have little to no explanation.

Blacklisting/Freezing

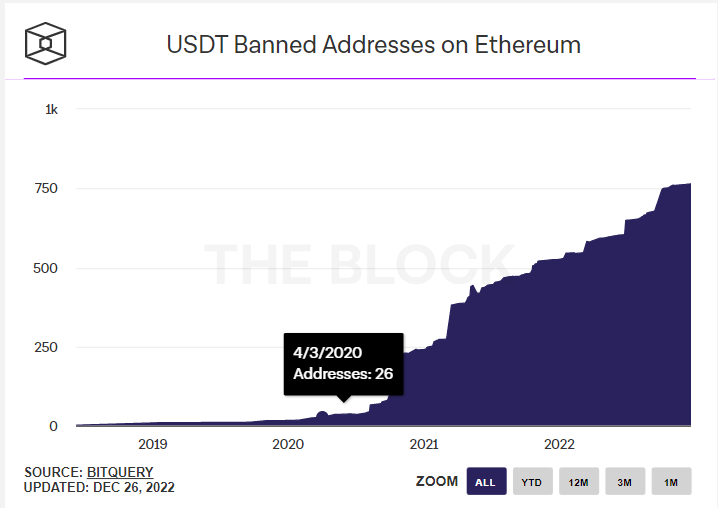

As USDC and USDT are issued by centralised entities, they can freeze the tokens if they deem it necessary.

Source: Coindesk

In total, Tether has blacklisted over 750 addresses since 2017. These are mostly addresses associated with malicious actors or as per the request of law enforcement. While this may sound good on the surface, it goes against the core principles of cryptocurrency, which include decentralisation and self-custody. Imagine you own USDT in your wallet, but a third party can freeze it.

Regulatory Risk

The regulators have a longstanding pessimistic outlook towards stablecoins. For instance, if they decide to ask Tether or Circle to stop operating at some point in the future, there will be no further issuance of centralised stablecoins, which is a significant risk that everyone should consider. Even if they do not completely eliminate these businesses, they can still exert influence over them by blacklisting wallets and taking other regulatory steps.

Decentralised Stablecoins

These are stablecoins with no centralised custodial risk. They are minted and redeemed using collaterals or using algorithms. They can be broadly classified into Endogenous.

Exogenous Collateral Stablecoins

These are collaterals that have little to no use other than maintaining the peg of the stablecoin. An example is $LUNA, whose main purpose is maintaining UST’s peg. Exogenous collateral stablecoins are mostly algorithmic stablecoins.

Endogenous Collateral Stablecoins

These collaterals have other use cases than maintaining the peg. An example is $ETH used as collateral for maintaining a peg of $DAI. These stablecoins are mostly over-collateralized.

Algorithmic Stablecoins

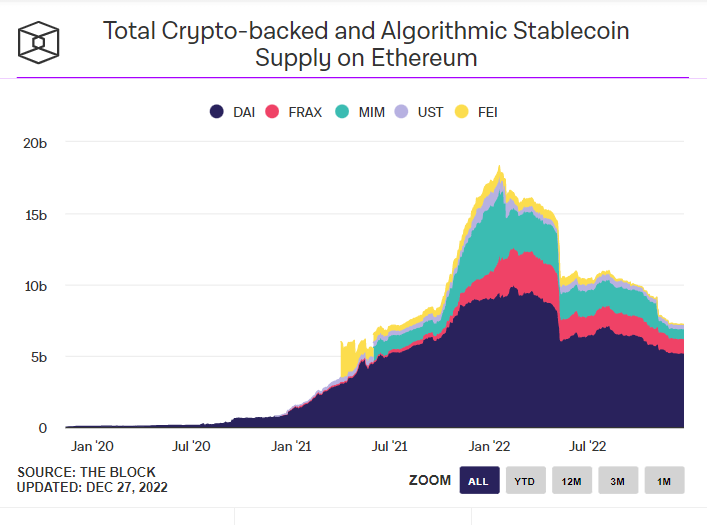

An example of an algorithmic stablecoin is UST. In a nutshell, algorithmic stablecoins are created by depositing $1 worth of a volatile asset to issue a $1 stablecoin. In the case of UST, $1 worth of LUNA is exchanged for 1 UST. These stablecoins are capital efficient and scalable but have an inherent risk of losing their peg.

