1 Month From the $ARB Airdrop

The $ARB airdrop has been a hot topic in the crypto world, with many eagerly anticipating its impact on the Arbitrum ecosystem. This airdrop involves the distribution of $ARB tokens to users who have interacted with the network, whether through transactions or staking, to incentivize user activity and promote the growth of the network. It is expected to increase the number of users and transactions on the platform, leading to a rise in the value of $ARB tokens and an overall boost in the popularity and adoption of Arbitrum as a leading blockchain solution.

Analysis of TVL in Arbitrum Network

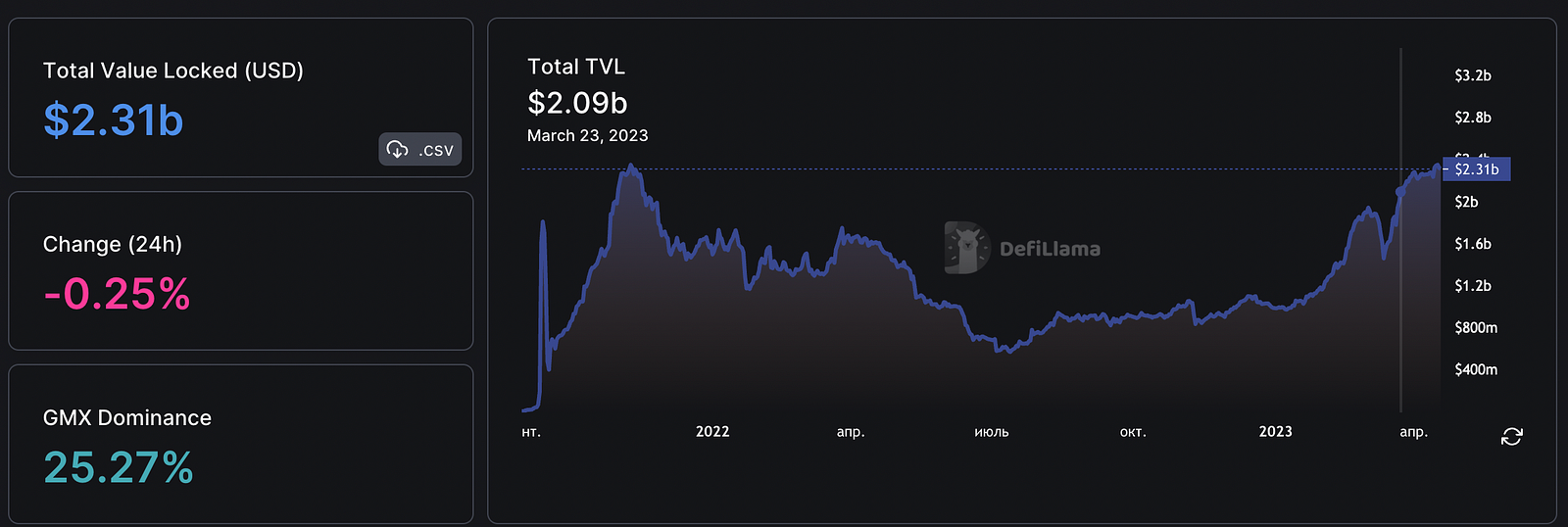

Let’s have a look at this TVL chart first.