CDP Stablecoins

These stablecoins are minted using one or more cryptocurrencies as collateral and are mostly over-collateralized. DAI is minted using assets like ETH, wBTC, etc. It has an over-collateralization ratio of 150%. These stablecoins may even have centralised stablecoins as their collateral. DAI can be minted using USDC. All the pitfalls in centralised stablecoins may affect these CDP stablecoins. Some stablecoins can be minted using a basket of assets such as MIM or even minted against your portfolio of assets like Yeti’s YUSD.

Elastic Supply Stablecoins

When the value of the stablecoin falls below the value of the pegged asset, stablecoin owners are incentivized to keep holding the stablecoin because they earn a high-interest rate. When the value of the stablecoin goes back up, the interest rate earned goes down. To earn interest, users have to lock up their coins until the value of the stablecoin goes back to the value of the pegged asset. When the value of the stablecoin rises above the pegged value, the supply of the stablecoin increases and vice versa. An example is Ampleforth.

Partially Algorithmic Stablecoins

These are over-collateralized and, at the same time, partially algorithmic. For example, FRAX is 95% collateralized by USDC but 5% collateralized by FXS. In a 90% collateral ratio, every FRAX minted requires $0.9 of collateral and burning $0.1 of FXS. In a 95% collateral ratio, every FRAX minted requires $0.95 of collateral, burning $0.05 of FXS, and so on. FRAX is the second-biggest stablecoin after DAI. Something similar is happening with Tron’s USDD.

Other Unique Stablecoins

UXD is a stablecoin on Solana that can be minted using delta-neutral SOL without over-collateralization. The spot SOL is hedged by a perpetual short using the mango market, hence maintaining delta-neutral.