Source: DefiLlama

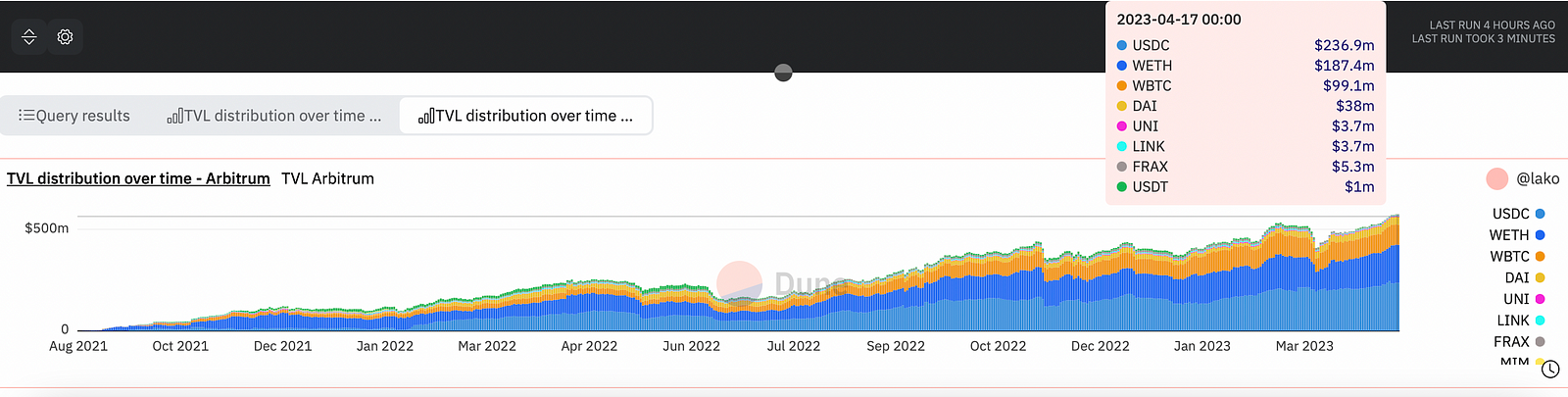

After the announcement of an airdrop, there was a drop in liquidity due to some investors exiting to participate in other airdrops, among other factors (like possible zkSync drop has already attracted $120M in TVL after Era release). However, despite this setback, the TVL continued to grow after the initial distribution of the $ARB token. This growth was fueled by various factors, such as the native $ARB token being locked in the defi protocol, fluctuations in token prices, and the overall growth of the network as seen by the increasing TVL in different tokens in Arbitrum (see the charts below).

Thus, the growth of TVL in the Arbitrum ecosystem cannot solely be attributed to the $ARB token airdrop lock. Rather, it is also a result of the continued involvement and interest of users who are engaging in liquidity providing and enjoying the various features of the network: optimistic rollups, compatibility, low fees for transactions and more. See the chart below.

Source: Dune Analytics

As a result, the token’s value remained stable, and its market cap continued to grow. The native token’s total value locked (TVL) in various defi projects has been steadily increasing, indicating a growing demand for Arbitrum network and $ARB as a utility token. The token’s locked-in network TVL performance post-airdrop has been impressive, with its price remaining relatively stable and showing strong resistance to market fluctuations.

As the bottom line: The total value locked has remained stable and strong for several reasons. Firstly, the $ARB token lock and its cap being moved into the product and protocols have contributed significantly to this. This has created a sense of security and trust in the Arbitrum, which has helped to maintain its value. Additionally, the continued demand for the project has played a crucial role in its sustained success. The Arbitrum offers many attractive features, like optimistic rollups, compatibility, low fees for transactions that have kept users engaged and interested, leading to its ongoing popularity. All of these factors combined have contributed to the TVL continuing to stand strong and steady.