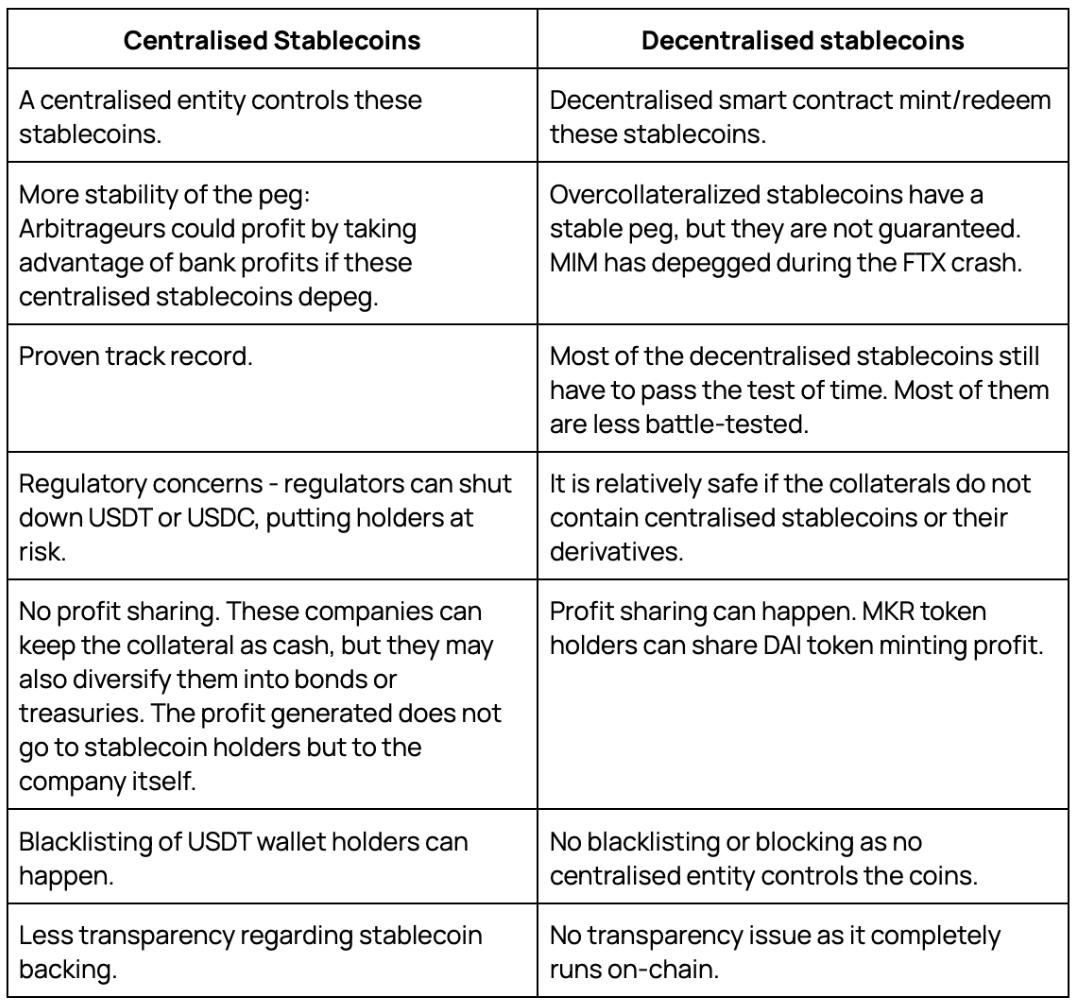

Difference Between Centralised And Decentralised Stablecoins

“I do not love chaos, but still see the need for new algorithmic stablecoins. As reserve currencies continue to inflate away purchasing power, we need new currencies that maintain their purchasing power” — Ryan Selkis, Messari Crypto Theses 2023.

An Important Metric To Consider — Is Your Stablecoin Bridged?

Another important thing to note before using stablecoins is whether it is bridged or native. There is only a limited number of blockchains where centralised stablecoins such as USDT/USDC are natively issued. The USDT/USDC you see on other blockchains may be bridged stablecoins. For example, USDT.e in Avalanche is a bridged version of USDT in Ethereum. If a bridge hack occurs, these assets could depeg. For example, the Nomad bridge of Harmony was hacked, causing its USDT value to drop to $0.50. This is not just an issue with centralised stablecoins, but decentralised stablecoins also have this risk.

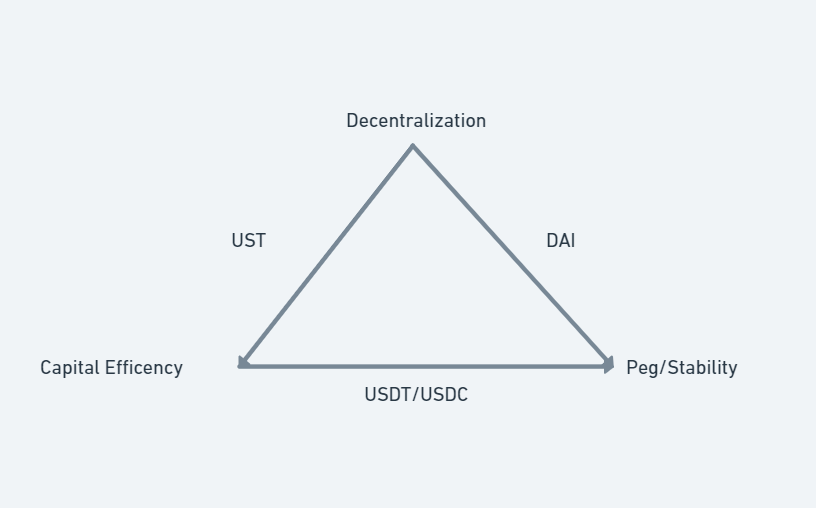

Conclusion — The Stablecoin Trilemma

It can be challenging to determine which type of stablecoin is the most advantageous, as it often comes down to one’s comfort level with taking risks. This is commonly referred to as the “stablecoin trilemma.” Centralised stablecoins are hard-pegged coins with a low risk of instability, but they are more regulated and controlled by a central authority.

Collateralized stablecoins offer advantages in terms of decentralisation and peg stability, but they lack scalability as they require overcollateralization to mint. In most cases, the collateral is locked within a smart contract, rendering it unusable.

However, as Terra’s founder, DoKwon, stated, “Decentralised applications need decentralised stablecoins. They are superior to centralised stablecoins in terms of censorship resistance, decentralisation, and sovereignty.”

Stablecoins based on algorithms are superior to CDP stablecoins in terms of decentralisation and capital efficiency, but they may not have peg stability. As Ryan Selkis quoted in Messari’s report, “Algorithmic stablecoins seem like the best solution to stablecoins trilemma, only if they can maintain their peg.”

Stablecoin Trilemma

The choice of stablecoin should be based on individual risk tolerance. If you prioritize a stablecoin with less risk of depegging but are willing to accept the risk of censorship and centralisation, you can choose USDT/USDC or BUSD.

However, if you are an advocate for decentralisation and are willing to take on more risk of depegging (usually associated with algorithmic stablecoins), you can choose decentralised stablecoins.

Decentralised stablecoins can also offer higher returns in the realm of DeFi, as many new stablecoins offer incentives for users to adopt their products.

Want to discuss stablecoins with the DeCommas community? Say hi on our social media channels on Discord and Twitter!

DeCommas does not audit nor endorse any protocols listed; we just focus on providing accurate data.