Analysis of Token Price Performance and Token Drop

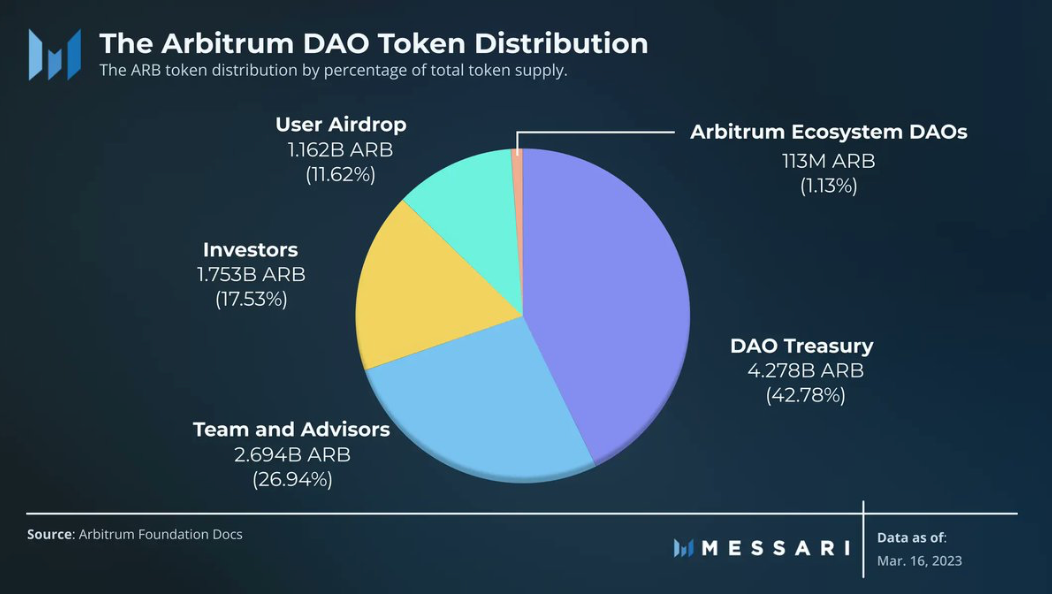

The claiming process for the Arbitrum airdrop began on Thursday 23rd. The airdrop involved the distribution of just over one billion $ARB tokens, which amounts to 11.6% of the total supply. As of noon ET, over 474 million tokens had been claimed.

Source: Messari

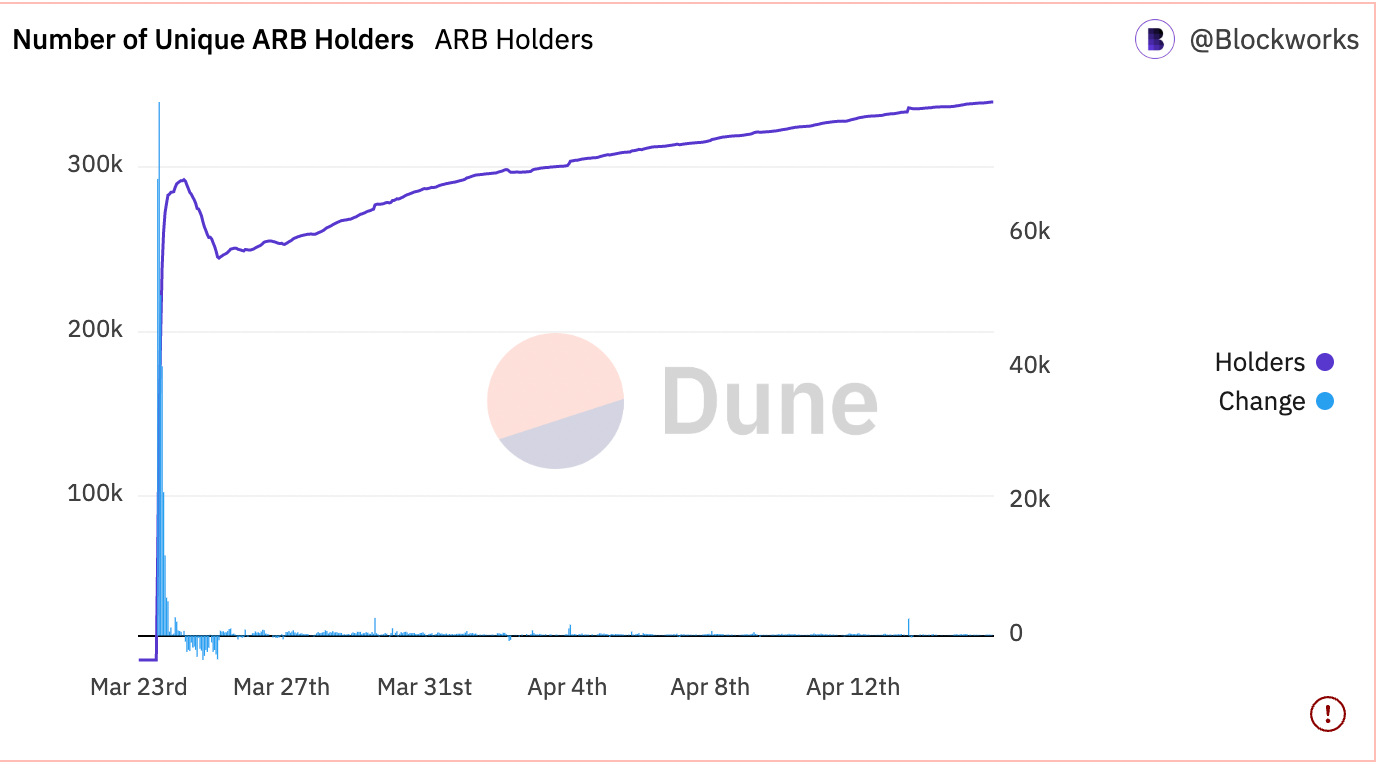

As of now, according to Dune Dashboards, there are 339,900 unique $ARB holders, with the top ten addresses owning 94.41% of the circulating $ARB. The DAO Treasury of the Arbitrum Foundation holds approximately 3.52 million $ARB, while the second-largest address holds 2.69 million $ARB. It indicates a relatively broad distribution of the token. This could suggest that there is significant interest and adoption of the Arbitrum network among a diverse range of individuals and entities.

Notably, Bybit, Kucoin, Mexc Global, and Bitget hold a significant amount of $ARB, with all four exchanges having addresses in the top 25 largest $ARB holders.

And on March 23, $ARB set both an all-time high and an all-time low on the same day.

Source: TradingView

As of the time of writing this article, $ARB has hit a new all-time high of $1.8. This means that the price of the token has increased significantly, potentially due to the growing popularity of the Arbitrum network. It is worth noting that the value of cryptocurrencies can be highly volatile and subject to frequent fluctuations, so this price point may not necessarily be sustained in the long term.

Source: TradingView

According to Dune Analytics, as of March 25, 968.71 million out of the 1.275 billion $ARB tokens have been claimed, which represents 91% of the claimable tokens.

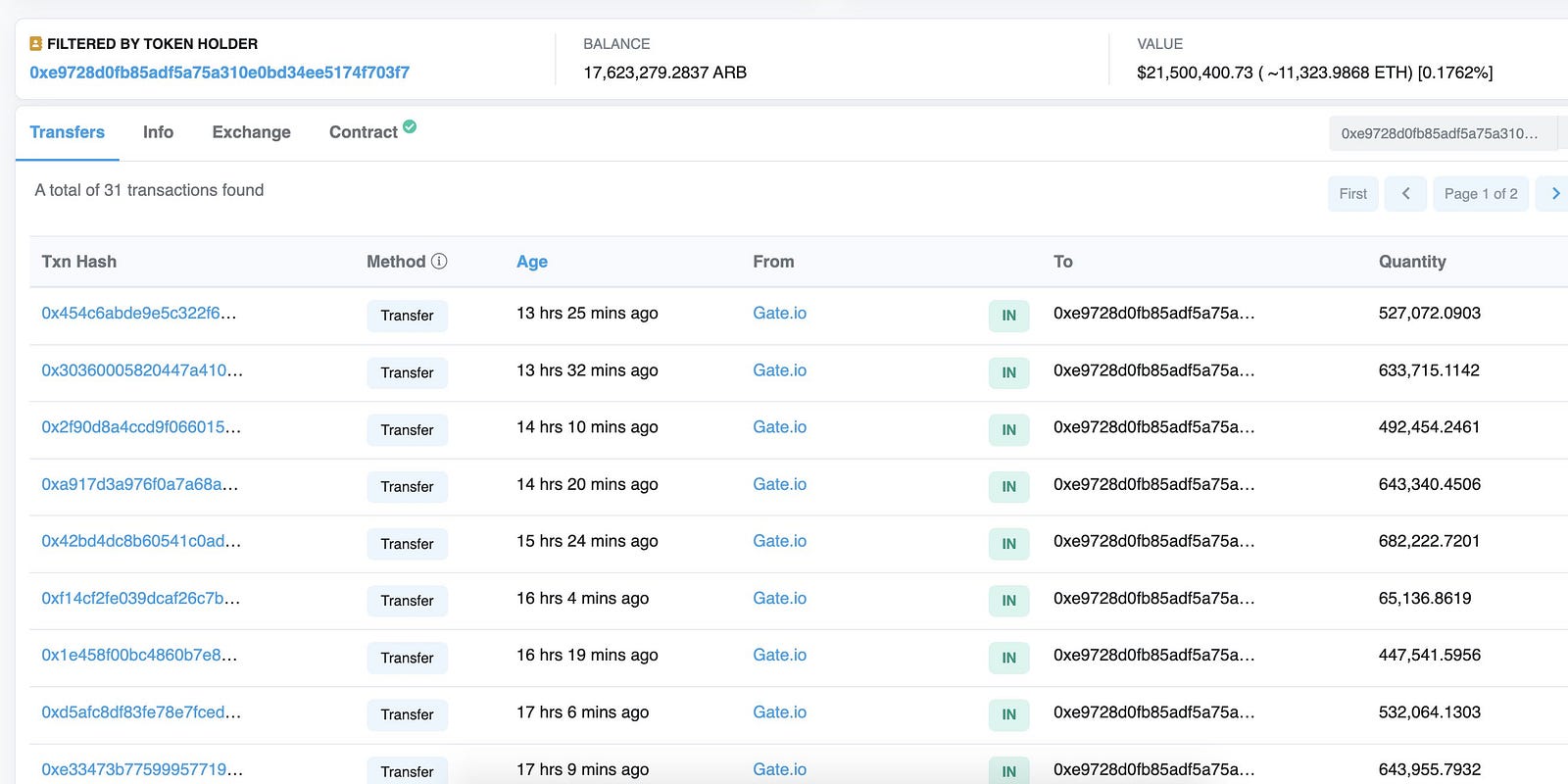

According to on-chain data, four major investors are regularly purchasing $ARB. Among them, Andrew Kang (@Rewkang) recently purchased 1.51 million $ARB using 1.85 million $USDC at a price of $1.23 per token. Overall, Kang has spent a total of 2.85 million $USDC to acquire 2.3 million $ARB, with an average buying price of $1.24 per token.

Source: Lookonchain

The number of unique $ARB holders is gradually increasing over time. This suggests that more people are becoming interested in the Arbitrum network and the various decentralized applications and services built on top of it. As the network continues to grow and develop.

Source: Dune Analytics

The $ARB token has been making waves in the defi world since its highly anticipated airdrop. After the distribution of free tokens to users, there was a small outflow of funds from airdrop hunters, as expected. However, the $ARB token compensated for this outflow by attracting more long-term investors who believed in the potential of the Arbitrum ecosystem.

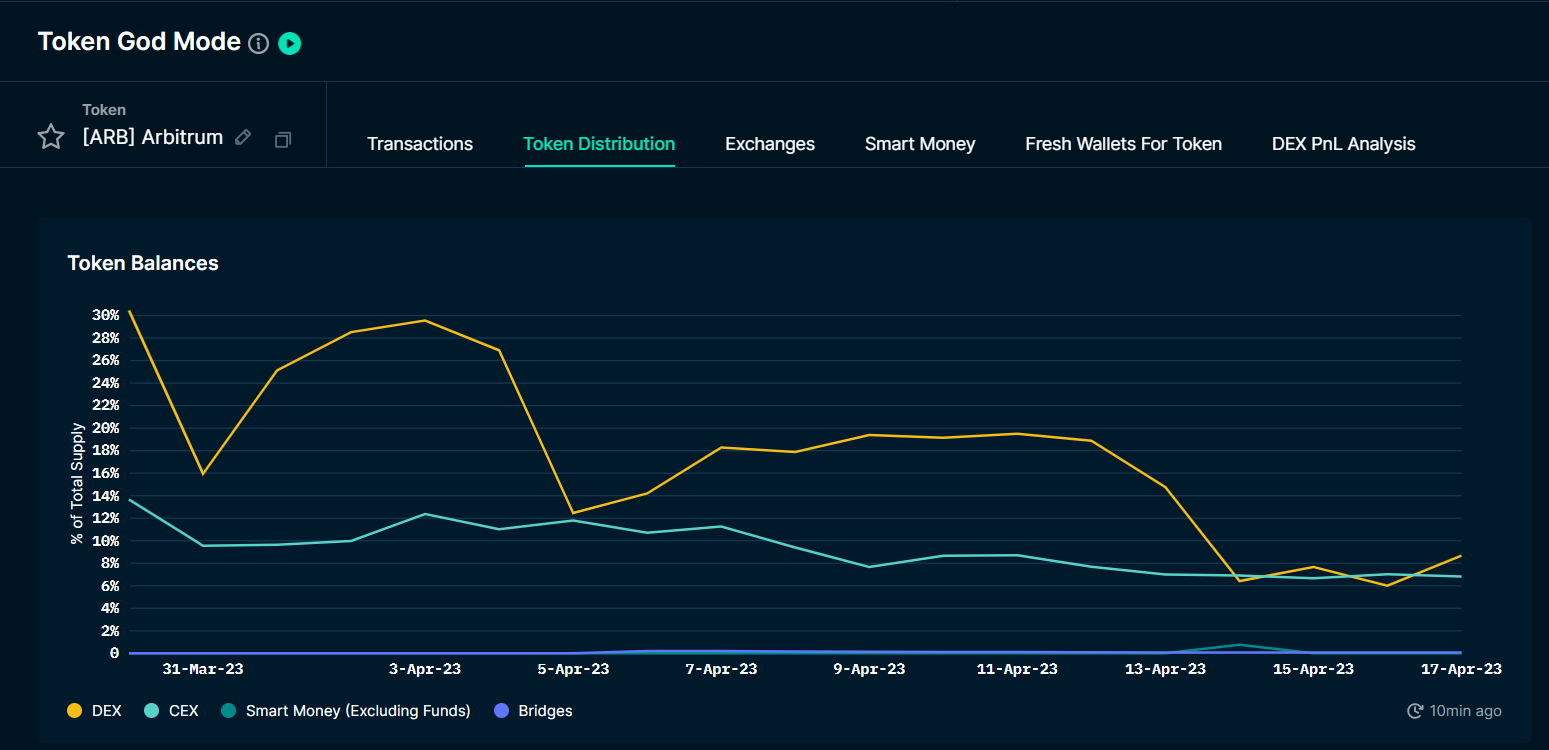

The data from the Nansen Token God Mode showed that after the initial distribution, 14% of the tokens were sold on centralized exchanges, and 30% were utilized for liquidity on decentralized exchanges. As a result, liquidity decreased, indicating that the initial distribution phase is over and there is less selling pressure in the market. On the other hand, less liquidity may translate into higher yields for LPs, assuming there is a consistent level of token demand.

Source: Nansen

Comparing With Optimism

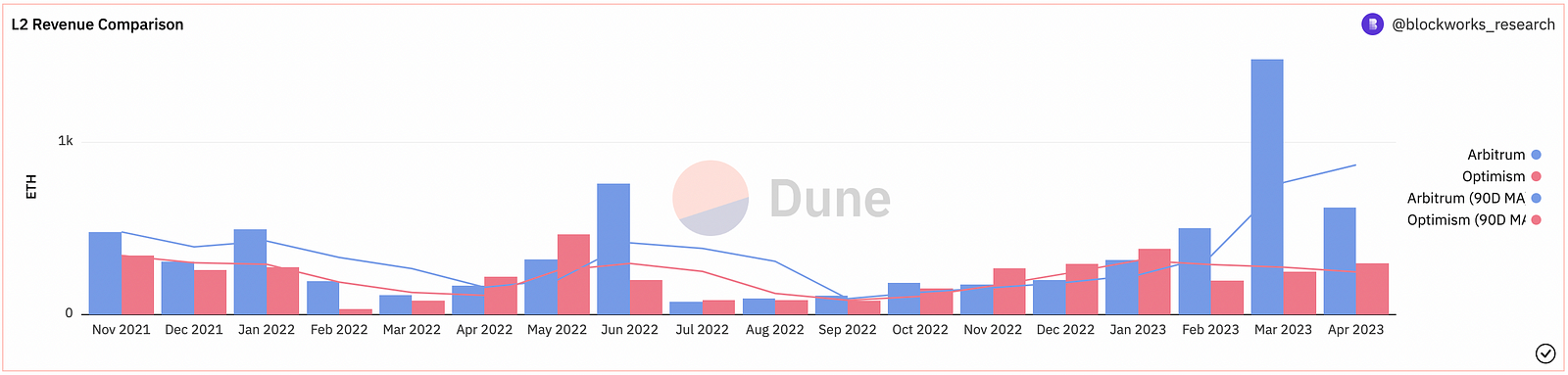

We can compare Arbitrum with Optimism and their previous drop. Both the Optimism (OP) and Arbitrum networks have seen an increase in active wallets, indicating growing usage of decentralized applications and services. In terms of transaction revenue, the Arbitrum network has generated higher revenue than OP due to its longer operational period and greater number of transactions.

Source: Dune Analytics

As for total gas usage, the Arbitrum network has used more gas than OP, largely due to its higher transaction volume and longer operational period. These trends reflect the rising popularity of these networks in the decentralized finance space.

Source: Dune Analytics

Airdrop Claiming and Selling

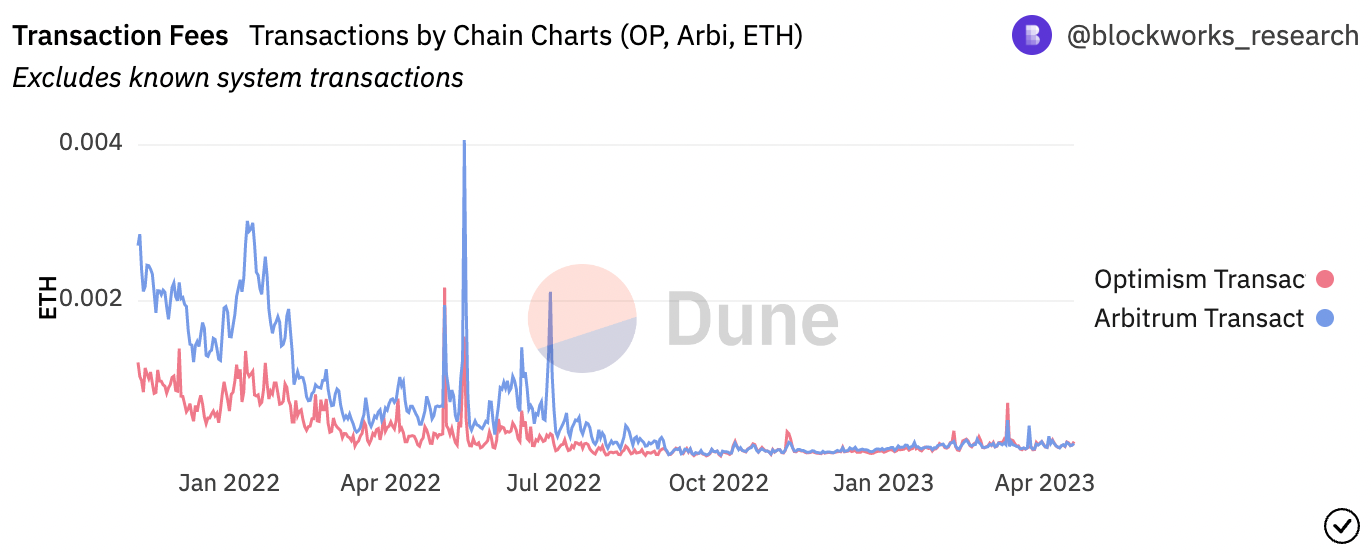

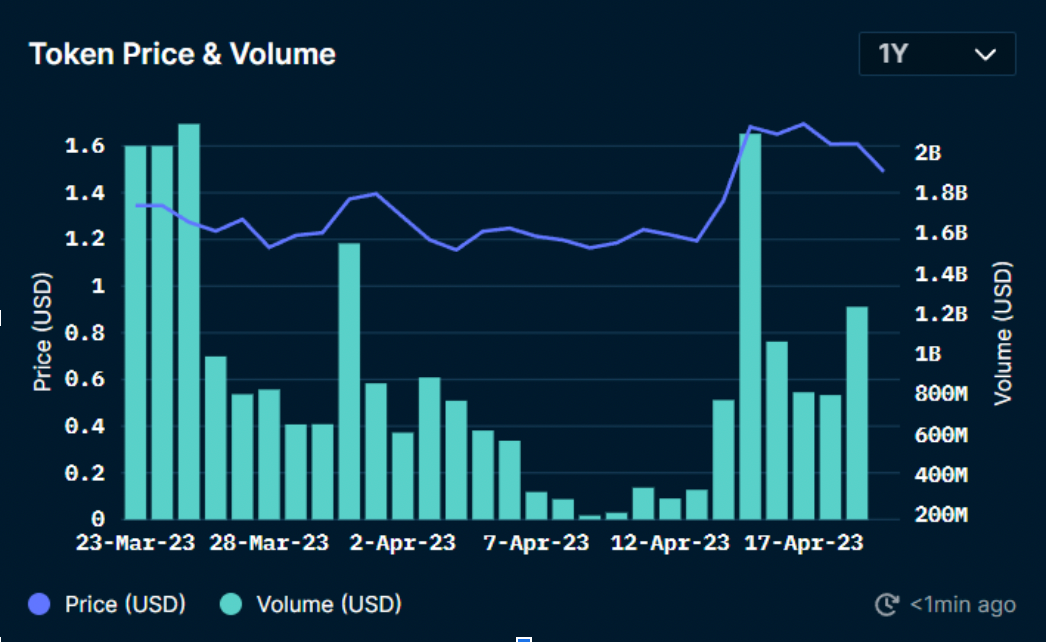

The $ARB airdrop was one of the most highly anticipated events in the crypto world, with many users eager to claim their free tokens. The number of users who claimed the airdrop was quite high, with many immediately selling their tokens on the market. However, despite the initial selling pressure, the $ARB token’s value remained stable, thanks to the strong demand from long-term investors. Additionally, the token’s liquidity decreased during the first month after the initial high-demand time for trading, as volumes remain quite high (see this chart below).

Source: Nansen

Given the decrease in liquidity for ARB on exchanges, one way to increase liquidity is to utilize cross-chain swaps with gas compensation. This approach allows users to swap tokens between various blockchains with minimal gas fees, as the fees are returned. Hopefully, DeCommas provides that, you can read more here “Gas Reimbursement Program”. This strategy not only enhances liquidity but also encourages interoperability among different blockchains, allowing users to access a wider range of defi products.

With the defi industry continuing to grow, cross-chain swaps are likely to play a crucial role in improving liquidity and spurring innovation. It’s important to note that despite the decrease in liquidity, demand for Arbitrum network products remains robust, as evidenced by the increasing TVL. Many fascinating projects are working on top of Arbitrum, which can be explored using the DeCommas Cross-chain Swap feature to gain access to native $ARB tokens and boost liquidity. You can find more information about these projects in our blog article about $GLP wars.

Summary

In summary, the $ARB airdrop has had a positive impact on the growth and popularity of the Arbitrum ecosystem and the defi industry, encouraging readers to consider using Arbitrum’s defi products and cross-chain swaps with gas compensation to take advantage of the low fees, faster transaction times, and greater transparency of the defi space. Supporting a platform that is dedicated to promoting innovation and interoperability can contribute to the growth and adoption of this exciting industry.

To discuss it, join our Discord, and follow us on Twitter for updates about DeCommas Cross-chain Swap.